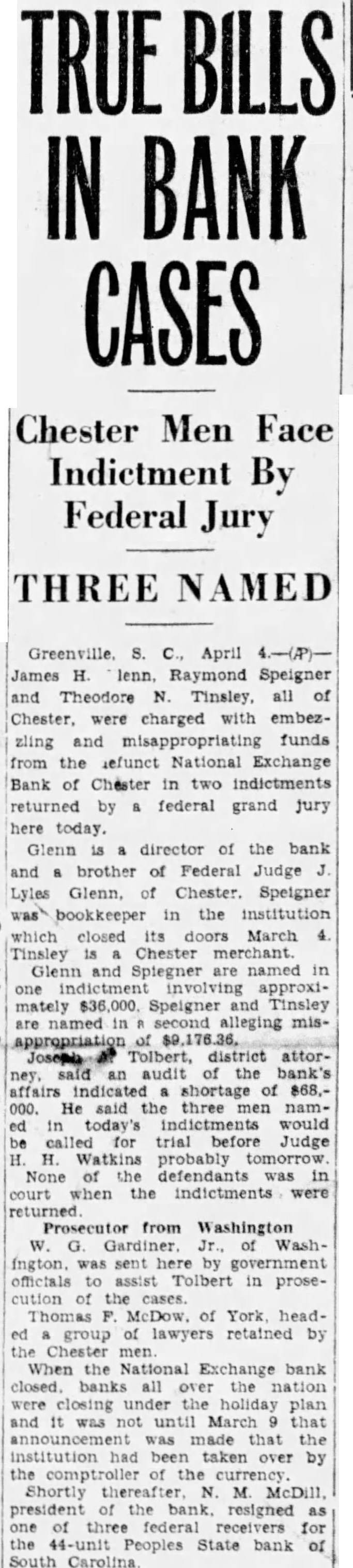

Article Text

Met monday Cheerfully Credit Arrangements Liberal in Financial Centers. Theaters and Night Clubs Do Rush Business. Problem of Small Change Is Considerable. could be cashed. The board of eduThe spirit in which the bank holication stopped payment on $2,000 salday is being met throughout the country is shown in the following ary checks so the restricted money available might be prorated. dispatches, assembled by The Star Credit is being extended freely to and the North American Newspaper Alliance known customers and many business firms accept checks for the exact NEW YORK, March 6 (N.A.N.A.) New York has bowed to the edict of a amount of purchases. All utility companies have been accepting checks as ank holiday with a friendly acquiesusual. There is plenty of small change ence that surpassed the hopes of the in circulation. Bank employers have host optimistic been ordered to advise depositors on Despite the forebodings of managers individual problems. such as insurance f restaurants and places of entertainpremiums. instalments and taxes. nent. no one walking along Broadway Banks have been accepting new dewould realize that eery bank in the posits and segregating them into trust State is closed. There is money, and funds for unrestricted checking. As a lenty of it, and it is being spent with result new deposits have been noted. he same nonchalance as that of the The majority of Kentucky banks ormal Sunday night throng. composed have been restricting withdrawals on hostly of men and women who work other than new accounts to 5 per cent ard during the week. Gov. Laffoon has extended the original The restaurants catering to the man four-day holiday through March 11. n the street, who spends perhaps $2.50 nce a week for supper for two. with Massachusetts. lancing and a floor show thrown in. BOSTON. March 6.-Boston faced ave the usual patronage. On Saturthe bank holiday situation without any ay night they were jammed. fuss and even with a kind of smile. Crowds Throng Movies. The public's psychology was amazing No crowds or even groups gathered Every theater offering a good movie in around either the banks or the newshe Times Square district did as much paper bulletin boards. as occurred in usiness as usual and an audit showed the crash of 1929 and again in isolated henomenal Saturday receipts. There bank closings at the end of 1931. 8 no trouble in changing large bills at There were. of course, minor inconhe box offices. and while one manageveniences, such as a lack of small coins. nent with two great theaters offered Change was short. A newspaper row o take checks on New York banks in restaurant refused to change $100 bills. ayment for tickets, not one was offered In the absence of banking. trade and uring the day business accommodation fell back on Thunderous applause greeted the news personal credit. Old customers of eels showing President Roosevelt makgrocery stores paid for groceries with hg his inaugural address. checks or were allowed to charge the Night club managers. while maintainamounts. Hotels took checks for the amount of the bill-no more. The hg a gay air. would not predict what ould come after midnight, but insisted larger stores agreed upon a policy of accepting no checks whatsoever. he night's receipts were good. The The theaters and night clubs did the roblem of checks. particularly those largest business in weeks. involving additional cash. troubled them, nd it was expected they would function Ohio. a cash basis. CLEVELANDCleveland accepts the The problem of change for large bank holiday cheerfully Depositors ills is considerable. The smaller cigar thronged the downtown banks the first tores and neighborhood shops in most day of the restriction on withdrawals ases decline to change a $5 bill unless and long lines stood before the cashiers he purchase is of considerable size, cages drawing out the small part of nd anything above $10 is out of the deposits made available. Reliable estiuestion. Pennies. usually frowned mates were that $5,000,000 was drawn pon in large numbers. are welcomed