Article Text

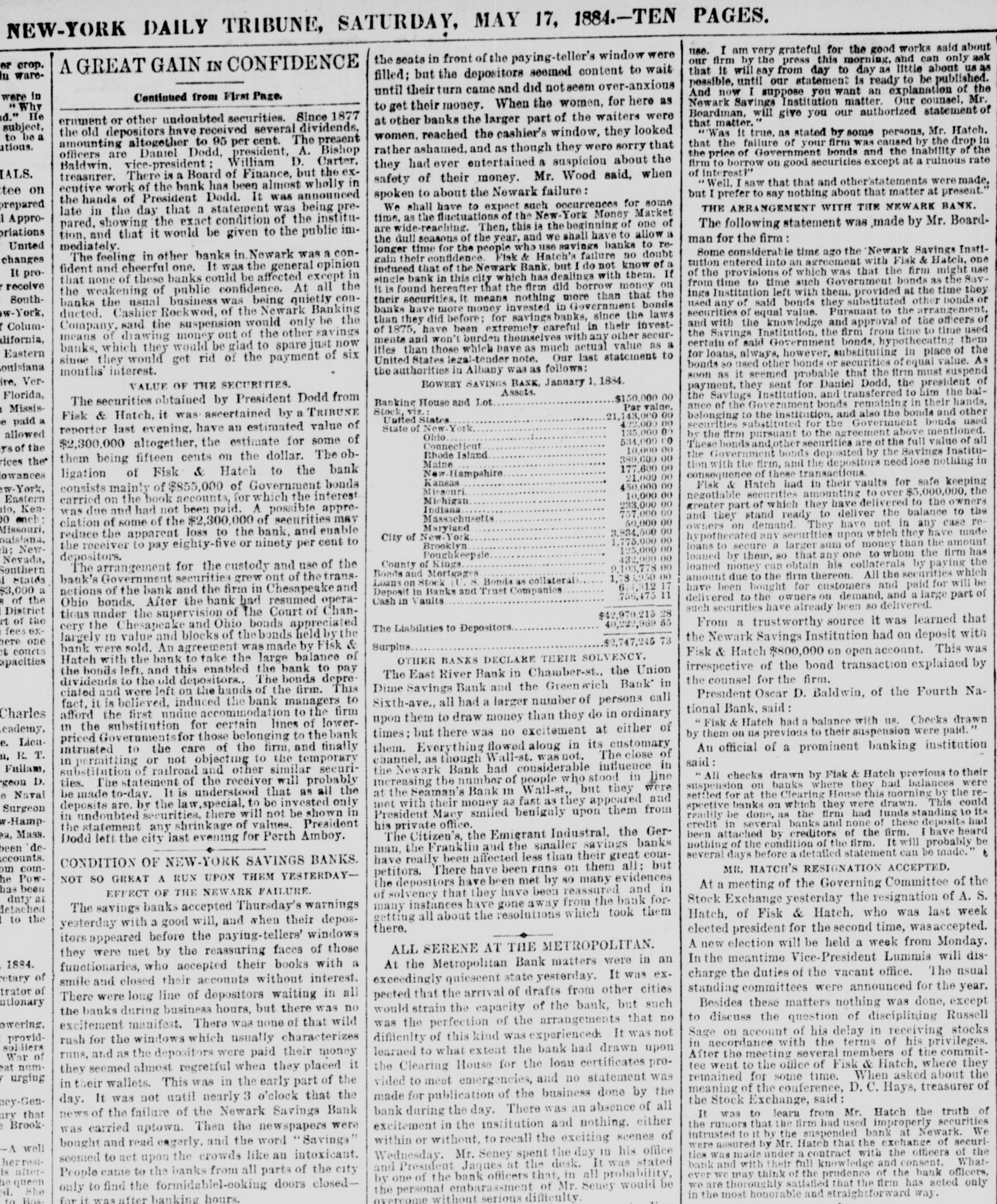

NEW-YORK DAILY TRIBUNE, SATURDAY, MAY 17, 1884.-TEN PAGES. use. I am very grateful for the good works said about the seats in front of the paying-teller's window were our firm by the press this morning, and can only ask crop. A GREAT GAIN IN CONFIDENCE that it will say from day to day as little about us as warefilled; but the depositors seemed content to wait possible, until our statement is ready to be published. until their turn came and did notseem over-anxious And now I suppose you want an explanation of the in were Continued from First Page. Newark Savings Institution matter. Our counsel, Mr. Why to get their money. When the women, for here as Boardman, will give you our authorized statement of He ernment or other undoubted securities. Since 1877 at other banks the larger part of the waiters were that matter." subject, "Was It true, as stated by some persons, Mr. Hatch. the old depositors have received several dividends, a be women, reached the cashier's window, they looked to that the failure of your firm was caused by the drop in amounting altogether to 95 per cent. The present rather ashamed, and as though they were sorry that the price of Government bonds and the inability of the officers are Daniel Dodd, president, A. Bishop firm to borrow on good securities except at a ruinous rate they had ever entertained a suspicion about the Baldwin, vice-president; William D. Carter, of interest?" treasurer. There is a Board of Finance, but the exsafety of their money. Mr. Wood said, when Well. I saw that that and other'statements were made, ecutive work of the bank has been almost wholly in on but I prefer to say nothing about that matter at present.' spoken to about the Newark failure: the hands of President Dodd. It was announced prepared We shall have to expect such occurrences for some THE ARRANGEMENT WITH THE NEWARK BANK. late in the day that a statement was being pretime, as the fluctuations of the New-York Money Market Appropared. showing the exact condition of the instituThe following statement was made by Mr. Boardare wide-reaching. Then, this is the beginning of one of priations tion, and that it would be given to the public imthe dull seasons of the year, and we shall have to allow a man for the firm: United longer time for the people who use savings banks to reSome considerable time ago the Newark Savings Instimediately. The feeling in other banks in Newark was a congain their confidence. Fisk & Hatch's failure no doubt changes tution entered into an agreement with Fisk & Hatch, one fident and cheerful one. It was the general opinion induced that of the Newark Bank. but I do not know of a It of the provisions of which was that the firm might use prosingle bank in this city which has dealings with them. If that none of these banks could be affected except in from time to time such Government bonds as the Savreceive It is found hereafter that the firm did borrow money on the weakening of public confidence. At all the ings Institution left with them. provided at the time they their securities, it means nothing more than that the Southbanks the usual business was being quietly conused any of said bonds they substituted other bonds or banks have more money invested in Government bonds securities of equal value. Pursuant to the arrangement, ducted. Cashier Rockwod, of the Newark Banking than they did before; for savings banks, since the laws and with the knowledge and approval of the officers of ColumCompany, said the suspension would only be the of 1875, have been extremely careful in their investthe Savings Institution, the firm from time to time used means of drawing money out of the other savings ments and won't burden themselves with any other securdifornia, certain of said Government bonds, hypothecating them itles than those which bave as much actual value as a banks, which they would be glad to spare just now Eastern for loans, always, however, substituting in place of the United States legal-tender note. Our last statement to since they would get rid of the payment of six bonds so used other bonds or securities of equal value. As ouisiana the authorities in Albany was as follows: months' interest. soon as it seemed probable that the firm must suspend VerBOWERY SAVINGS BANK, January 1, 1884. VALUE OF THE SECURITIES. payment. they sent for Daniel Dodd, the president of Assets. Florida, the Savings Institution. and transferred to him the bal$150,000.00 The securities obtained by President Dodd from Banking House and Lot ance of