Article Text

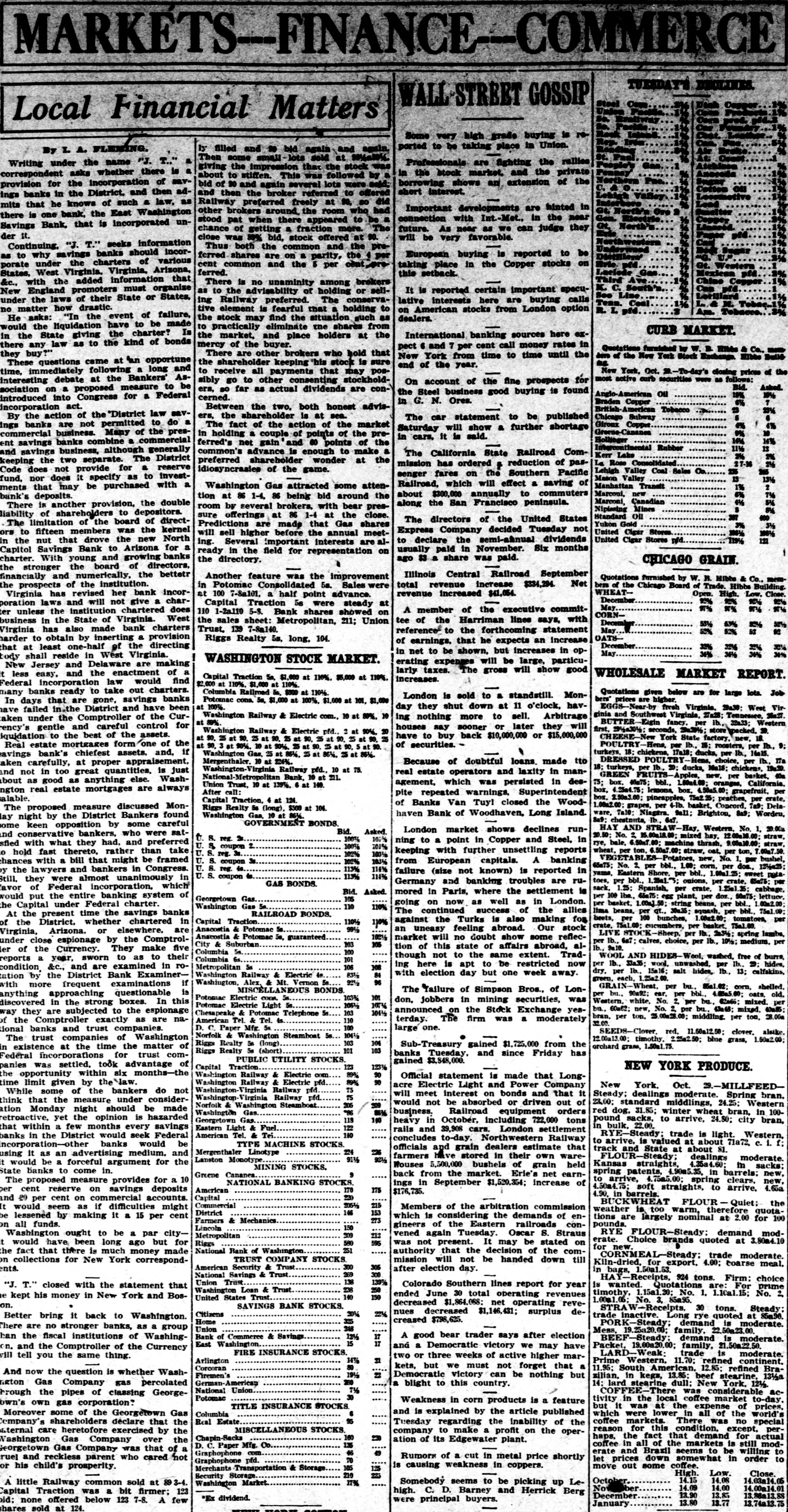

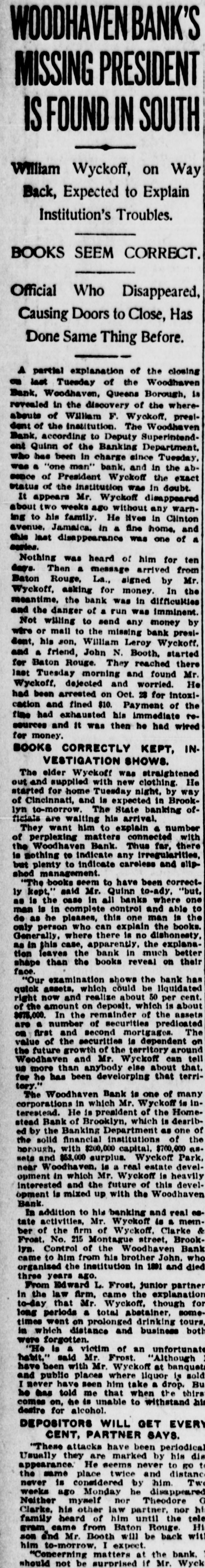

MARKETS-FINANCE-COMMERCE WALL STREET GOSSIP Local Financial Matters Some very high grade buying is reported to be taking place in Union. by filled and bid again and again. By L A. FLEMING. 21. Then some small lots sold at Professionals are fighting the rellies Vriting under the name "J. T.." a giving the impression that the stock was in the stock market, and the private respondent asks whether there is a about to stiffen. This followed by Northern borrowing shows an extension of the bid of 90 and again several lots were sold; vision for the incorporation of savshort interest. and then the broker referred to offered banks in the District, and then adRailway preferred freely at 90, so did that he knows of such a law, as Important developments are hinted in Gt. other brokers around, the room who had is one bank, the East Washington Gen. Electric connection with Int.-Met., in the near Copper stood pat when there appeared to be & Bank, that is incorporated unGt, Linneed. North's future. As near as we can judge they chance of getting a fraction more. The Erie it. pfd. Paper close was 89% bid, stock offered at 90. will be very favorable. Northwestern ontinuing. "J. T." seeks information Thus both the common and the preUnderwood Sugar European buying is reported to be to why savings banks should incorferred shares are on a parity, the 4 per Distillers' under the charters of various taking place in the Copper stocks on Brie. pfd. Gt. Western cent common and the 5 per cent preLaciede ferred. West Virginia, Virginia, Arizona, Gas Mexican this setback. Third Ave with the added information that % Chine Capper There is no unaminity among brokers K. C. South's Can It is reported certain important specuEngland promoters must organize as to the advisability holding or sellSee Line. Lorillard the laws of their State or States, ing Railway preferred. The conservalative interests here are buying calls Team. Coal M. matter how drastic. tive element is fearful that a holding to on American stocks from London option R. L pfd. Am. Tobacco. asks: "In the event of failure, the stock may find the situation such as dealers. the liquidation have to be made to practically eliminate the shares from CURB MARKET. the State giving the charter? Is International banking sources here exthe market, and place holders at the mercy of the buyer. any law as to the kind of bonds pect 6 and 7 per cent call money rates in Quotations by W. B. Hibbs & Co., There are other brokers who hold that buy?" New York from time to time until the ders of the New York Stock Exchange. Hibbs Buildhese questions came at "an opportune the shareholder keeping 'his stock is sure a end of the year. immediately following a long and to receive all payments that may posNew York, Oct. 20.