Click image to open full size in new tab

Article Text

Britain there are fewer murders in in any one of the larger cities of the United States. Force, or punishment is the surest deter to crime there is, not

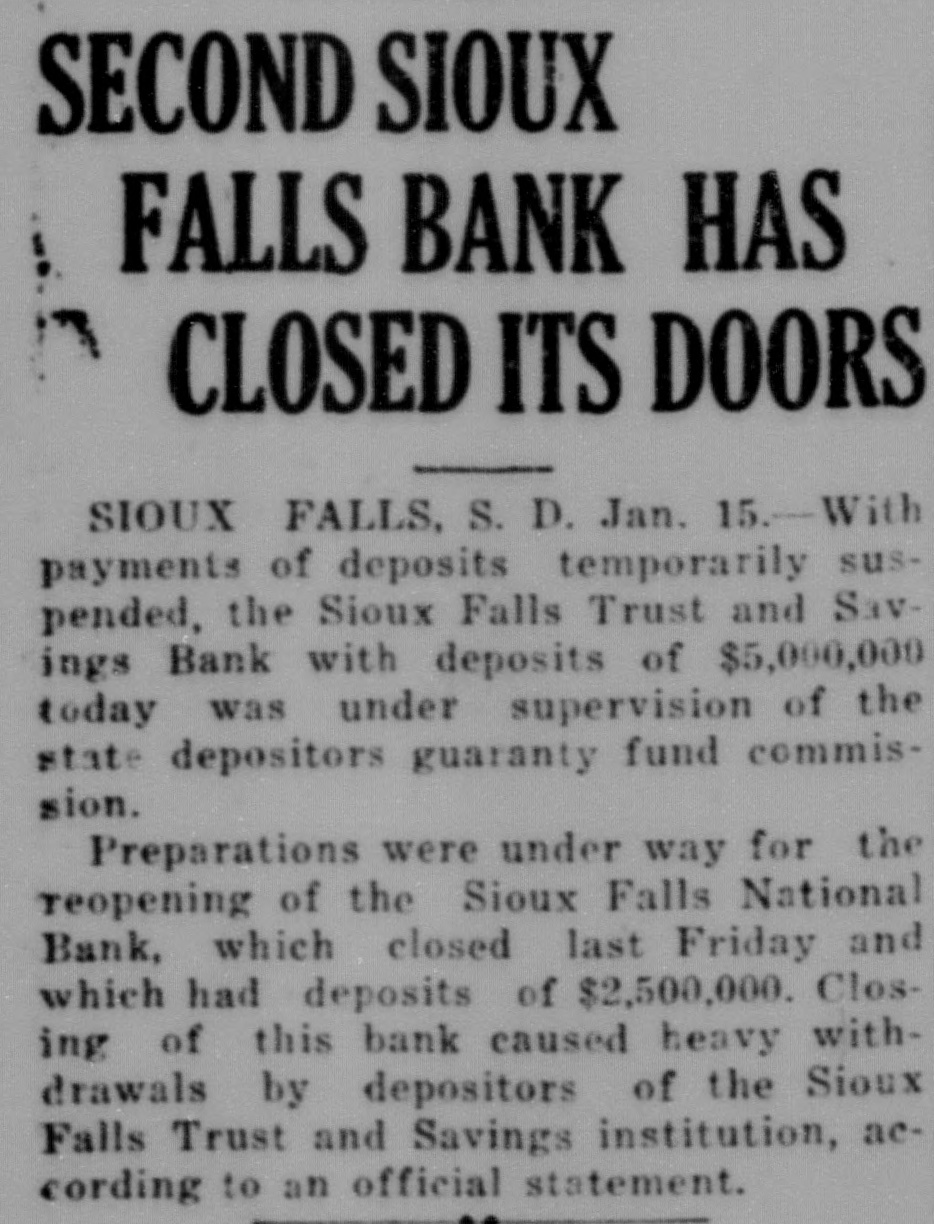

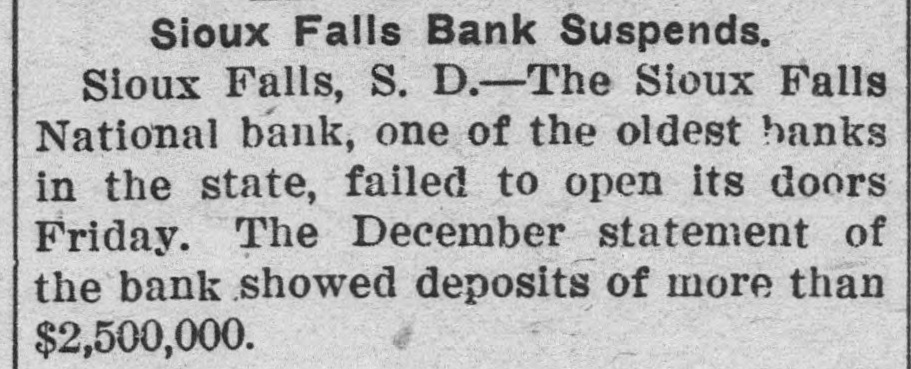

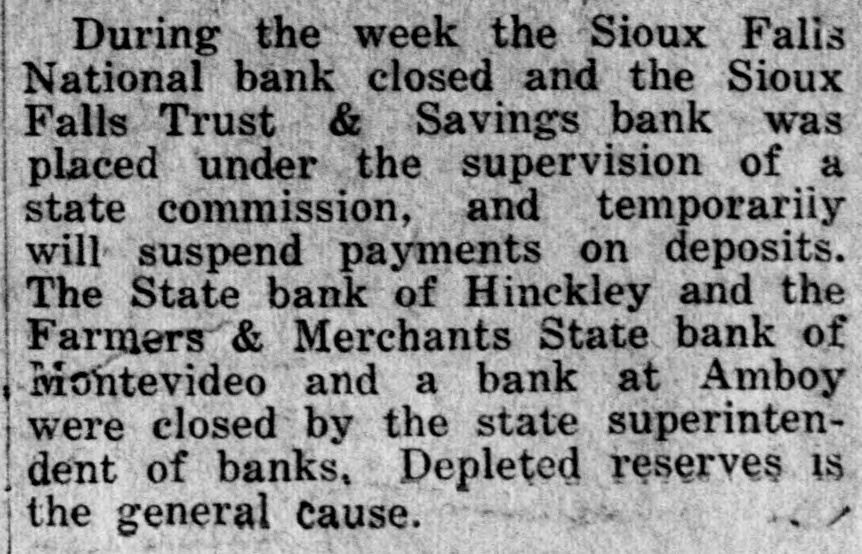

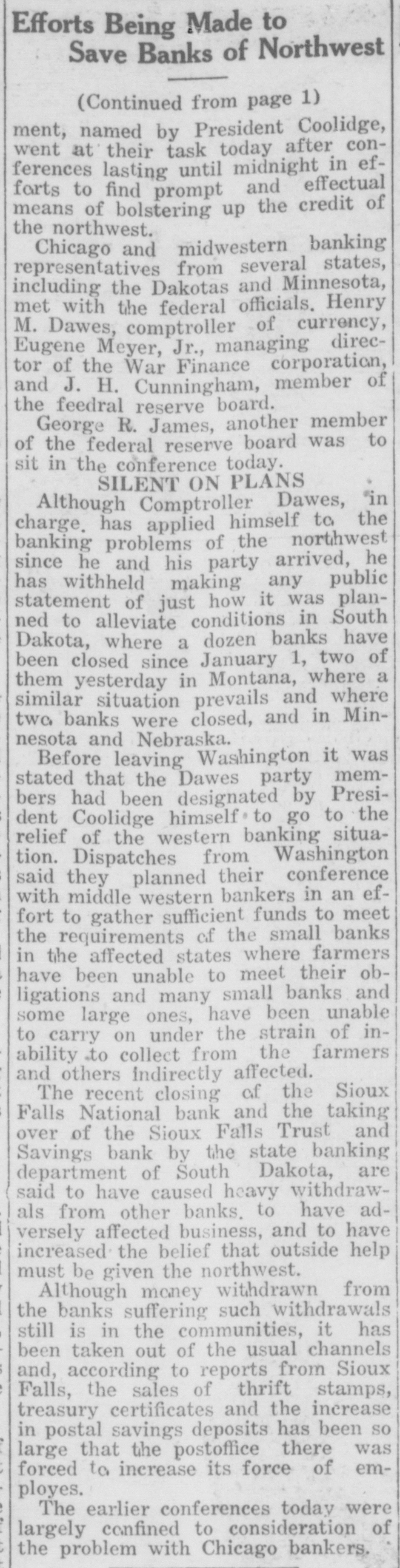

Gigantie Governmental Waste Quite comment has been rife in Sioux Falls during recent months relative to the cost of receiverships of closed banks. The Sioux Falls bank was the biggest in South and its affairs are wound at less than half the cost of the receivership in the Sioux Falls National The receiver in the latter institution gets thousand dollars month, has only about half he volume of of that by the recelver in the Falls Savings, though the latter gets a third of that salary. The federal pays the salary of national bank of course of the proceeds of the the job supposed to last for state of Dakota the rate of for the men in pay of the state its affairs of public trust, and the federal department in particular not waste time in trying to make savings The receiver of the Sloux Falls New Donal bank in Chicago, and part his time is spent on the road be tween his his here in Sioux Careful prime requisite in winding up closed national bank, in with desire to nurse a job.

