Article Text

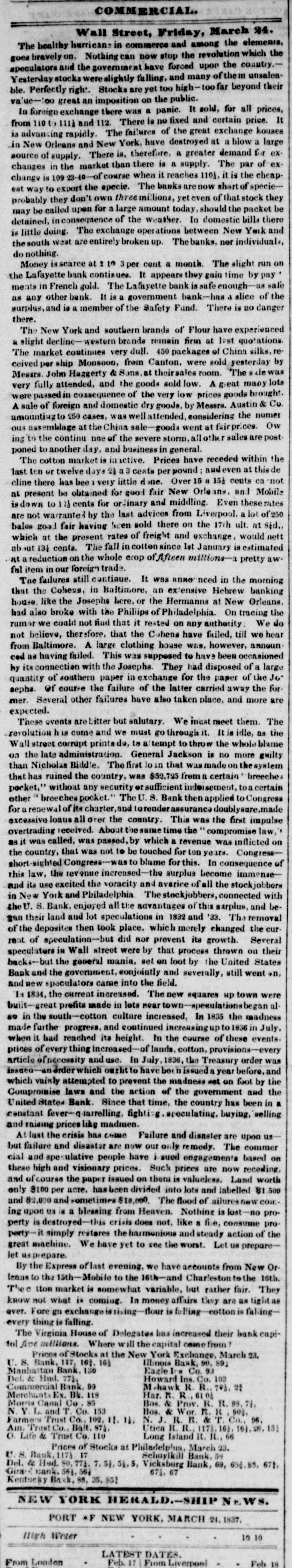

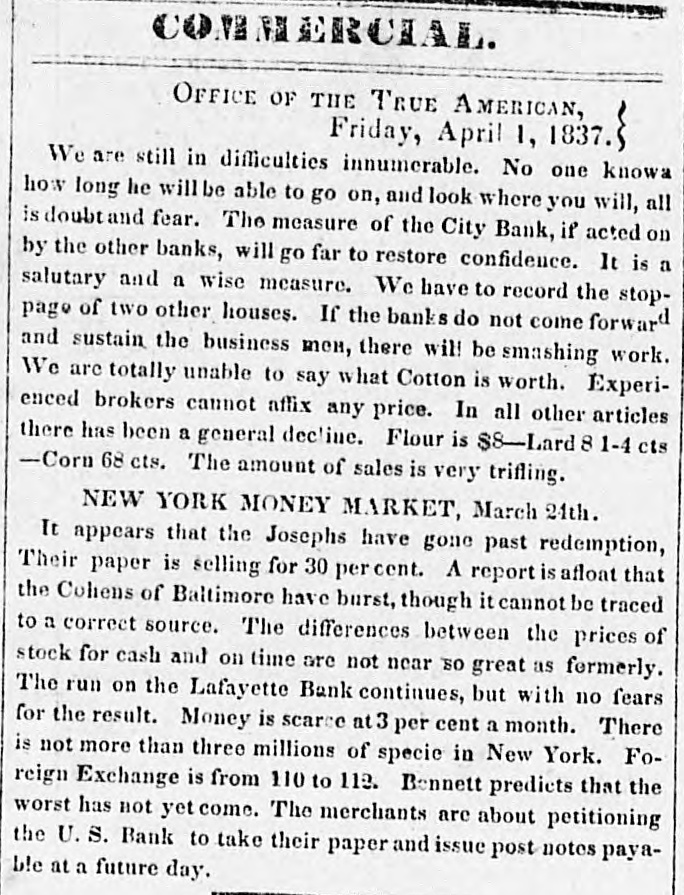

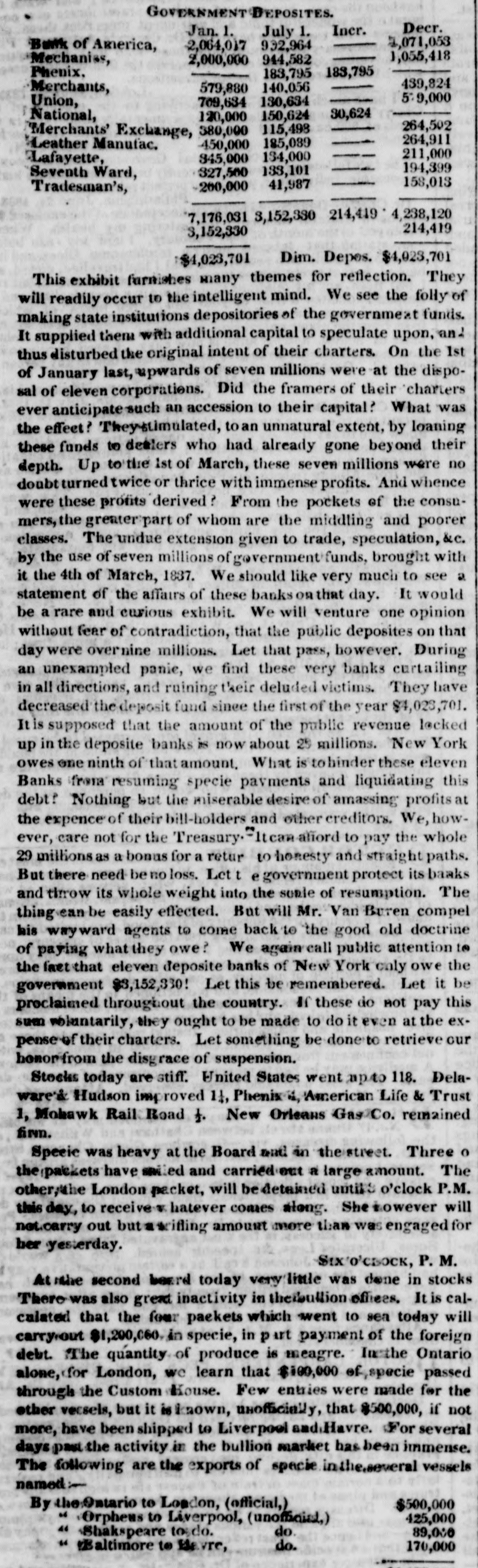

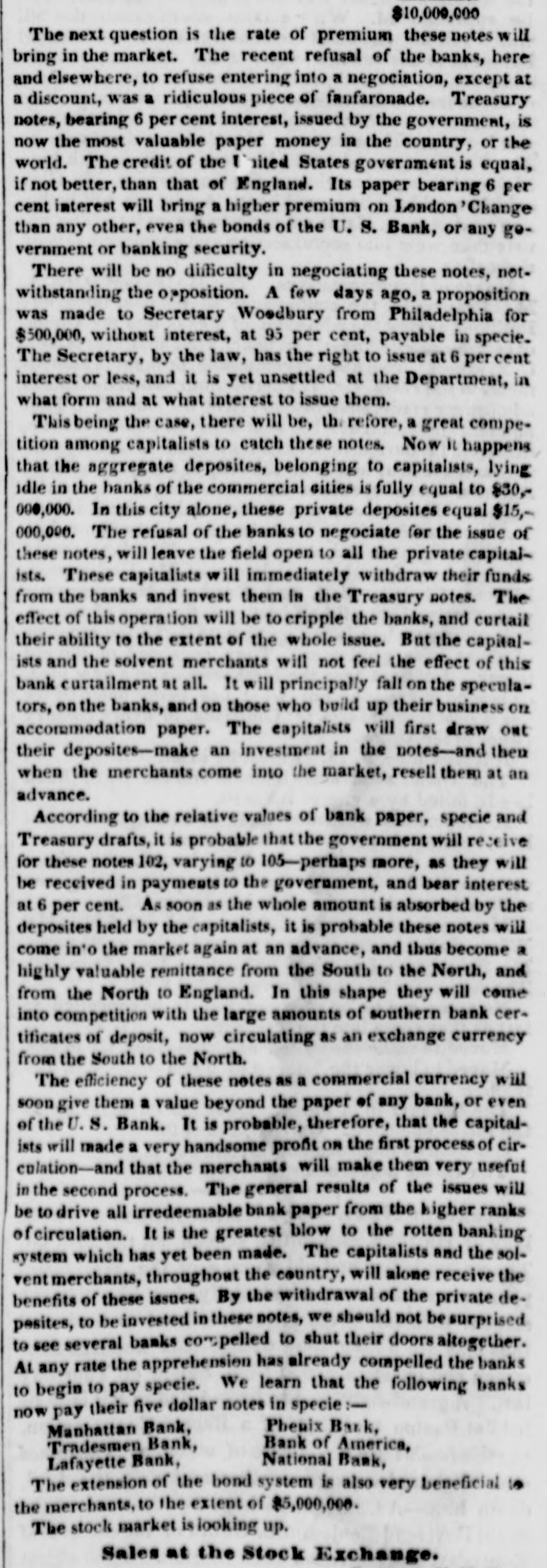

COMMERCIAL. Wall Street, Friday, March 24. The healthy hurricans in commerce and among the elemenis, the bravely on. Nothing can now stop the revolution which speculators goes and the government have forced upon the country. unsaleaYesterday stocks were slightly falling, and many of the their ble. Perfectly right. Stocks are yet too high- too far beyond value-:00 great an imposition on the public. all In foreign exchange there was a panie. It sold, for prices, It 110 to 111 and 112. There is no fixed and certain price. houses from rapidly. The failures of the great exchange is advansing New Orleans and New York, have destroyed at a blow a large in of supply. There is, therefore, a greater demand for exsource market than there is a supply. The par of of course when it reaches 1101, it the specie. The banks arenow short change est changes way is to in 109 export the 23-40 of that is of the stock specie- cheap they exthey don't own three millions, yet even probably be called upon for a large amount today, should the packet be detained, may in consequence of the weather. In domestic bills there little doing. The exchange operations between New York and is south west are entirely broken up. The banks, nor individuals, o nothing. Money is scarce at : to 3 per cent a month. The slight run on the Lafayette bank continues. It appears they gain time by pay' ments in French gold. The Lafayette bank safe enough- as safe any other bank. It is a government bank-has a slice of the surplus, as and is a member of the Safety Fund. There is 20 danger there. The New York and southern brands of Flour have experienced slight decline western brands remain firm at last quotations. The a market continues very dull. 450 packages of China silks, ceived per ship Monsoon, from Canton, were sold yesterday by Messrs. John Haggerty & Sons, at theirsales room. The was lots