-To-day's closing prices of the most active curb securities were as follows: sibly go to other consenting stockholderesting debate at the Bankers' AsOn account of the fine prospects for Bid. Asked. on a proposed measure to be ers, so far as actual dividends are conthe Steel business good buying is found Anglo- ou 10% 10% cerned. roduced into Congress for a Federal in G. N. Ores. Braden Copper 6% Between the two, both honest advisorporation act. British Tobacco 23 23% the action of the "District law savers, the shareholder is at sea. Chicago Subway The car statement to be published banks are not permitted to do a Giroux Copper The fact of the action of the market $ 6% Saturday will show a further shortage Greene-Cananea 0% nmercial business. Many of the presin holding a couple of points of the prein cars, It is said. Hollinger 14% 14% savings banks combine a commercial ferred's net gain and 60 points of the Rubber 11% common's advance is enough to make a savings business, although generally The California State Railroad ComKerr Lake 2% 2% the two separate. The District preferred shareholder wonder at the La Rose Consolidated 27-16 2½ mission has ordered + reduction of pasdoes not provide for a reserve idiosyncrasies of the game. Lehigh Valley Coal Sales Co. 235 265 senger fares on the Southern Pacific nor does it specify as to investMason Valley 13 13½ Railroad, which will effect a saving of Manhattan Transit Washington Gas attracted some atten1% that may be purchased with a Marconi. new about $300,000 annually to commuters 6% 7% tion at 86 1-4, 86 being bid around the deposits. Marconi, Canadian 4½ 5% along the San Francisco peninsula. here is another provision, the double room by several brokers, with bear presNipissing Mines 8% of shareholders to depositors. sure offerings at 86 1-4 at the close. Standard on 397 600 The directors of the United States he limitation of the board of directYukon Gold Predictions are made that Gas shares 3% 3½ Express Company decided Tuesday not to fifteen members was the kernel United Cigar Stores. will sell higher before the annual meet100% to declare the semi-annual dividends the nut that drove the new North United Cigar Stores n/d. 119% 121 ing. Several important interests are alSavings Bank to Arizona for a usually paid in November. Six months ready in the field for representation on With young and growing banks ago $3 a share was paid. the directory. CHICAGO GRAIN. stronger the board of directors, Illinois Central Railroad September ancially and numerically, the bettetr Another feature was the improvement Quotations furnished by W. B. Hibbs & Co., memtotal revenue increase $334,294. Net in Potomac Consolidated 5a. Sales were prospects of the institution. bers of the Chicago Board of Trade. Hibbs Building. WHEATrevenue increased $41,054. Open. High. Low. Close. irginia has revised her bank incorat 100 7-8a101. a half point advance. December 92% 92% 90% 92% laws and will not give a charCapital Traction 5s were steady at May 97% 97% 97% 97% A member of the executive commitunless the institution chartered does 110 1-2a.110 5-8. Bank shares showed on CORNtee of the Harriman lines says, with in the State of Virginia. West the sales sheet: Metropolitan, 211; Union December 53% 63% 50% 52% has also made bank charters Trust, 139 7-8a140. May reference to the forthcoming statement 52% 52 52% OATSto obtain by inserting a provision Riggs Realty 5a, long. 104. of earnings, that he expects an increase December 32% 