the Government bonds remaining in their hands, Par value. MissisStock, viz. belonging to the institution. and also the bonds and other Fisk & Hatch, it was ascertained by a TRIBUNE 21,143,000 0 United States a paid 422,000.00 securities substituted for the Govermment bonds used State of New.York reporter last evening, have an estimated value of 135,000.00 allowed by the firm pursuant to the agreement above mentioned. Ohio 534,000.00 These bonds andother securities are of the full value of all $2,300,000 altogether, the estimate for some of Connecticut the of 10,000 00 the Government bonds deposited by the Savings InstituRhode Island 389,600.00 them being fifteen cents on the dollar. The obthe Maine tion with the firm, and the depositors need lose nothing in 177,600.00 New-Hampshire consequence of these transactions. lowances ligation of Fisk & Hatch to the bank 21,000 00 Kansas Fisk & Hatch had in their vaults for safe keeping 450,000.00 consists mainly of $855,000 of Government bonds Missouri. negotiable securities amounting to over $5,000,000, the 10,000 00 Eastern carried on the book accounts, for which the interest Michigan 233,000 € greater part of which they have delivered to the owners KenIndiana was due and had not been paid. A possible appre757,000.00 and they stand ready to deliver the balance to the Massachusetts each: ciation of some of the $2,300,000 of securities may 50,000.00 owners on demand. They have not in any case reMaryland Missouri, 3,834,500 00 reduce the apparent loss to the bank, and enable hypothecated any securities upon which they have made City of New.York ouisiana, 1,775,000 loans to secure a larger sum of money than the amount Brooklyn the receiver to pay eighty-five or ninety per cent to New125,000.00 Poughkeepsie loaned by their, so that any one to whom the firm has 432,000.00 Nevada, County of Kings loaned money can obtain his collaterals by paying the 9,103,778.00 depositors. The arrangement for the custody and use of the Southern Bonds and Mortgages amount due to the firm thereon. All the securities which 1,786,950.00 bank's Government securities grew out of the transStates Loans on Stock (U. S. Bonds as collateral) 674,312 17 have been bought for customers and paid for will be a $3,000 actions of the bank and the firm in Chesapeake and Deposit in Banks and Trust Companies delivered to the owners on demand, and a large part of the of Cash in Vaults Ohio bonds. After the bank had resumed operasuch securities have already been so delivered. District tions under the supervision of the Court of Chan$42,970.215 of the From a trustworthy source it was learned that 40,222,969 55 cery the Chesapeake and Ohio bonds appreciated The Liabilities to Depositors exfees largely ID value and blocks of thebonds held by the the Newark Savings Institution had on deposit with one $2,747,245 Surplus bank were sold. An agreement was made by Fisk & courts Fisk & Hatch $800,000 on account. This was Hatch with the bank to take the large balance of OTHER BANKS DECLARE THEIR SOLVENCY. apacities irrespective of the bond transaction explained by the bonds left. and this enabled the bank to pay The East River Bank in Chamber-st., the Union the counsel for the firm. dividends to the old depositors.. The bonds depreDime Savings Bank and the Greenwich Bank* in ciated and were left on the hands of the firm. This President Oscar D. Baldwin, of the Fourth NaSixth-ave., all had a larger number of persons call fact, it is believed, induced the bank managers to tional Bank, said: Charles afford the first undue accommodation to the firm upon them to draw money than they do in ordinary Fisk & Hatch had a balance with us. Checks drawn in the substitution for certain lines of lowerleademy, times; but there was no excitement at either of by them on us previous to their suspension were paid." priced Governmentsfor those belonging to the bank LieuAn official of a prominent banking institution them. Everything flowed along in its customary intrusted to the care of the firm, and finally T. R. channel, as though Wall-st. not. The close of in permitting or not objecting to the temporary said: Fullam, the Newark Bank had considerable influence in substitution of railroad and other similar securiAll checks drawn by Fisk & Hatch previous to their D. increasing the number of people who stood in line ties. The statement of the receiver will probably suspension on banks where they had balances were at the Seaman's Bank in Wall-st., but they were be made to-day. It is understood that as all the Naval settled for at