Click image to open full size in new tab

Article Text

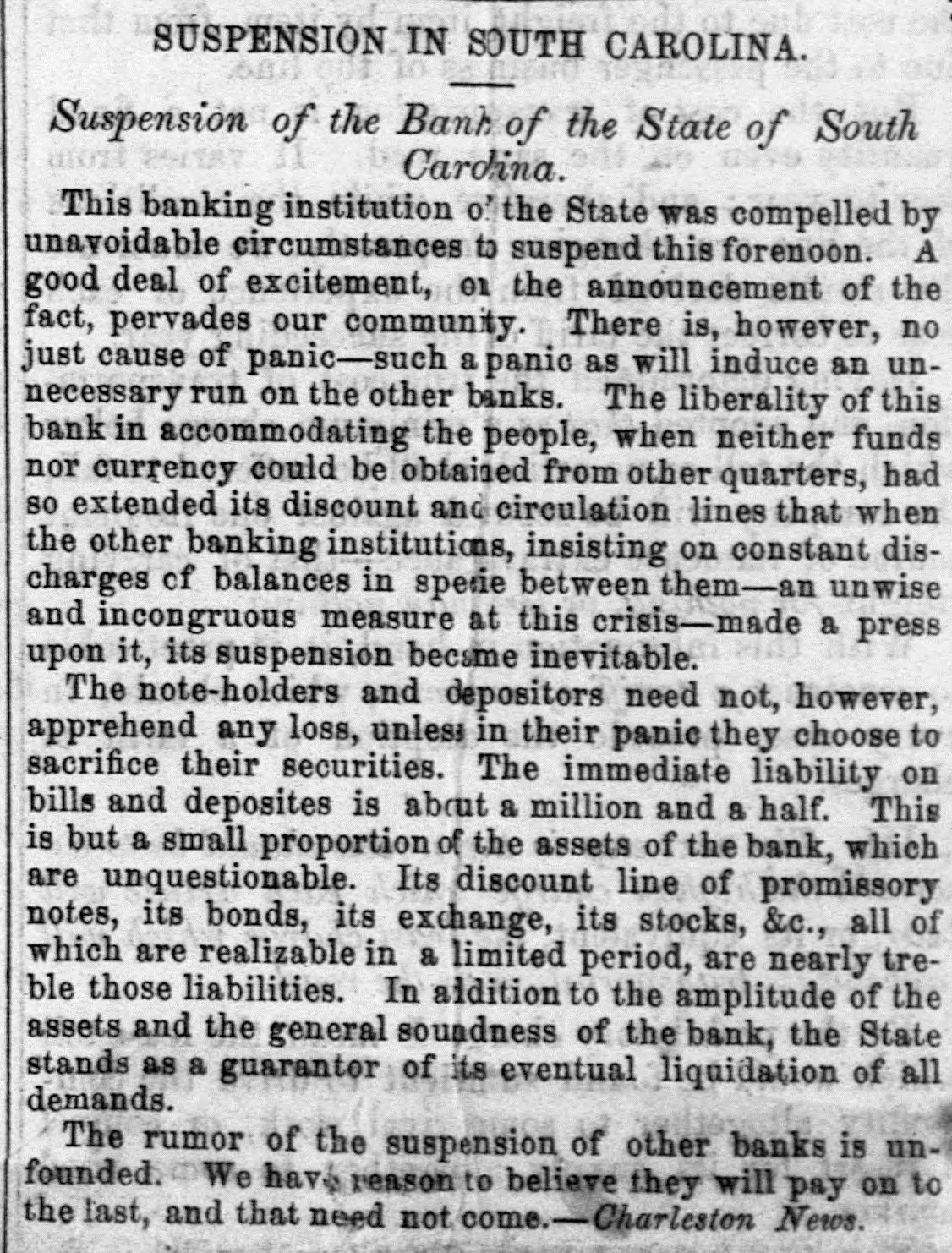

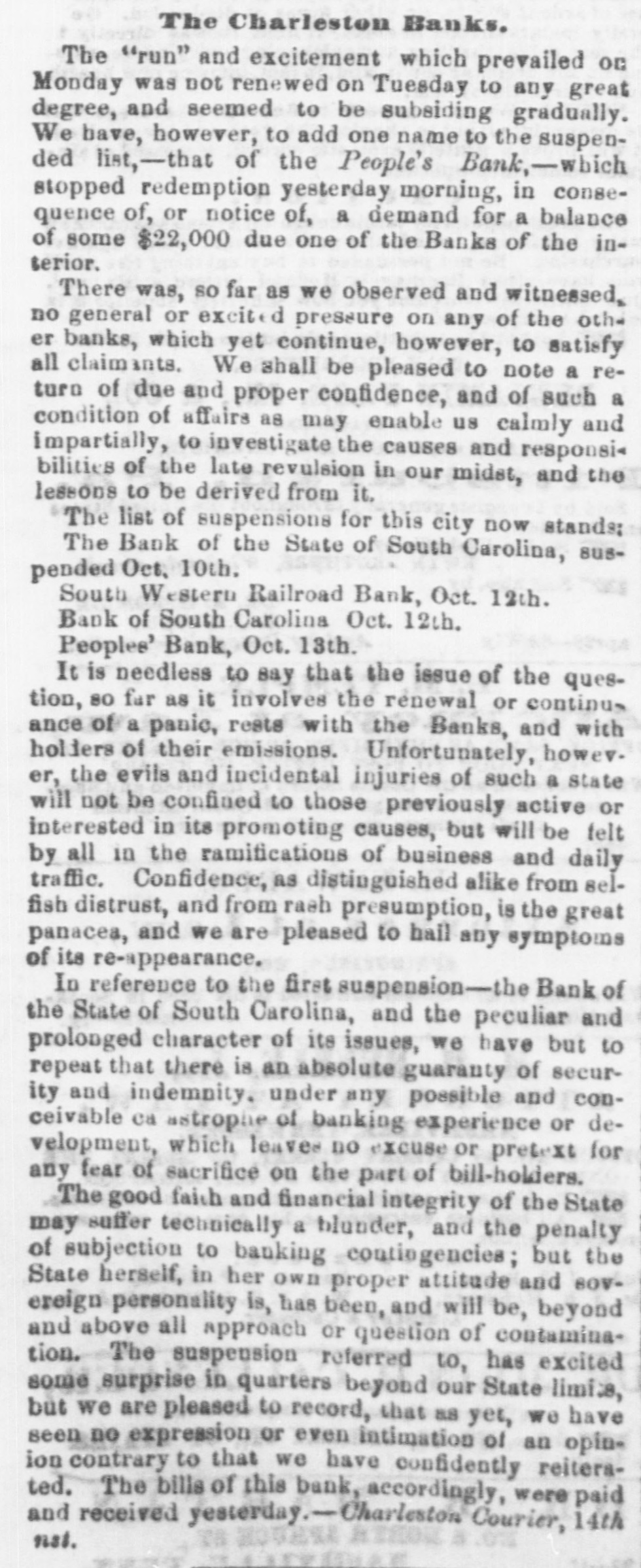

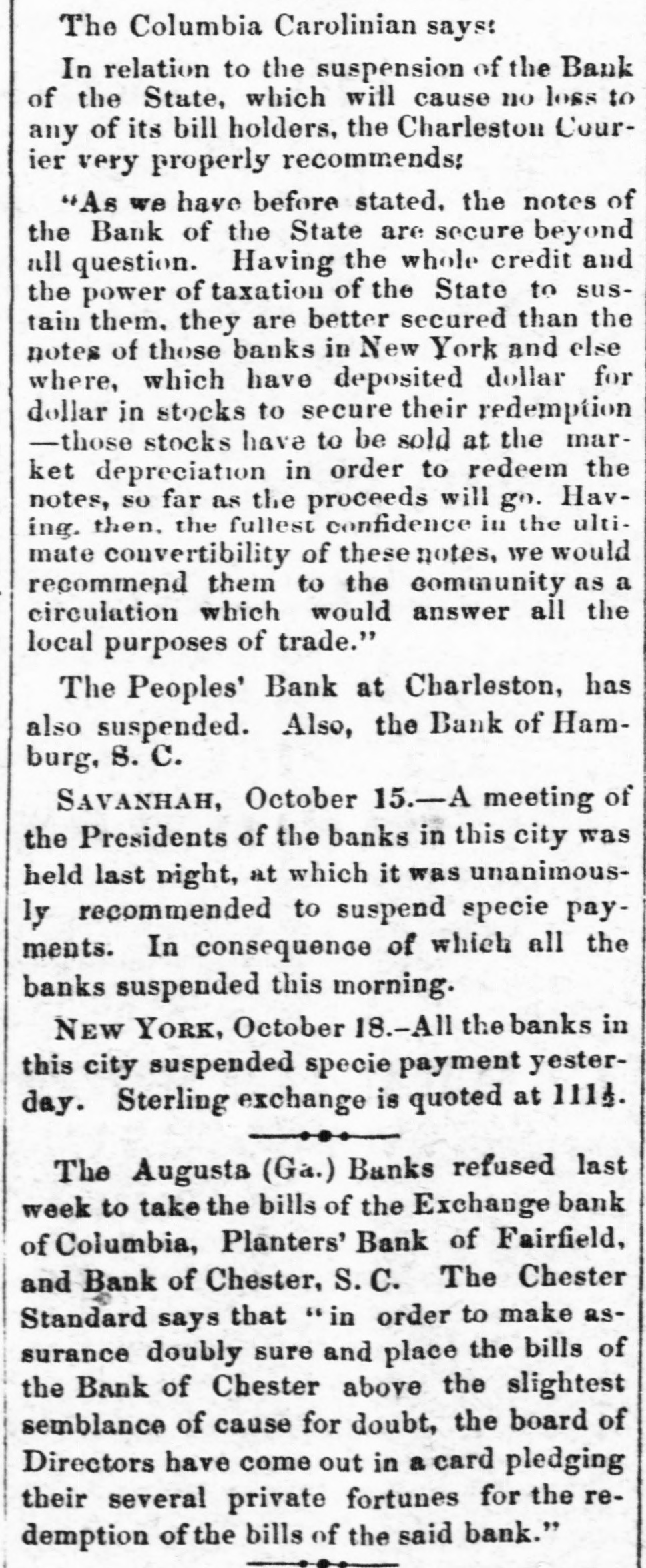

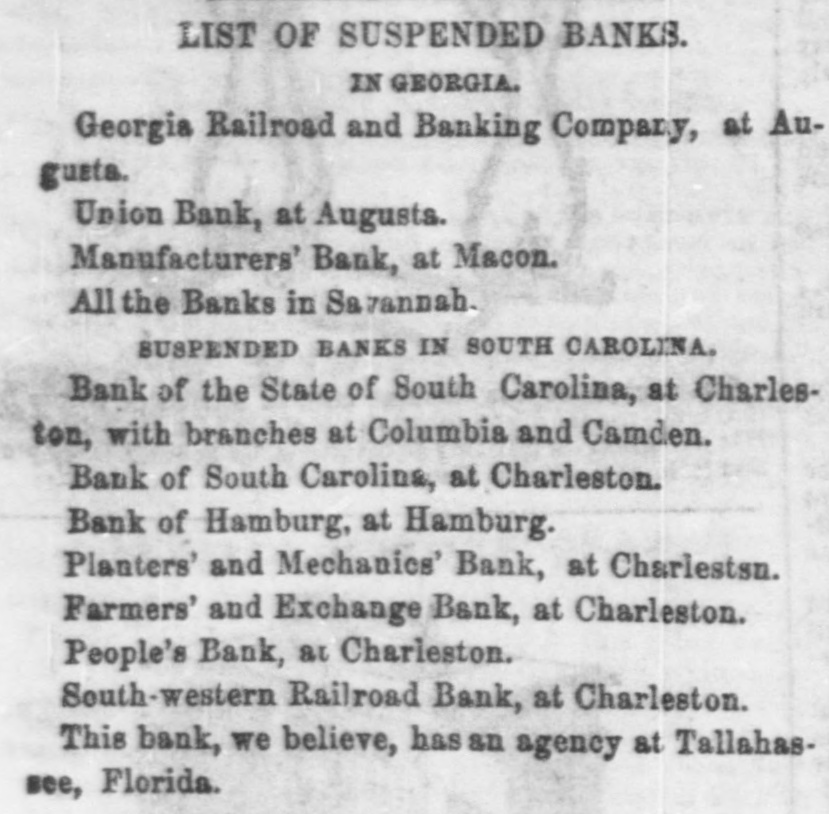

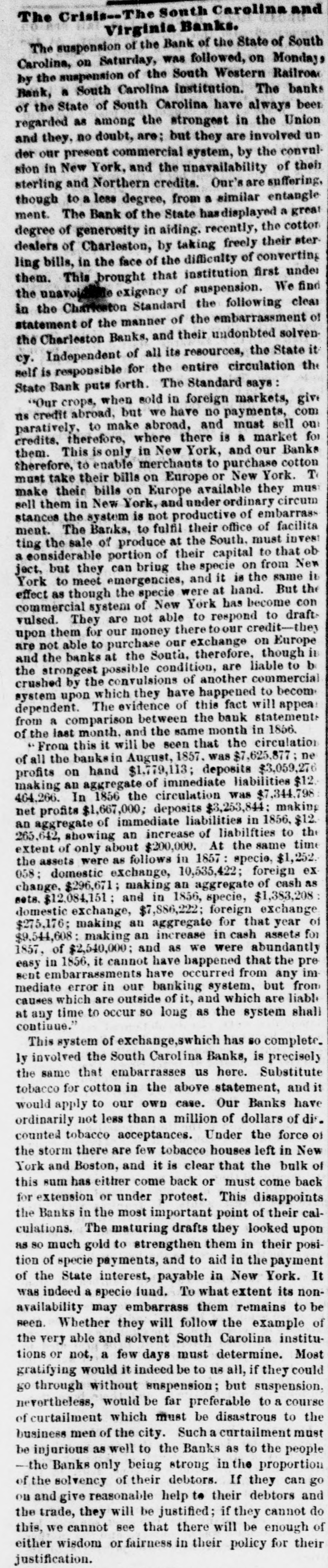

a Bank, of the State of South Carolina have always been regarded as among the strongest in the Union and they, no doubt, are: but they are involved un der our present commercial system, by the convulsion in New York, and the unavailability of their sterling and Northern credits. Our's are suffering, though to a less degree, from a similar entangle ment. The Bank of the State hasdisplayed a great degree of generosity in aiding. recently, the cotton dealers of Charleston, by taking freely their sterling bills, in the face of the difficulty of converting them. This brought that institution first under the unavoidable exigency of suspension. We find in the Charleston Standard the following clear statement of the manner of the embarrassment of the Charleston Banks, and their undoubted solvency. Independent of all its resources, the State it self is responsible for the entire circulation the State Bank puts forth. The Standard says: "Our crops, when sold in foreign markets, give ns credit