33% at least one-half of the directing 32% in net to be shown, but increases in opMay 34% 34½ shall reside in West Virginia. WASHINGTON STOCK MARKET. erating expenses will be large, particuJersey and Delaware are making larly taxes. The gross will show good easy, and the enactment of a WHOLESALE MARKET REPORT. Capital Traction 5a. $1,000 at 110%. $5,000 at 110%. increases. incorporation law would find $2,000 at 110%, $1,000 at 110%. banks ready to take out charters. Columbia Railroad 5a, $500 at 110% Quotations given below are for large lots. Job London is sold to a standstill. Monbers' prices are higher. Potomac cons. 5a. $1,000 at 100%, $1,000 at 101, $1,000 days that are gone, savings banks 100%. at day they shut down at 11 o'clock, havEGGS- Near-by fresh Virginia. 29a30; West Virfailed in the District and have been ginia and Southwest Virginia, 27a28; Tennessee, Ma27. Washington Railway & Electric com., 10 at 89%. 10 ing nothing more to sell. Arbitrage under the Comptroller of the Curat BUTTER Eigin fancy. per lb., 32a33; Western houses say sooner or later they will gentle and careful control for first. 29½a3014: seconds, 29a301/2; store packed. 20. Washington Railway & Electric pfd.. 2 at 90%. 20 have to buy back $10,000,000 or $15,000,000 idation to the best of the assets. CHEESE- York State factory new, 18. at 90. 25 at 90. 25 90. 25 at 90, 25 at 90, 25 at 90, 25 estate mortgages form one of the of securities. POULTRY-Hens, per lb., 15: roosters, per lb., 9; at 90, at 90%. 10 at 90%. 25 at 90, 3 at 90, bank's chiefest assets. and, if turkeys. 18; chickens, 17a18; ducks, per lb., 14a15. Washington Gas, 25 at 86%. 25 at 86%, 25 at 86½. DRESSED POULTRY- Hens. choice, per lb., 17a Because of doubtful loans. made tto Mergenthaler 10 at 224%. carefully, at proper appraisement, 18; turkeys, per lb., 20; ducks, Mals: chickens, 19a.20. Washington-Virginia Railway pfd., 10 at 75. not in too great quantities, is just real estate operators and laxity in manGREEN FRUITS Apples, new, per basket, 40a onal-Metropolitan Bank. 10 at 211. as good as anything else. Washagement, which was persisted in des75; box. 40a75; bbl., 1.50a4.00; oranges, California. Union Trust, 10 at 139%. 6 at 140. real estate mortgages are always box, 4.25a4.75; lemons, box, 4.50a5.00; grapefruit, per After call: pite repeated warnings, Superintendent box. 2.50a3.00; pineapples, 75a2.25; peaches, per crate, Capital Traction. 4 at 124. of Banks Van Tuyl closed the Wood1.00a2.00: grapes, per 4-lb. basket. Concord. 7a9; Delaproposed measure discussed MonRiggs Realty 5a (long). $500 at 104. haven Bank of Woodhaven, Long Island. ware, Ta10; Niagara. Sall; Brighton, 8a9; Worden, Washington Gas, 10 at 86%. night by the District Bankers found 8a9; chestnuts, lb., 6a7. GOVERNMENT BONDS keen opposition by some careful HAY AND STRAW- Western. No. 1, 20.00a London market shows declines runBid. Asked. conservative bankers, who were sat20.50; No. 15.00a18.00; mixed hay. 12.00al8.00; straw, t. S. reg. 2a. 100% 10% ning to a point in Copper and Steel, in with what they had, and preferred rye, bale, 6.50m7. machine thrash. 9.00a.10.00; straw, U. 2. 