that day, with no disorder and very y a 'well, it's money." little complaining or bad temper. The next day banks had little more Checks Practically Worthless. than their usual crowds. and withChecks are practically worthless. At a drawals were estimated at about otels or stores, old patrons may setenth of the day before. The excite: ure $5 or $10, if fortunate, but the ment was mostly over. ttitude of a cashier is that of one reRetail business announces that "usual eiving an I. O. U. lines' of credit will be maintained. One Women with accounts at stores or of the theaters promises that checks ered their foodstuffs in larger amounts for tickets. though drawn against achan usual. The small merchant, fearcounts not immediately negotiable. will hg to lose an account, saw his stock be accepted. unning low. and no cash coming in With hardly an exception. business ith which to pay the wholesaler. and industry of this city met the first There was surcease for those in betweek's pay roll of the emergency in er circumstances when the departcash, generally by building up funds in hent stores opened today. Large adnew bank deposits. specifically exertisements, sponsored by nearly all empted from the restrictions of the rominent New York department stores, emergency bank laws. rged all customers to come and trade Most Cleveland banks started the avishly, and charge everything. Their holiday by limiting withdrawals from ttitude is the one concrete evidence all accounts to 5 per cent of the total f the value of credit, and theirs will balance. Limitations of 1 or 2 per e the harvest if bills are paid. cent were in effect at a few banks. Meanwhile. there is no confusion. here is evident a certain brotherhood South Carolina. hat New York has not seen since the CHARLESTON. March -Operating ar. Every one is in the same boat, under moderate restrictions designed to nd willing to help another. Mingled prevent drainage of cash resources into other States where banks are closed ith a lilting. 'what's the use of worryng?" thoughts turn to when the banks and to conserve resources for conductill-or will not-open. ing business against withdrawals for hoarding, banks of Charleston funcCalifornia. tioned Saturday completely in all business relations and cashed checks for LOS ANGELES, March 6.-Having ndured with cheerful fortitude the such sums as were considered actually needed by individuals. Other South three-day bank holiday first decreed Carolina banks followed Charleston's or California by Gov. Rolph, this city lead. waits with optimism the future develThe State was among the few doing pments of the situation, with news of business on a cash basis. Depositors he extension of the holiday until were allowed to withdraw sums to cover Thursday. immediate needs. Checks from outside Plans pending for the issuance of were not accepted. crip by the Los Angeles Clearing House Two banks in Spartanburg announced association have the widespread inthey would observe a holiday until pasorsement of merchants and manusage of Federal legislation for banking acturers, indicating the belief that this relief. The National Exchange Bank ethod will be a chief factor in keeping in Chester closed "until further orders usiness and employment on an even from the controller of the currency. eel. Scrip issuance is contingent on Otherwise the banking situation in State legislative action on banking the State appeared good. Pay rolls ffairs. but there is a general feeling were met in cash. f confidence that it will be an affecive way of coping with the emerWisconsin. ency. MILWAUKEE, March 6.-Merchants There is no lack of confidence in are planning liberal extensions of credit LOS Angeles banking institutions and during the moratorium to keep business he sentiment generally is that on the moving. The churches in Milwaukee teps taken and contemplated will come would materially improved condition in not announced be passed that during collection the moratorium. plates business throughout the State. The The Wisconsin holiday, proclaimed appearance of principal business disfor 14 dave followed slow runs on