abroad, but we have no payments, com paratively, to make abroad, and must sell our credits. therefore, where there is a market for them. This is only in New York, and our Banks therefore, to enable merchants to purchase cotton must take their bills on Europe or New York. T make their bills on Europe available they mus sell them in New York, and under ordinary circum stances the system is not productive of embarrass ment. The Banks, to fulfil their office of facilita ting the sale of produce at the South. must invest a considerable portion of their capital to that ob ject, but they can bring the specie on from New York to meet emergencies, and it is the same it effect as though the specie were at hand. But the commercial system of New York has become con vulsed. They are not able to respond to draftupon them for our money thereto our credit-they are not able to purchase our exchange on Europe and the banks at the South, therefore, though in the strongest possible condition, are liable to b crushed by the convulsions of another commercial system upon which they have happened to become dependent. The evidence of this fact will appeal from a comparison between the bank statements of the last month. and the same month in 1856. From this it will be seen that the circulation of all the banks August, 1857. was $7,625,877; ne profits on hand $1,779,113; deposits $3,059,276 making an aggregate of immediate liabilities $12. 464,266. In 1856 the circulation was $7,344,798 net profits $1,667,000; deposits $3,253,844; making an aggregate of immediate liabilities in 1856, $12. 265,642, showing an increase of liabilfties to the extent of only about $200,000. At the same time the assets were as follows in 1857 : specio, $1,252. 058: domostic exchange, 10,535,422; foreign ex change, $296,671; making an aggregate of cash as nets. $12,084,151; and in 1856, specie, $1,383,208 : domestic exchange, $7,886,222; foreign exchange $275,176; making an aggregate for that year of $9,544,608; making an increase in cash assets for 1857, of $2,540,000; and as we were abundantly easy in 1856, it cannot have happened that the pre sent embarrassments have occurred from any immediate error in our banking system. but from causes which are outside of it, and which are liable at any time to occur 80 long as the system shall continue." This system of exchange,swhich has SO complete. ly involved the South Carolina Banks, is precisely the same that embarrasses us here. Substitute tobacco for cotton in the above statement, and it would apply to our own case. Our Banks have ordinarily not less than a million of dollars of dis. counted tobacco acceptances. Under the force 01 the storm there are few tobacco houses left in New York and Boston, and it is clear that the bulk of this sum has either come back or must come back for extension or under protest. This disappoints the Banks in the most important point of their calculations. The maturing drafts they looked upon as 80 much gold to strengthen them in their position of specie payments, and to aid in the payment of the State interest, payable in New York. It was indeed a specie fund. To what extent its nonavailability may embarrass them remains to be seen. Whether they will follow the example of the very able and solvent South Carolina institutions or not, a few days must determine. Most gratifying would it indeed be to us all, if they could go through without suspension; but suspension, nevertheless, would be far preferable to a course of curtailment which must be disastrous to the business men of the city. Such a curtailment must be injurious as well to the Banks as to the people -the Banks only being strong in the proportion of the solvency of their debtors. If they can go on and give reasonable help to their debtors and