Click image to open full size in new tab

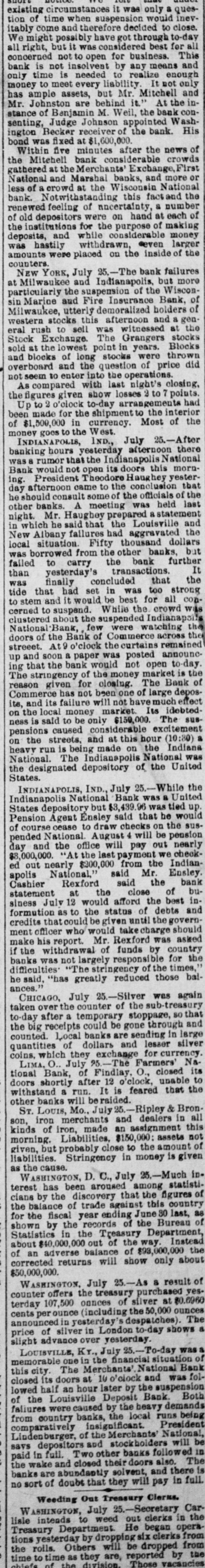

Article Text

existing circumstances was only a question of time when suspension would inev itably come and therefore decided to close. We might possibly have got through to-day all right, but it was considered best for concerned not t open for business. This bank is not insolvent by any means and only time is needed to realize enough money to meet every liability It not only has ample assets, but Mr. Mitchell and Mr. Johnston are behind it. At the instance of Benjamin M. Weil, the bank con senting, Judge Johnson appointed Washington Becker receiver of the bank. His bond was fixed at $1,600,000 Within five minutes after the news of the Mitehell bank considerable crowds gathered at the Merchants Exchange, First National and Marshal banks, and more or less of a crowd at the Wisconsin National bank. Notwithstanding this fact and the renewed feeling of nncertainty, & number of old depositors were on hand at each of the institutions for the purpose of making deposits, and while considerable money was hastily withdrawn, even larger amounts were placed on the inside of the counters. NEW YORK, July 25 -The bank failures at Milwaukee and Indianapolis, but more particularly the suspension of the Wiscon sin Marine and Fire Insurance Bank, of Milwaukee, utterly demoralized holders of western stocks this afternoon and a gen eral rush to sell was witnessed at the Stock Exchange The Grangers stocks sold at the lowest point in years. Blocks and blocks of long stocks were thrown overboard and the question of price did not seem to enter into the operations As compared with last night's closing, the figures given show losses to 7 points Up to o'olock to-day arrangements had been made for the shipment to the interior of $1,500,000 in currency. Most of the money goes to the West. INDIANAPOLIS, IND., July 5.-After banking hours yesterday afternoon there was 8 rumor that the Indianapolis National Bank would not open its doors this morning. President Theodore Haughey yester day afternoon came to the conclusion that he should consult some of the officials of the other banks. A meeting was held last night. Mr. Haughey prepared a statement in which he said that the Louisville and New Albany failures had aggravated the local situation Fifty thousand dollars was borrowed from the other banks, but failed to carry the bank further than yesterday' transactions It was finally concluded that the tide that had set in was too strong to stem and it would be best for all concorned to suspend. While the crowd was clustered about the suspended Indianapa National Bank, few were watching the doors of the Bank of Commerce across the streeet. At9 o'clock the curtains remained up and soon a paper was posted announce ing that the bank would not open day The stringency of the money market is the reason given for closing. The Bank of Commerce has not been one of large deposits, and its failure will not much effect on the local money market Its idebted ness is said to be only $150,000. The suspensions caused considerable excitement on the streets, and at this hour (10:30) heavy run is being made on the Indiana National. The Indianapolis National was the designated depository of the United States. INDIANAPOLIS, IND. July 25. While the Indianapolis National Bank was a United States depository but $3,439.96 was tied up Pension Agent Ensley said that be would of course cease to draw checks on the suspended National August 4 will be pension day and the office will pay out nearly $8,000,000. At the last payment we check ed out nearly $200,000 from the Indian apolis National, said Mr Ensley. Cashier Rexford said the bank statement at the close of business Julv 12 would afford the best informution as to the status of debts and credits atcould be given until the government officer who would take charge should make his report. Mr. Rexford was asked if the withdrawal of funds by country banks was not largely responsible for the difficulties "The stringency of the times he said, "has greatly reduced those balances. CHICAGO, July 25 6.-Silver was again taken over the counter of the sub-treasury -day after a temporary stoppage, so that the big receipts could be gone through and counted. Local banks are sending in large quantities of dollars and lessor silver coins, which they exchange for currency. LIMA. O. July 95. The Farmers' National Bank, of Findlay O., closed its doors shortly after 12 o'clock, unable to withstand a run. It is feared that the other banks will be raided. & BronST. LOUIS, Mo. July 25 Ripley son, iron merchants and dealers in all kinds of iron, made an assignment this morning. Liabilities, $150,000 assets not given, but probably close to the amount of liabilities. Stringency in money is given as the cause WASHINGTON D. C., July 25 Much interest has been aroused among statisticians by the discovery that the figures of the balance of trade against this country for the fiscal year ending June 30 last, as shown by the records of the Bureau of Statistics in the Treasury Department, about $40,000,000 out of the way. Instead of an adverse balance of $93,000,000 the corrected returns will show only about $50,000,000. WASHINGTON, July 25 -As a result of counter offers the treasury purchased yesterday 107,500 onnees of silver at $0.6960 cents per ounce (including the 50,000 ounces announced in yesterday s despatches). The price of silver in London to-day shows a slight advance over yesterday. LOUISVILLE, Kr. July 6.-To-day was a memorable one in the financial situation of this city. The Merchants' National Bank closed its doors at 10 o'clock and was followed half an hour later by the suspension of the Louisville Deposit Bank Both failures were caused by the beavy demands from country banks, the local runs being comparatively insignificant. President Lindenburger, of the Merchants National, says depositors and stockholders will be paid in full. Two other banks followed in the wake and closed their doors also The banks are abundantly solvent, and there is no sort of doubt that they will pay in full. Weeding Out Treasury Clerks. W ASHINGTON, July 25. Secretary Carlisle intends to weed out clerks in the Treasury Department. He began operations yesterday by dropping six clerks from the rolls. Others will be dropped from time to time as they are, reported by the the division. Those vacancies