fully attended, and the goods sold low. A great maoy brought. very passed in cossequence of the very low prices goods Co. were sale of foreign and domestic dry goods, by Messrs. Austin & amountiest A to 250 cases, was well attended, considering the numer Ow assemblage at the China sale-goods went at fair prices. ous ing to the continu noe of the severe storm, allothe sales are postponed to another day, and business in general. The cotton market is in active. Prices have receded within this the last ten or twelve days a3 cents er pound ; andeven at not de has bee very little done. Over a 15 cents ca be obtained for good fair New cents for or inary and middling. isdawn at cline present there told Orlea Liverpool, Even and theserates lot Mobile are not warrante by the last advices from a bales good fair having !cen sold there on the 17th ult. at 8td., which at the present rates of freight and exchange would nett ut 131 cents. The fall in cottensince 1st January is estimated at ab a reduction on the whole crop of fifteen millions a pretty awitem in our foreign trade. The failures still continue. It was announce in the morning that the Cohens, in Baltimore, an extensive Hebrew banking house like the Josephs here. or the Hermanns at New Orleans, had also broke with the Philips of Philadelphia. On tracing the do rumor we could not find that it rested on any authority We not believe, therefore, that the Cohens have failed, till we hear Baltimore. A large clothing house was. however, amnoun. from cod having failed. This was supposed to have been occasioned its as connection with the Josephs. They had disposed of a large Jo by of soathern paper in exchange for the paper of the quantity sephs. Of course the failure of the latter carried away the for mer. Several other failures have also taken place, and more are expected. These events are Litter but salutary. We must meet them. The revolution h is come and we must go through It is idle, as the Wall street corrupt prints to attempt to throw the whole blame the late administration. General