Article Text

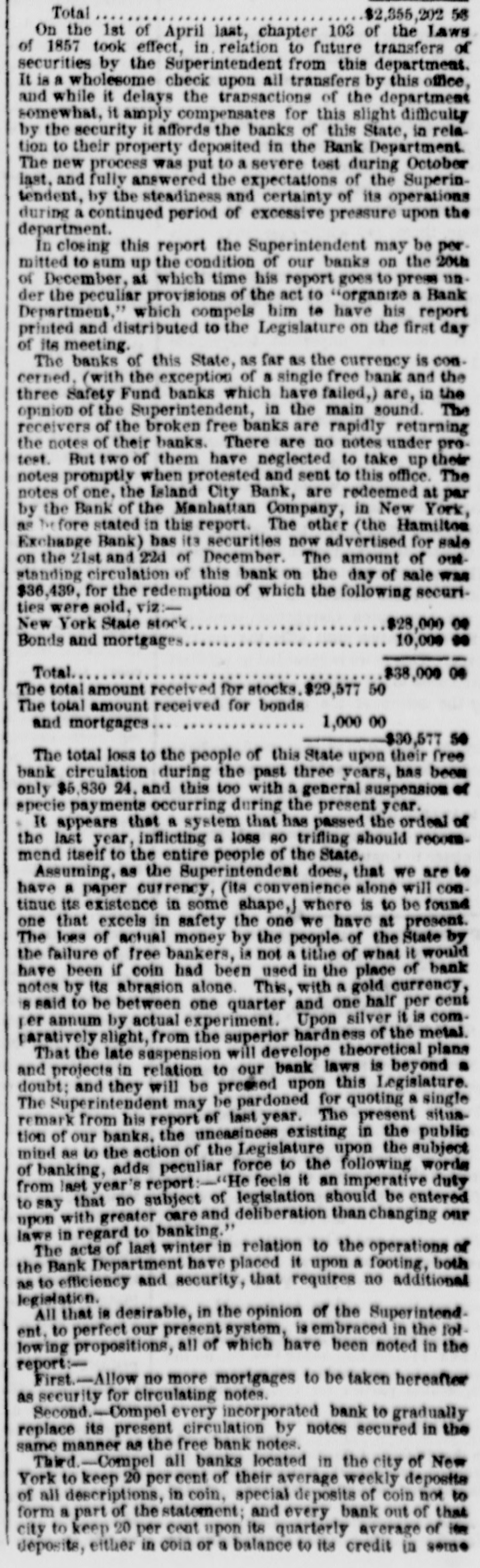

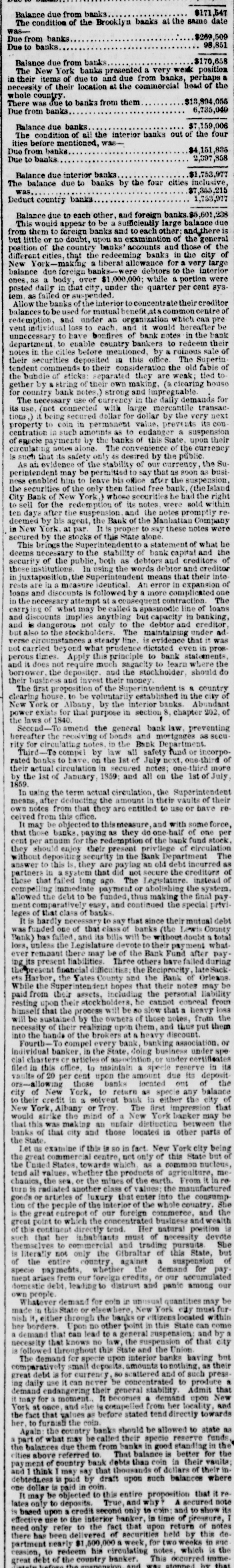

Balance due from banks. $171,547

The condition of the Brooklyn banks at the same date was-

Due from banks. $269,509

Due to banks. 98,851

Balance due from banks. $170,658

The New York banks presented a very weak position in their items of due to and due from banks, perhaps a necessity of their location at the commercial head of the whole country.

There was due to banks from them. $13,894,055

Due from banks. 6,735,040

Balance due banks. $7,159,006

The condition of all the interior banks out of the four ities before mentioned, was-

Due from banks. $4,151,835

Due to banks. 2,397,858

Balance due interior banks. $1,753,977

The balance due to banks by the four cities inclusive, was. $7,355,215

Deduct country banks. 1,753,977

Balance due to each other, and foreign banks.$5,601,238

This would appear to be a sufficiently large balance due from them to foreign banks and to each other; and there is but little or no doubt, upon an examination of the general position of the country banks' accounts and those of the different cities, that the redeeming banks in the city of New York-making a liberal allowance for a very large balance due foreign banks-were debtors to the interior ones, as a body, over $1,000,000; while a portion were posted daily in that city, under the quarter per cent system, as failed or suspended.

