Click image to open full size in new tab

Article Text

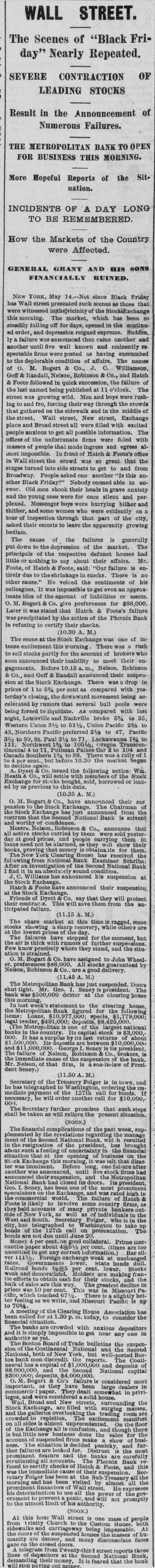

WALL STREET. The Scenes of "Black Friday" Nearly Repeated. SEVERE CONTRACTION OF LEADING STOCKS Result in the Announcement of Numerous Failures. THE METROPOLITAN BANK TO OPEN FOR BUSINESS THIS MORNING. More Hopeful Reports of the Situation. INCIDENTS OF A DAY LONG TO BE REMEMBERED. How the Markets of the Country were Affected. GENERAL GRANT AND HIS SONS FINANCIALLY RUINED. NEW YORK, May 14.-Not since Black Friday has Wall street presented such scenes those that were witnessed in)thelvicinity of the StockiExchange this morning. The market, which has been so steadily falling off for days, opened the continued erder, and depression reigned supreme. Sudden. lya failure was then came another and another until five well known and eminently re spectable firms were posted having succumbed to the condition of affairs. The names of O. M. Bogert & Co., J. C. Williamson, Goff Randall, Nelson, Robinson Co., and Hatch & Foote followed in quick succession, the failure of the last named being published 11 o'clock. The street was growing wild. Men and boys were rushing and fro, forcing their way through the crowds that gathered on the sidewalk and in the middle of the street. Wall street, New street, Exchange place and Broad street were filled with excited people anxious to get all possible The offices of the unfortunate firms were filled with masses of people that made ingress and egress alnost impossible. In front of Hatch & Foote's office in Wall street the crowd was 80 great that the stages turned into side streets to get to and from Broadway. People asked one another "Is this another Black Friday?" Nobody seemed able to answer. Old men shook their heads grave anxiety and the young ones were for once silent and perplexed. Messenger boys were hurrying bither and thither, and some women who were evidently on tour of inspection through that part of the city, asked their escorts to leave the apparently growing bedlam. The cause of the failures is generally put down depression the market. The principals of the respective defunct houses had little or nothing to say about their affairs. Mr. Foote, of Hatch & Foote, said "Our failure is entirely due to the shrinkage in stocks There is no other cause." He voiced the sentiments of his colleagues. It was impossible to get even an approximate idea of the amount of liabilities or assets. O. M. Bogert Co. give preferences for $86,000. Later was stated that Hatch & Foote's failure was precipitated by the action the Phoenix Bank in refusing to certify their checks. (10.30 M.) The scene at the Stock Exchange was one of intense excitement this morning. There was rush to sell stocks partly for the of brokers who soon their inability to meet their engagements. Before 10.15 m., Nelson, Robinson & Co., and Goff Randall their suspension the Stock Exchange. There was drop in prices of to 5% per cent as compared with yes. terday' closing, the dow ward being accelerated by rumors that several bull pools were being foreed liquidate. AS compared with last night, Louisville and Nashville broke 5% to 35, Western Union 3½ 511/2, Union Pacific 2% to 43, Northern Pacific preferred 31/8 to 47, Pacific 39, St. Paul 21/4 Lackawanna 1% to Northwest TransconOregon 1% 1051/2, tinental toll, Pullman Palace Car 104 and Canada Southern There was of 1 per but 10.30 the market began to decline Dyett again. issued the following notice: Wm. Heath Co., will settle with of the Stock Exchange for stock bought, sold, borrowed or loanby previous (10.35 M.) O. M. Bogart have nonnced their sus pension the Stock Exchange. The Chairman the Stock Exchange has announced from the rum that the National Bank is solvent confidence. and worthy Messrs. Nelson, Robinson & Co., announce that all active stocks carried by them were day good prices, and people carrying them in loans need not alarmed, show their books, proving that money ole them. The New York Clearing House has received the following from National Bank Examiner Schriba: investigation of the Second Bank I find ely sound Iliams has announced bis suspension at the Stock Exchange Hatch Foote have announced their suspension at the Stock Exchange. Friends Dyett say that they will protect their This will them from the anticipated failure. M.) The share market at this time ragged, some stocks showing sharp recovery, while are the at lowest the day. The failures have stopped for the moment, bnt the thick with rumors further suspensions. Few know precisely where they stand, and the situation Bogart Co. have assigned to John Wheelpreferences $86,000. All stocks ateed by Nelson, Robinson Co., are good delivery. 