8 100% coupon 201% keeping with further unsettling reports wheat. per ton. 6.50a7 straw, oat, per ton, 7.00a7. 50. fast thereto, rather than take S. reg. 103% 102% Potatoes. new, No. 1, per bushel, U. with a bill that might be framed S. coupon 3a. from European capitals. A banking 102% 103% 65a75; No. 2. per bbl., 1.00; corn, per dos., 12%a25; U. S. reg. 4a. 113% 114% the lawyers and bankers in Congress. failure (size not known) is reported in yams, Eastern Shore, per bbl., 1.00al.25; sweet notaS. coupon 4a. 113% 111% they were almost unanimously in toes, per bbl., 1.25a1."5; onions, per crate, 65a75; per Germany and banking troubles are ruGAS BONDS. of Federal incorporation, which sack, 1.25: Spanish, per crate, 1.25al.35: cabbage, Bid. Asked. mored in Paris, where the settlement is per 100 lbs., 65a75: egg plant, per doz., 50a75: lettuce, put the entire banking system of 105 Georgetown Gas going on now as well as in London. per basket, 1.00al. string beans, per bbl., .00a2.00; Capital under Federal charter. 110 Washington Gas 5a. 110% The continued success of the allies lima beans, per qt., 30a35; squash. per bbl., 75al.00; the present time the savings banks RAILROAD BONDS. beets, per 100 bunches, 1.00a2.00; tomatoes, per against the Turks is also making for Capital Traction 110% the District, whether chartered in 110% crate, 75a1.00; cucumbers, per basket. 75al.00 an uneasy feeling abroad. Our stock Anacostia & Potomac 5a. 991/2 Arizona, or elsewhere, are LIVE STOCK -Sheep, per lb., 2a31/2: spring lambs, Anacostia & Potomac 5a, guaranteed market will no doubt show some reflec102% close espionage by the Comptrolper lb., 6a7; calves, ehoice, per lb., 10%: medium. per & City Suburban 103 105 tion of this state of affairs abroad, al9a10. lb., of the Currency. They make five Columbia 100 though not to the same extent. TradWOOL AND HIDES-Wool, washed. free of burrs, a year, sworn to as to their Columbia 6s. 101 per lb., 33a35; wool. unwashed. per lb., 29: hides, ing here is apt to be restricted now &c., and are examined in ro106 Metropolitan 5s 108 dry, per lb., 15a16; salt hides, lb., 13; calfskins, with election day but one week away. 83% 84 Washington Railway & Electric 4a. by the District Bank Examinergreen, each, 1.25a2.00. 96 Washington, Alex, & Mt. Vernon 5a 92% more frequent examinations if GRAIN Wheat, per bu., 85al.02; corn, shelled. The Tailure of Simpson Bros., of LonMISCELLANEOUS BONDS approaching questionable is per bu., 90a92; ear, per bbl. 4.85a.5.00; oats. old. 101 103% Potomac Electric cons. don, jobbers in mining securities, was covered in the strong boxes. In this Western. white, No. 2, per bu., 62a66: mixed. per Potomac Electric Light 5s. 107% 1061/2 bu., 60a62; new, No. per bu. 43a48; mixed. 40a85; announced on the Stock Exchange yesthey are subjected to the espionage 103 1041/2 Chesapeake & Potomac Telephone 5s bran, per ton. 25.00a28.00; middling. per ton, 28.00a American Tel. Tel. 4s. terday. The firm was a moderately 110 the Comptroller exactly as are na32.00. 100 one. D. c. Paper Mfg. 5s large banks and trust companies. SEEDS-Clover. red. 11.50a12.50: clover. alsike. 1041/2 Norfolk & Washington Steamboat 5s . trust companies of Washington 12.00a13.00; timothy. 