Click image to open full size in new tab

Article Text

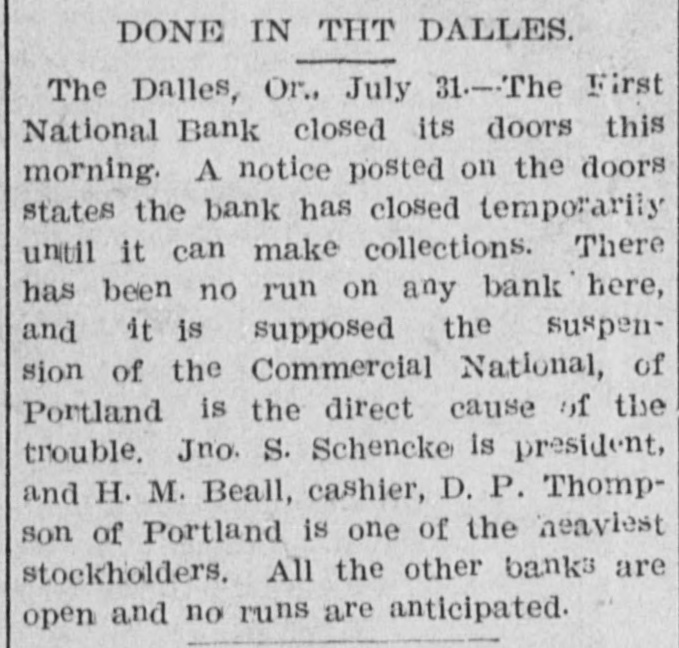

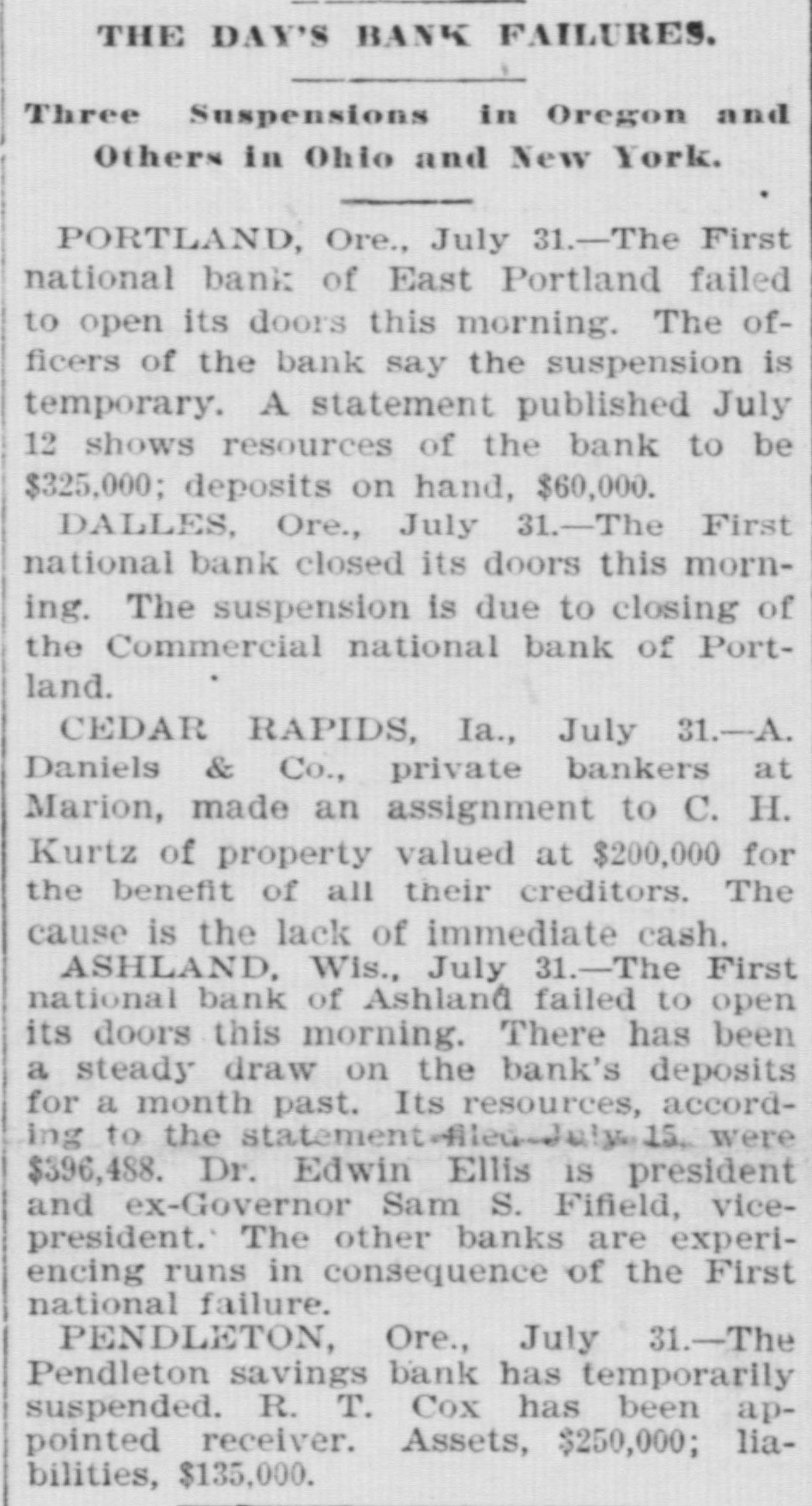

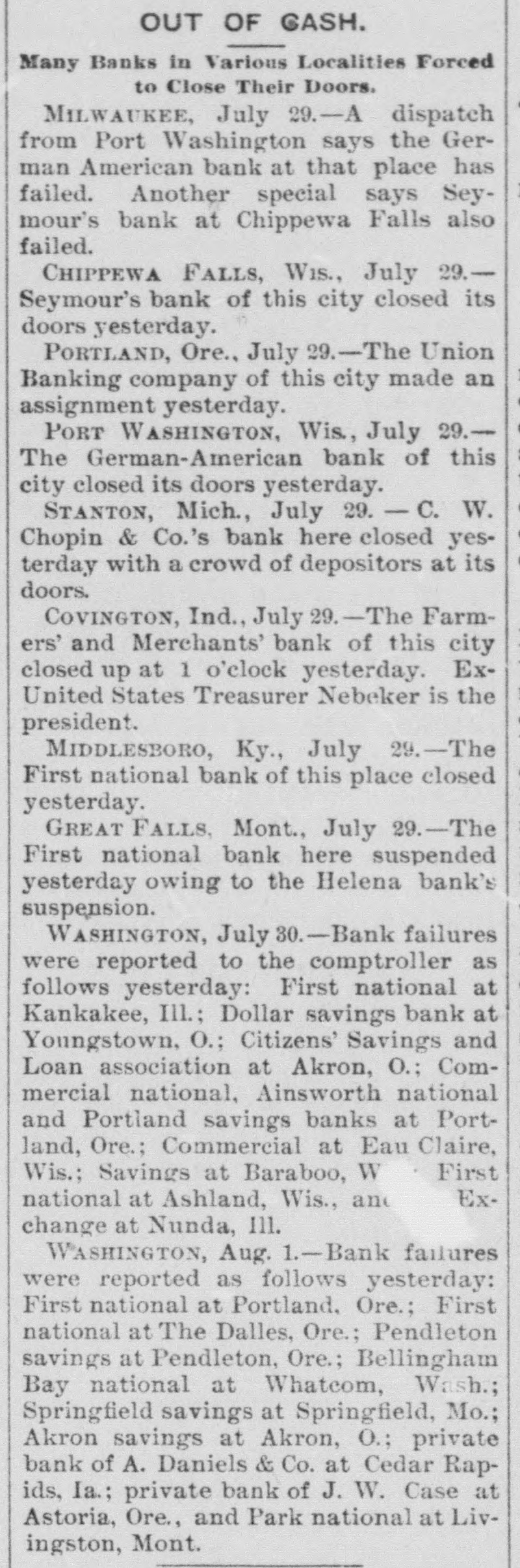

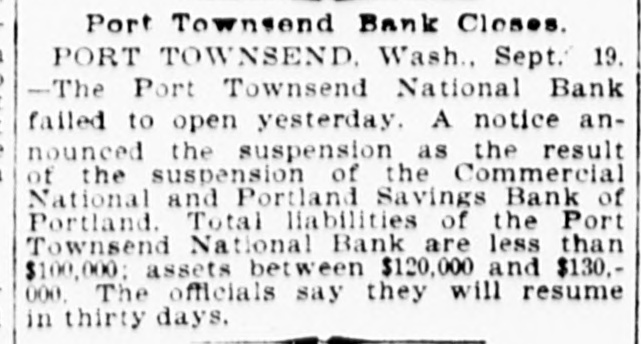

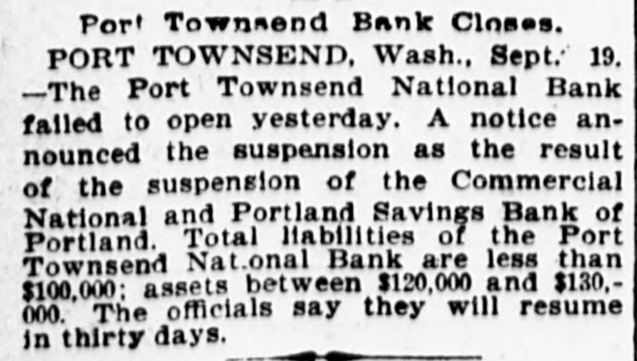

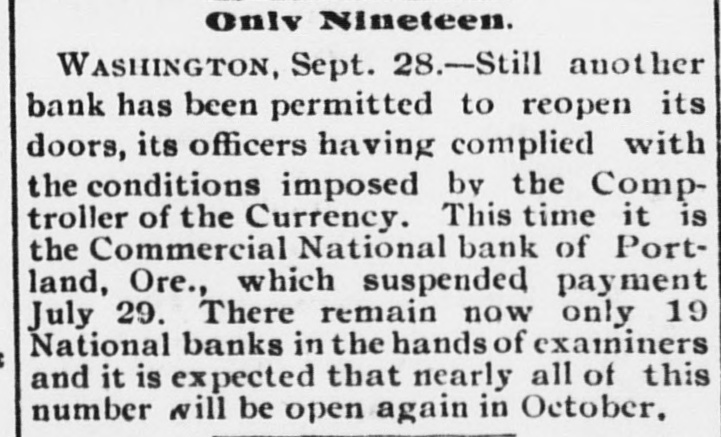

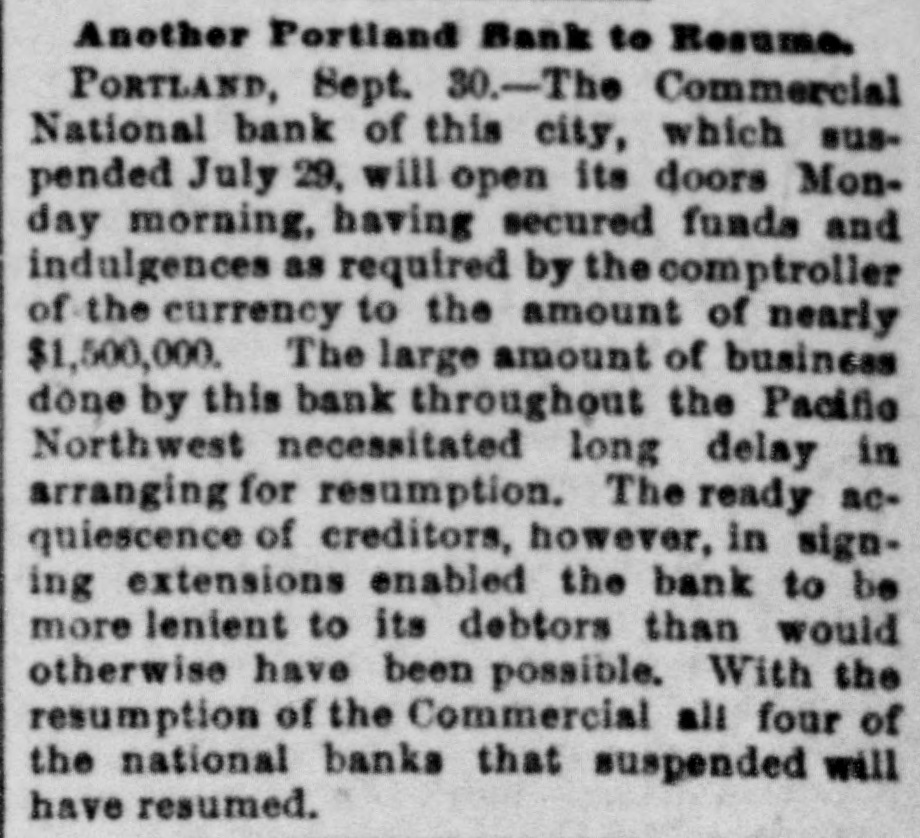

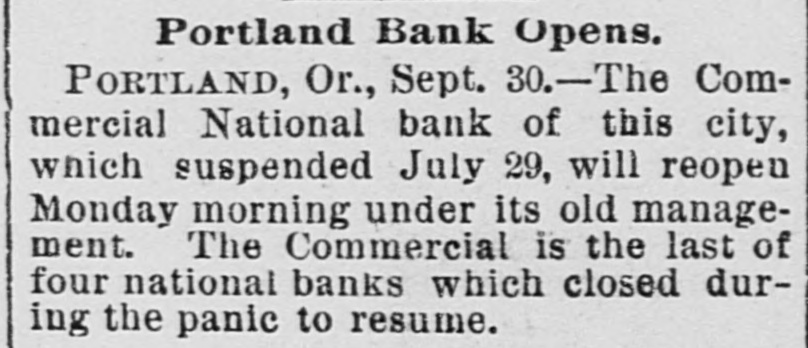

syndicate expects the year to show the largest export in the history of the island. At Shreveport, La., Henry Coleman, jr., colored, who attempted to assassinate Capt. Thomas Lyles, was taken from jail at Benton by eighty men and hanged. He confessed his crime, The scheme planned by the Cherokee allotters and E. P. McCabe, the colored ex-secretary of state of Kansas, to establish a negro town of liberty in the Cherokee strip has been crystallized. The vice-president of the lower house of the Hungarian diet, Count Andreassy A. Bokros, in some manner as yet unexplained to the public, was found dead on the pavement below his residence. At Pittsburg bills were filed in the United States courts by Jesse Higgs and Samuel Bancroft, jr., asking for the appointment of a receiver for the Bedford Springs