Click image to open full size in new tab

Article Text

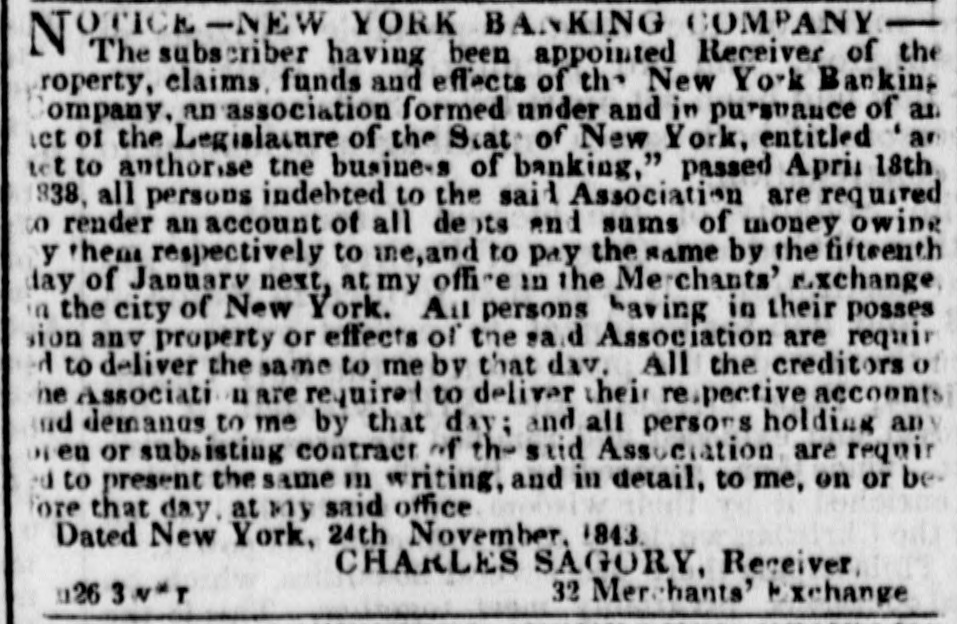

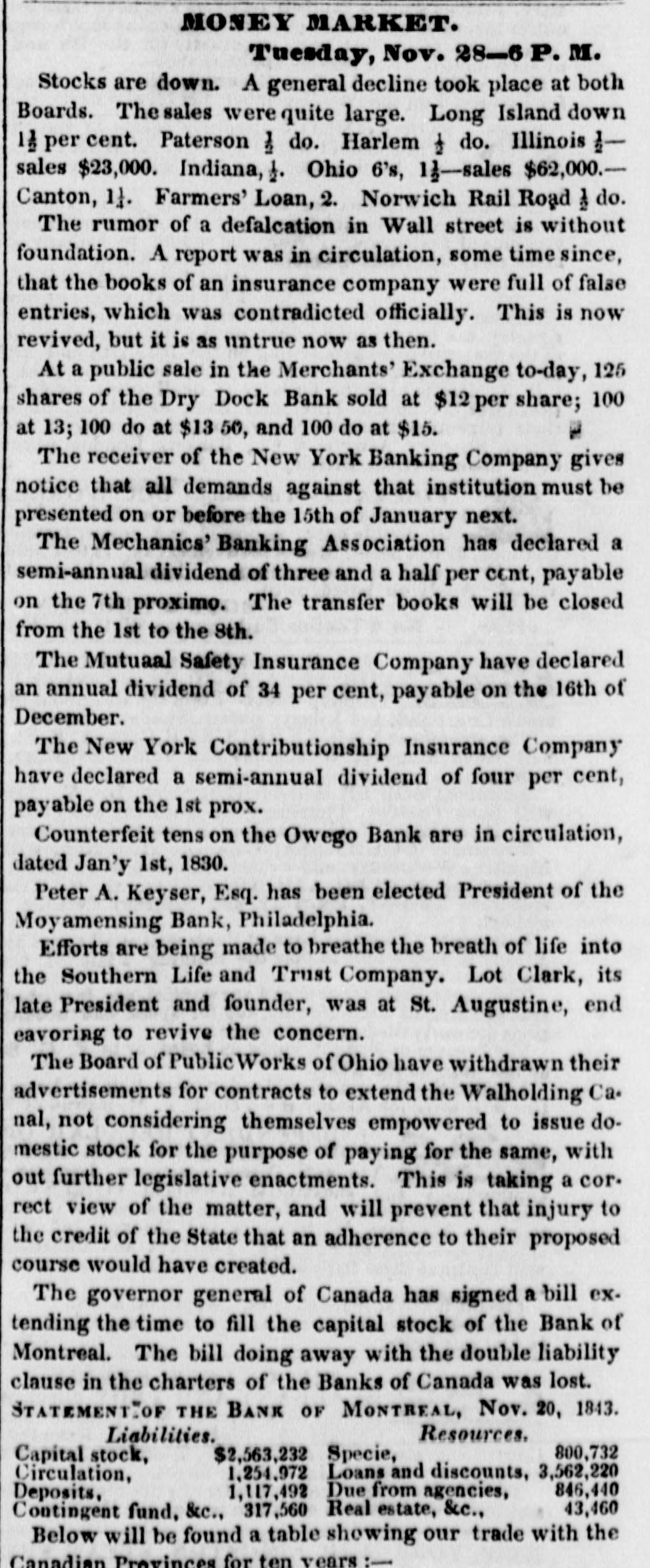

MONEY MARKET. Tuesday, Nov. 28-6 P. Stocks are down. A general decline took place at both Boards. The sales were quite large. Long Island down 12 per cent. Paterson 1 do. Harlem & do. Illinois sales $23,000. Indiana, 1. Ohio 6's, 1-sales $62,000.Canton, 1}. Farmers' Loan, 2. Norwich Rail Road I do. The rumor of a defalcation in Wall street is without foundation. A report was in circulation, some time since, that the books of an insurance company were full of false entries, which was contradicted officially. This is now revived, but it is as untrue now as then. At a public sale in the Merchants' Exchange to-day, 125 shares of the Dry Dock Bank sold at $12 per share; 100 at 13; 100 do at $13 50, and 100 do at $15. The receiver of the New York Banking Company gives notice that all demands against that institution must be presented on or before the 15th of January next. The Mechanics' Banking Association has declared a semi-annual dividend of three and a half per cent, payable on the 7th proximo. The transfer books will be closed from the 1st to the 8th. The Mutuaal Safety Insurance Company have declared an annual dividend of 34 per cent, payable on the 16th of December. The New York Contributionship Insurance Company have declared a semi-annual dividend