2.25a2.50; blue grass, 1.50a2.00; 103 104 Riggs Realty 56 (long) Sub-Treasury gained $1,725,000 from the orchard grass, 1.50ml.75. existence at the time the matter of 103 101 Riggs Realty 5a (short) banks Tuesday, and since Friday has incorporations for trust comPUBLIC UTILITY STOCKS gained $3,848,000. was settled, took advantage of 123 Traction. 123% Capital NEW YORK PRODUCE. opportunity within six months-the 90 Washington Railway & Electric com 89% Official statement is made that Long90 Washington Railway & Electric pfd. 89% limit given by the Naw. acre Electric Light and Power Company New York. Oct. 29.-MILLFEED75 Washington-Virginia Railway pfd. some of the bankers do not will meet interest on bonds and that it Steady: dealings moderate. Spring bran. 75 Washington-Virginia Railway pfd. that the measure under considerwould not be absorbed or driven out of 23,00; standard middlings, 24.25; Western 205 209 Norfolk & Washington Steamboat Monday night should be made red dog. 31.85; winter bran, in 10098. business. Railroad equipment orders Washington Gas. 86% roactive, yet the opinion is hazarded 118 140 Georgetown Gas. pound sacks, to arrive, 24.80; city bran, heavy in October, including 722,000 tons bulk. in 22.00. within a few months every savings 122 Eastern Light & Fuel rails and 39,908 cars. London settlement 140 in the District would seek Federal American Tel. Tei. Steady: trade is light. Western, concludes to-day. Northwestern Railway to arrive, is valued at about 71a72, c. i. f; TYPE MACHINE STOCKS orporation-other banks would be officials and grain dealers estimate that track and State at about 81. 224 226 Mergenthaler Linotype it as an advertising medium. and farmers have stored in their own wareFLOUR- Steady; dealings moderate. 92½ 9116 Lanston Monotype vould be a forceful argument for the Houses 5,500,000 bushels of grain held Kansas straights, 4.35a4.60: in sacks: MINING STOCKS. banks to come in. spring patents, 4.90a5.35, in barrels: new, 9 back from the market. Erie's net earnCananea. Greene proposed measure provides for a 10 to arrive, spring clears, new, NATIONAL BANKING STOCKS ings in September $1,520,354; increase of 4.50a4.75; soft straights, to arrive. 4.65a cent reserve on savings deposits 170 American 175 $176,735. 4.90, in barrels. 230 Capital 20 per cent on commercial accounts. CKWHEAT FLOUR the 215 Commercial 2051/2 Members of the arbitration commission would seem as if difficulties might weather is too warm, quota146 153 District lessened by making it a 15 per cent which is considering the demands of entions are largely nominal at 2.00 for 100 273 Farmers & Mechanics all funds. pounds. gineers of the Eastern railroads con150 Lincoln vened again Tuesday. Oscar S. Straus RYE FLOUR-Steady: demand modashington ought to be a par city209 212 Metropolitan would have been long ago but for was not present. It may be stated on 580 Riggs 595 erate. for Choice brands quoted at 3.80m4.10 251 National Bank of Washington authority that the decision of the comfact that there is much money made trade moderate. TRUST COMPANY STOCKS mission will not be handed down till collections for New York correspondKiln-dried, for export. 