Allow the banks of the interior to concentrate their creditor balances to be used for mutual benefit, at a common centre of redemption, and under an organization which can prevent individual loss to each, and it would hereafter be unnecessary to bave bonfires of bank notes in the bank department, to enable country bankers to redeem their notes in the cities before mentioned, by a ruinous sale of their securities deposited in this office. The Superintendent commends to their consideration the old fable of the bubdie of sticks: separated they are weak; tied together by a string of their own making, (a clearing house for country bank notes,) strong and impregnable.

The necessary use of currency in the daily demands for its use, (not connected with la large mercantile transactions,) it being secured dollar for dollar by the very next property to coin in permanent value, prevents its concentration in such amounts as to endanger a suspension of specie payments by the banks of this State, upon their circulating notes alone. The convenience of the currency is such that its safety only is desired by the public.

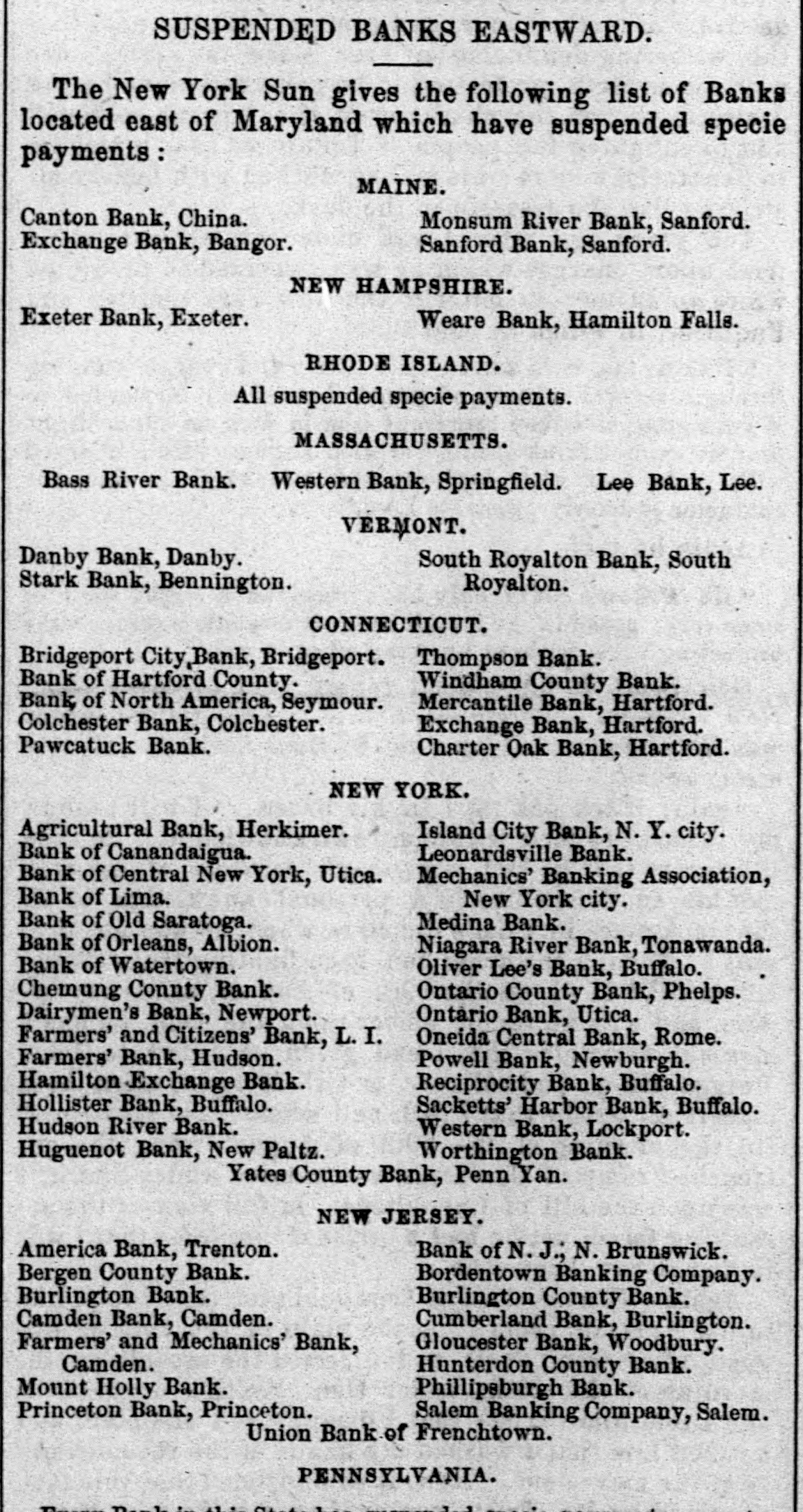

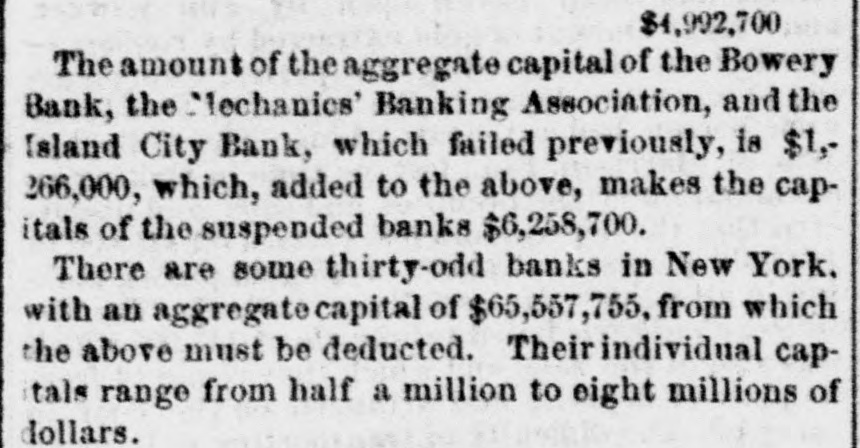

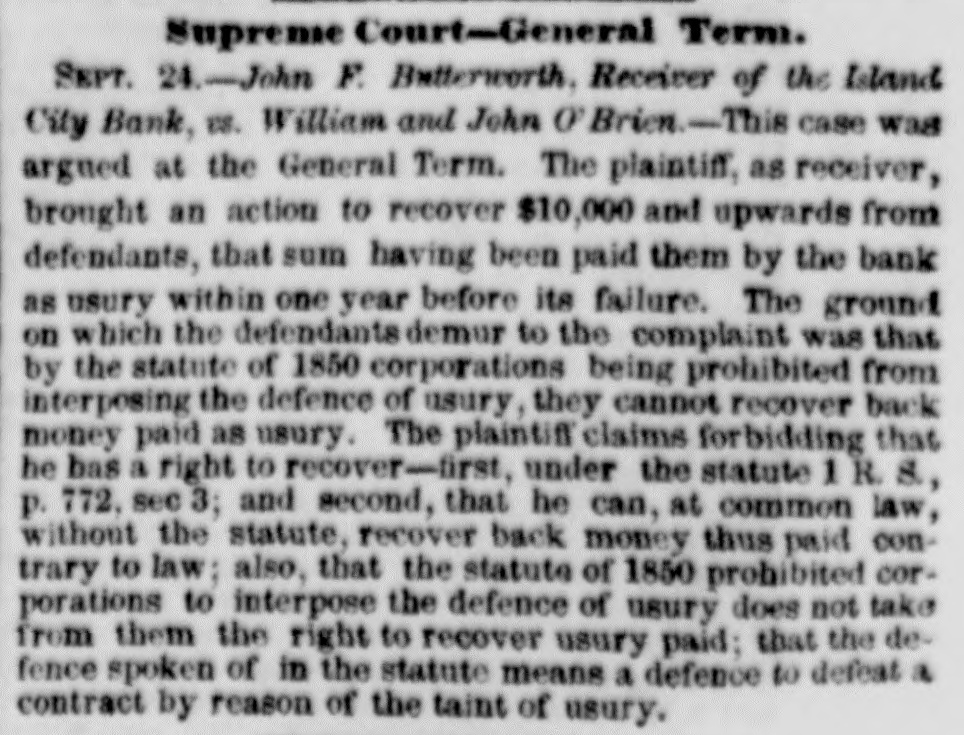

As an evidence of the stability of our currency, the Superintendent may be permitted to say that as soon as business enabled him to leave his office after the suspension, the securities of the only then failed free bank, (the Island City Bank of New York,) whose securities he had the right to sell for the redemption of its notes, were sold within ten days after the suspension, and the notes promptly redeemed by his agent, the Bank of the Manhattan Company in New York, at par. It is proper to say these notes were secured by the stocks of this State alone.