11.45 M.) The Metropolitan Bank has just suspended. Doors shut tight. Mr. Geo Seney president. The bank was 8500 debtor at the clearing house this morning. last week's statement to the clearing house, the Bank figured for the following items: Loans, 79,000; tender, $491, deposits, $8,425,000 (The Metropolitan one largest national banks country. capital stock is $3,000, has by returns about Its between and George Senev president, failure of Nelson, Robinson brokers, the immediate cause the bank. Nelson. that firm, a son-in- of President Seney.) (11.50 A.M.) Secretary of the Treasury Folger is in town, and he has teleg aphed dering the immediate yment of the 127th call for bonds. necessary, 000. he order another call for $10,000,The Secretary further promises that such steps shall be taken as will the present situation. (NOON.) The financial complications of the past week, supment plemented of the by Second the revelations National Bank the manage in the resignation the president, has brought about eeling financial situation that at the opening business the Exchange this morning. that disaster imminent. Before long one failure after was announced, firms until had announced their suspension, and the Metropolitan been National Bank had closed doors the its president, Geo. has Seney, prominent most speculators the Exchange, and was rated high world. The failure Hatch Foote likely involve some country nrms, they held accounts of many private bankers side lew York, well Westand South. Secretary Folger, who the city has telegraphed to take bonds of the call on presentation. The bonds intil not are June due Money per cent. good collateral. Prime mercantile paper about 406% per cent. (times are too unsett any correct ver Foreign exchange weak rates. Governments lower. State bonds dull. Railroad bonds 1/2@5 cent. lower. Stocks weak and demoralizhd. Holders making efforts obtain cash for their stocks, and the bulk sales are way The greatest decline prices was per cent. This Missouri cific touched slightly betfeeling as we write, and Missouri Pacific is up to 701/4 meeting of the Clearing House Association has been 1.30 m. today, to consider the financial situation The banks are crowded with anxious depositors and is simply impossible to get near any one in The Board Trade bulletins the suspension the Continental National and Second National, both New York, but Bos ton bank men reports. The Conti nental has capital ,000,000 and deposits and Second National capital deposits Bogert Co's failure is considered most important they have been large dealers in and paper. They dealt a solid in privihouse. Broad aud New streets, surrounding the Stock Exchange are filled with surging masses, and the trading room crowded to repletion. The excitement manifest on sides almost unprecedented. door the Exchange and though there but little new business done the sales for the account suspended firms make show business. the situation decided panicky and further failures are looked for Distrust the most prominent feature and the banks scrutinizing accounts. Phoenix Bank fused checks of Hatch Foote, and this was immedi has cause their suspension. Secretary has been the Sub- Treasury all morning and has been visited almost the prominent financiers treet. expresses ination use the the ernment to the limit panic, his authority. will act promptly (NOON.) At this hour Wall street is one mass of people from Trinity Church lustom House both sidewalks and carriageway being impassable manity are closed denser, and many disconsolate faces doors.