water company of Bedford, Pa. A difficulty occurred at the village of Sisseton, S. D., between Thomas Morse, a white man, and three Indians of the Sissetons, which terminated in the killing of one of the Indians, Henry Campbell. Two large caravans, one conveying a large consignment of clothes for the troops and the other conveying a party of merchants, have been attacked near Fez and all the animals and goods stolen. In a riot at Benwood, Pa., among a party of forty foreigners-Poles, Italians and Hungarians - who occupy a building known as the Harmony hotel, four of them were seriously hurt, one fatally. Lieut. Buck of company E and Sargt. Linze and Private Sheffield of company D, Sixteenth infantry of the regular army, stationed at Ft. Douglas, have been indected by the grand jury for murder. The loan committee of the New York clearing-house canceled $240,000 of loan certificates and called for redemption Monday $600,000, making the total called for Monday $720,000. Total outstandings, $25,075,000. It is learned that the donor of $500,000 to Harvard university a year ago to build, equip and maintain a reading room, the identity of whom has created a good deal of speculation, was the late Frederick L. Ames. The Commercial national bank of Portland, Ore., which suspended July 29, will reopen Monday under its old management. The Commercial is the last of four national banks which closed during the panic to resume. A statement prepared at the treasury department shows the collections from internal revenue for July and August of this year to have been $25,092,834 as compared with receipts of $28,577,641 during July and August of 1892. At Waco, Tex., a negro burglar in a boarding house fired on William Downs, who fired and killed the negro. On his person was found a kit of burglar tools. Several thousand dollars worth of stolen jewelry was found in his house. The grand jury at Lexington, Ky., brought in four indictments against Frank P. Scearce for forgery. Two are for forging the name of his father, James M. Searce, to notes of $1,300 each and the other on a check for $600. The excitement caused by the discovery of the great anarchist plot to blow up the reichsrath and other public buildings in Vienna on Oct. 19, the date of the assembling of parliament, has not abated. Other arrests were made. Col. H. Clay King, the slayer of David H. Poston, who is now serving a life sentence in the Tennessee penitentiary, has issued an address to the public in which he charges that his conviction was brought about by a conspiracy. At Pittsburg Samuel G. Stodhart, a car accountant at the Carnegie steel company, shot his wife in the heart while she was sleeping and then placing the muzzle of the revolver into his mouth killed himself. Business troubles the cause. At Ft. Smith, Ark., "Kid" Wilson and Henry Starr led an unsuccessful attempt to break jail. They were assisted by John Pointer, Alexander Allen and Frank Collins, condemned murderers, and Charles Young and Jim Fair, negroes. Notices were posted at the Edgar Thompson steel works that all men not actually employed upon repairs would be suspended without pay until such time as the works shall resume operations. This order will affect nearly 1,000 salaried clerks, furnacemen and others. Warren McCullough of the First national bank at Milan, Mo., had about thirty head of cattle stolen from his place. An attempt to ship the cattle having failed, they were abandoned by the thieves. The sheriff arrested William P. Taylor, cashier of the People's exchange bank, on a warrant sworn out by McCullough.