This brings the Superintendent to a statement of what he deems necessary to the stability of bank capital and the security of the public, both as debtors and creditors of those institutions. In using the words debtor and creditor in juxtaposition, the Superintendent means that their interests are in a measure identical. An error in expansion of loans and discounts is followed by a more complicated one in the necessary attempt at a consequent contraction. The carrying of what may be called a spasmodic line of loans and discounts implies anything but capacity in banking, and is dangerous not only to the debtor and creditor, but also to the stockholders. The maintaining under adverse circumstances a steady line, is evidence that it was not carried beyond what prudence dictated even in prosperous times. Apply this principle to bank statements, and it does not require much sagacity to learn where the borrower, the depositer, and the stockholder, should do their business and invest their money.

The first proposition of the Superintendent is a country clearing house, to be voluntarily established in the city of New York or Albany, by the interior banks. Abundant power exists for that purpose in section 8, chapter 202, of the laws of 1840.

Second To amend the general bank law, preventing hereafter the receiving of bonds and mortgages as security for circulating notes, in the Bank Department.

Third-To compel by law all safety fund or incorporated banks to bave, on the 1st of July next, one-third of their actual circulation in secured notes; one-third more by the 1st of January, 1859; and all on the 1st of July, 1859.

In using the term actual circulation, the Superintendent means, after deducting the amount in their vaults of their own notes from that they arc entitled to use or have received from this office.

It may be objected to this measure, and with some force, that those banks, paying as they do one-half of one per cent per annum for the redemption of the bank fund stock, they should enjoy their present privilege of circulation without depositing security in the Bank Department The answer to this is, they are paying an old debt incurred as partners in a system that did not secure the creditors of those that failed long ago. The Legislature. instead of compelling immediate payment or abolishing the system, allowed the debt to be funded, thus making the final payment comparatively easy, and continued the special privileges of that class of banks.

It is hardly necessary to say that since their mutual debt was funded one of that class of banks (the Lewis County Bank) bas failed, and its bills will be without doubt a total loss, unless the Legislature devote to their payment whatever remaant there may be of the Bank Fund after paying its present liabilities. Three others have falled during the present financial difficultiss; the Reciprocity, late Sackets Harbor, the Yates County and the Bank of Orleans. While the Superintendent hopes that their notes may be paid from their assets, including the personal liability resting upon their stockholders, he cannot conceal from himself that the process will be so slow that a heavy loss will be sustained by the owners of those notes, from the necessity of their realizing upon them, and thus put them into the hands of the brokers at a heavy discount.

Fourth To compel every bank, banking association, or individual banker, in the State, doing business under special charters or articles of association, or under certificates filed in this office, to maintain a specie reserve in ita vaults of 20 per cent upon the amount due its depositors-allowing those banks located out of the city of New York, to return as specie any balance to their credit in a solvent bank in either the city of New York, Albany or Troy. The first impression that would strike the mind of a New York banker may be that this was making an unfair distinction between the banks of that city and those located in other parts of the State.

Let us examine if this is so in fact. New York city being the great commercial centre, not only of this State but of the United States, towards which, as a common nucleus, tend all values, whether the products of agriculture, mechanics, the sea, or the mines of the earth. From it in return is radiated another class of values; the manufactured goods or articles of luxury that enter into the consumption of the pecple of the interior of the whole country. She is the great entrepot of our foreign commerce, and the great point to which the concentrated business and wealth of this continent directly tend. Her natural position is such that her inhabitants must of necessity devote themselves to commercial and trading pursuits. She is literally not only the Gibraltar of this State, but of the entire country, against a suspension of specie payments, whether the demand for payment arises from our foreiga credits, or our accumulated domestic debt, leading to distrust and panic among our own people.

Whatever demand for coln in unusual quantities may be made in this State or elsewhere, New York city must furnish it, either through the banks or citizens located within her borders. Upon no other point in this State can come a demand that can lead to a general zuspension; and by a necessity that knows no law, the suspension of that city is followed throughout this State and the Union.

The demand for specie upon interior banks having but comparatively small deposits, amounts to nothing, as their great debt is for currency, so scattered and of such pressing daily use it can never be concentrated to produce a demand endangering their general stability. Admit that it may for a moment. It becomes a demand upon New York at once, and she is compelled from her locality, and the fact that values as before stated tend directly towards her, to furnish the coin.

Again: the country banks should be allowed to state as a part of what may be called their specie reserve funds, the balances due them from banks in good standing in the cities above referred to. That balance is better for the payment of country bank debts than coin in their vauits; and I think I may say that thousands of dollars of their indebtedness is paid by draft upon such balances where one dollar is paid in coin.

It may be objected to this entire proposition that it relates only to deposits. True, and why? A secured note is based upon a credit second only to coin; and to show its effective use to the interior banker, in time of pressure, I need only refer to the fact that upon return of notes there has been delivered of securities held by this department nearly $1,500,000 a week, for two weeks in succession, to redeem his circulating notes, which is the great debt of the country banker. This occurred imme before the ananension and was stopped by that