Another Dutchman's Gun Congress made bully good Dutchman's gun out of the world court. You remember that gun would hit when pointed deer, but would miss when at the owner's GOW. Same way with the membership of Uncle Sam in the world court. is all right while doesn't mean anything, and it is all wrong when it seeks to involve the United States, according to the tions, hence we are not in if means we are in good standing if it doesn't mean anything.

Psychology and Things to Eat "Just let the sun shine for half day, and all that fine rhubarb will picked up in almost no time,' remarked Mr Foster of the Golden Rule grocery the other day. Mr. Foster said that on full drab day the rhubarb not look, spite of the fact it is one of the items for table use in the vegetable line.

Industrious Hens Clarence Berry, on East Eighth street, flock of Industrious hens that is worth talking These hens, 135 of them, lay from 90 to 100 eggs each day. They belong to the Tom Baron strain of English Leghorns this particular flock of 135 hens laid 3,006 eggs during January. In of eggs was 2,643, they are on the job during holiday Victor Tharp, of the who thinks is something of hen shark himself, says the English Leghorns are not RB nice to look at as the American type, but he admits they are great on the egg production. Mr. Berry says the English Leghorns are good sized fowl, the roosters often reaching six pounds in size.

More School Room Needed The Stoux Falls board of education is again confronted with a need of more school room. The high school. crowded, and the ward schools are uncomfortably filled. The need seems to be for ward school and completion of the high school. The architects advise that over $600,000 will be needed for the completion of school single additional school cost more. drew Dell like bond of or would be needed for require- MRS. WILLIAM ments in the future. Lack The funeral of of made boe, Mrs. in the future. Those pupils who are of this city, held for of ernoon facilities are for all at Hills, where will time. School days come but once in made. ber of Falls lifetime. to be the people will the funeral. attend for bad this is the fact that the Miss Martin and institutions daughter filled famous of are with of whom but received medal for reciting recently poetry. very small per cent have reached the eighth grade in public schools. Bad citizenship generally is due to ignor. ance, in self defense the public must provide those remedies which MUDDY. quickly improved OILY SKIN promise greatest returns, namely more school facilities.

SOUTH DAKOTANS AT SIOUX FALLS HOTELS

Teton: Mr. and Mrs. Paul Hansen, USE SULPHUR TO Viborg; Leo Traver, Mr. and Mrs. M. Van Hees, Stickney; B. H. Dell Rapids; Iver Tufty, Nunda; HEAL YOUR SKIN G. Hazel; G. Wilson, Madison; B. F. Magness, St. Gordon Magness, St. Lawrence: O. H. Tol Any breaking Albert: H. Comstock, Brookings: out the L. Penhallegon, Rapid City: G. even can be quickly come by Sinal: W. O. Glenapp, William applying Mentho Potas, Alvin R. Lidel, Went- clares noted worth: Carl Rude, Toronto: Gust skin specialist. Because Chester: A. Carlson, Trent; C. E. Lind- its germ destroying Aberdeen. properties, this Cataract: F. Halladay, Iroquois: E. phur preparation U. Berdahl, Brook stantly brings Fred from skin Hitcheock; G. H. Glendenning. Arling and heals the ton; Mr. and eczema right up and leaves the skin Mrs. J. Keller, Bereaford; Mrs. clear and Swartz, Watertown; Mrs. M. Smith, It seldom fails to relieve the Watertown: O. F. McKillip, Madison: Rowles without delay. You can obtain torment jar Robert Harding, Brookings; W. E. Ly from any good man, Spearfish: E. D. Parker; druggist. A. Gentle, Brookings; Ed W. Rebel, Let trial of show what this to Olivet: Elmer Spindler, Olivet: Eddie Send the pon for it. Clip It now. town; G. W. Gage, Gayville; George Whitehall Pharmacal Co. Ings; F. D. Peckham, Alexandria: A. Avenue Free New York, M. Gun, Watertown; A. R. Schlosser, Dept. Trial Plankinton: G. F. Adams, Yankton; Frank Ferguson, Artesian; H. M. Sulphur. Mall me Free Sample of Mentho. Fairchild, Madison: Mr. and Mrs. A. Feinman, Lennox: Ella VermilMon; A. T. Wilson, Vermillion; Ruth Cunningham, Canton. Carpenter: Mrs. Elinor H. Whiting. Pierre; A. O. Ringsrud, Elk Point: Aberdeen; F. L. Youngers, Parker; Ralph O. Howe, Mellette;