the Clearing House this morning by the remet with their money as fast as they appeared and spective banks on which they were drawn. This could deposits are. by the law, special, to be invested only Surgeon President Macy smiled benignly upon them from readily be done, as the firm had funds standing to its in undoubted securities. there will not be shown in credit in several banks and none of these deposits had his private office. the statement any shrinkage of values. President Mass. been attached by creditors of the firm. I have heard The Citizen's, the Emigrant Industral, the GerDodd left the city last evening for Perth Amboy. nothing of the condition of the firm. It will probably be "deman, the Franklin and the smaller savings banks several days before a detailed statement can be made." t, accounts. have really been affected less than their great comCONDITION OF NEW-YORK SAVINGS BANKS. comMR. HATCH'S RESIGNATION ACCEPTED. petitors. There have been runs on them all; but PowNOT so GREAT A RUN UPON THEM YESTERDAYthe depositors have been met by so many evidences At a meeting of the Governing Committee of the been EFFECT OF THE NEWARK FAILURE. of solvency that they have been reassured and in at duty Stock Exchange yesterday the resignation of A. S. many instances have gone away from the bank fordetached The savings banks accepted Thursday's warnings Hatch, of Fisk & Hatch, who was last week getting all about the resolutions which took them to the yesterday with a good will, and when their deposthere. elected president for the second time, wasaccepted. itors appeared before the paying-tellers' windows A new election will be held a week from Monday. ALL SERENE AT THE METROPOLITAN. they were met by the reassuring faces of those In the meantime Vice-President Lummis will dis1884. At the Metropolitan Bank matters were in an functionaries, who accepted their books with a charge the duties of the vacant office. The usual of exceedingly quiescent state yesterday. It was exsmile and closed their accounts without interest. standing committees were announced for the year. of pected that the arrival of drafts from other cities There were long line of depositors waiting in all utionary Besides these matters nothing was done, except would strain the capacity of the bank, but such the banks during business hours, but there was no to discuss the question of disciplining Russell was the perfection of the arrangements that no owering, excitement manifest. There was none of that wild Sage on account of his delay in receiving stocks difficulty of this kind was experienced. It was not providrush for the windows which usually characterizes in accordance with the terms of his privileges. soldiers learned to what extent the bank had drawn upon After the meeting several members of the commitruns, and as the depositors were paid their money of War tee went to the office of Fisk & Hatch, where they the Clearing House for the loan certificates pronumthey seemed almost regretful when they placed it remained for some time. When asked about the urging vided to meet emergencies, and no statement was in their wallets. This was in the early part of the meaning of the conference, D. C. Hays, treasurer of made for publication of the business done by the day. It was not until nearly 3 o'clock that the the Stock Exchange, said: ney-Genbank during the day. There was an absence of all It was to learn from Mr. Hatch the truth of news of the failure of the Newark Savings Bank that the rumors that the firm had used improperly securities Brookexcitement in the institution and nothing. either was carried uptown. Then the newspapers were intrusted to it by the suspended bank at Newark. We within or without, to recall the exciting scenes of bought and read eagerly. and the word "Savings" were assured by Mr. Hatch that the exchange of securiwell ties was made under a contract with the officers of the Wednesday. Mr. Seney spent the day 10 his office seemed to act upon the crowds like an intoxicant. resibank and with their full knowledge and consent. Whatand President Jaques at the desk. It was stated afterPeople came to the banks from all parts of the city ever we may think of the prudence of the bank officers, by one of the bank officers that. in all probability, queen we are thoroughly satisfied that the firm has acted only only to find the formidablel-ooking doors closedthe personal embarassment of Mr. Seney would be She in the most honorable and straightforward way. to Bosfor it was after banking hours. overcome without serious difficulty.