Jackson is no more guilty on Nicholas Biddle. The first lo in that was made on the system than that has ruined the country, was $52,723 from certain breeche porket," withoat any security er sufficient indoisement, toa certain breeches pocket. The U. 9. Bank then applied to Congress for other renewal of its charter, and torender assurance doublysare,made excessive a loaus all orer the country. This was the first impulse overtrading received. About the same time the compromise law,' as it was called, was passed, by which a revenue was inflicted on country, that was not to be touched for ten years. Congressthe as to blame for this. In consequence of revenue increased-the surplus excited the voracity and avarice of and Philadelphia The and this short-sighted its law, use the Congress-" stockjobbers, become all the connected stockjohners immense- with enjoyed all the advantages of land and lot speculations in 1832 and '33. gan in the U New their S. York Bank, this changed Arplus, The removal the and beof the deposites then took place. which merely current of speculation-br did nor prevent its growth. Several in Wall street were by that process thrown on their speculators backs-but the general mania, set en foot by the United States Bank and the government, conjointly and severally, still went on, and new speculators came into the field. Is 1834, the current increased. The new squares up town were albuilt-great prefits made in lots near town-speculationsbegan in the south-cotton culture increased, In 1835 the madness so made furthe progress, and continued increasing up to 1836 in July, when it had reached its height. In the course of these events. prices of every thing increased- of lands, cotton, provisions-every article of necessity and use. In July, 1836, the Treasury order was and issuea- an Order which ought to have n issued a year before. which vainly attempted to prevent the madness net on foot by the the Compromise laws and the action of the government and a United States Bank. Since that time, the country