of four per cent, payable on the 1st prox. Counterfeit tens on the Owego Bank are in circulation, dated Jan'y 1st, 1830. Peter A. Keyser, Esq. has been elected President of the Moyamensing Bank, Philadelphia. Efforts are being made to breathe the breath of life into the Southern Life and Trust Company. Lot Clark, its late President and founder, was at St. Augustine, end eavoring to revive the concern. The Board of Public Works of Ohio have withdrawn their advertisements for contracts to extend the Walholding Ca. nal, not considering themselves empowered to issue domestic stock for the purpose of paying for the same, with out further legislative enactments. This is taking a cor. rect view of the matter, and will prevent that injury to the credit of the State that an adherence to their proposed course would have created. The governor general of Canada has signed a bill extending the time to fill the capital stock of the Bank of Montreal. The bill doing away with the double liability clause in the charters of the Banks of Canada was lost. STATEMENT.OF THE BANK OF MONTREAL, Nov. 20, 1843. Resources. Liabilities. 800,732 Capital stock, $2,563,232 Specie, 1,254,972 Loans and discounts, 3,562,220 Circulation, 846,440 Deposits. 1,117,492 Due from agencies, 43,460 Contingent fund. &c., 317,560 Real estate, &c., Below will be found a table showing our trade with the Canadian Provinces for ten years :-