4.00; coarse meal. 300 305 American Security Trust after election day. 1.50a1.53. in bags, 269 300 National Savings & Trust HA Receipts, 924 tons. Firm: choice 138 139% Union Trust. Colorado Southern lines report for year T." closed with the statement that is wanted. Quotations prime 238 250 Washington Loan & Trust timothy, 1.15al 1, 1.10al.15; No. 2. ended June 30 total operating revenues his money in New York and Bos140 150 United States Trust. 1.00al.05; 85a95. No. 3, decreased $1,864,088: net operating reveSAVINGS BANK STOCKS. STRAW-Recelpts, 30 tons. Steady: nues decreased $1,146,431; surplus de20% Citizens 2 trade inactive. Long rye quoted at 85a.90. bring it back to Washington. creased $798,625. 325 Home -Steady; demand is moderate. are no stronger banks, as a group 248 Union Mess. 19.25a20.00; family. A good bear trader says after election 17 12½ Bank of Commerce & Savings the fiscal institutions of WashingBEEF -Steady: demand is moderate. 17 15 East Washington. Packet, 19.00a20.00; family, 21.50a.22.50. and a Democratic victory we may have and the Comptroller of the Currency FIRE INSURANCE STOCKS Weak: trade is moderate. tell you the same thing. two or three weeks of active higher mar14% 21 Arlington Prime Western, 11.70; refined continent. kets, but we must not forget that a 80 Corcoran 11.95; South American. 12.85; refined Branow the question is whether WashFiremen's 22 19½ Democratic victory can be nothing but zilian. in kegs, 13.85: beef stearine, 13½a 260 Gas Company gas percolated German American a blight to this country. 14: lard stearine dull: New York. 12½. 7½ National Union There was considerable acthe pipes of classing GeorgeR Potomac tivity in the local coffee market to-day. Weakness in corn products is a feature own gas corporation? TITLE INSURANCE STOCKS but it was the expense prices, and is explained by the article published 6 oreover some of the Georgetown Gas Columbia which were lower in all of the world's 95 Real Estate shareholders declare that the Tuesday regarding the inability of the coffee markets. There was no special MISCELLANEOUS STOCKS reason for this condition. except. percare heretofore exercised by the company to make a profit on the operhaps, the fact that demand for actual 160 230 Chapin-Sacks ation of its Edgewater plant. shington Gas Company over the coffee in all of the markets is still mod135 D. C. Paper Mfg. Co rgetown Gas Company was that of a erate and Brazil seems to be willing to 46 a Graphophone and reckless parent who cared not Rumors of a cut in metal price shortly let prices down somewhat in order to 70 Graphophone pfd. move out some coffee. is causing weakness in coppers. his child's prosperity. 125 105 Merchants Transportation & Storage Low. High. Close. 210 Security Storage 225 14.15 14.08 October. 14.03a14.05 little Railway common sold at 89 3-4. Somebody seems to be picking up Le17% Washington Market 14.00 14.09 14.00a14.01 Traction was a bit firmer; 123 high. C. D. Barney and Herrick Berg 13.85 13.90 13.86a13.88 December *Ex dividend. were principal buyers. none offered below 123 7-8. A few 13.80 13.77 13.74a13.75 January 124. sold