has been in constant fever q.larrelling, fighti: speculating. buying, selling and raising prices like madmen. At last the crisis has come Failure and disaster are upon us failure and disaster are now our only re medy. The commer but cial and speculative people have i sued engagements based on these high and visionary prices. Such prices are now receding, worth the paper issued on them is valueless. Land acre, has been divided into lots and and sometimes $18,000. The flood of new only and and 82,000 of 9100 course per ailures labelled lost $1.500 com. proing upon us is a blessing from Heaven. Nothing is no perty is destroyed-this crisis does not, like a fire, consume property it simply restores the harmonious and steady action of the great machine. We have yet to see the worst. Let us preparelet prepare. By the Express of last evening, we have accounts from New Orlease to the 15th-Mobile to the 16th-an Charleston to the 16th. Thee tton market is somewhat variable, but rather fair. They know not what is coming. In money affairs they are as tight ever. Fore gn exchange issising flour is folling cotton is fallingevery thing is falling. The Virginia House of Delegates has increased their bank capitol Ave millions. Where will the capital come from , Prices of Stocks at the New York Exchange, March 23. Illinois Bank, 90, 89. U. S. Bank 117, 16t. 16 Eagle In Co. 93 Manhatta Bank, 130 Del. & Hud. 773, Howard Ins. Co. 103 Commercial Bank, 99 M-hawk R R., 70A, 21 Har. R. R 6108 Merchants Ex. Bk. 118 Morris Canal Co. 85 Bos. & Prov. R. R. 98,71, N.Y L. and T. Co. 153 Bos. & Wor. N. R 901. N.J. R. & 96. Farmers Trust Co., 102, 11. 11. Am. Trust Co. Balt, Utica R. R.,117) 151 O. Life & Trust Co. 110 Long Island R. It., 66 Prices of Stocks at Philadelphus, March 23. U.S. Bank,117h Schuylkill Bank, Del. & Hud. 80,77b. 17 7. 51, 51, Vicksburg Bank, 69, 694.85.678 671, 67 Gira Bank. 561,561 Kentucky Bark, 88, NEW YORK HERALD SHIP WS. PORT F NEW YORK, MARCH 24. 1837. 10 10 High Weter LATEST DATES. Feb. 17 From London Feb From Liverpool