Article Text

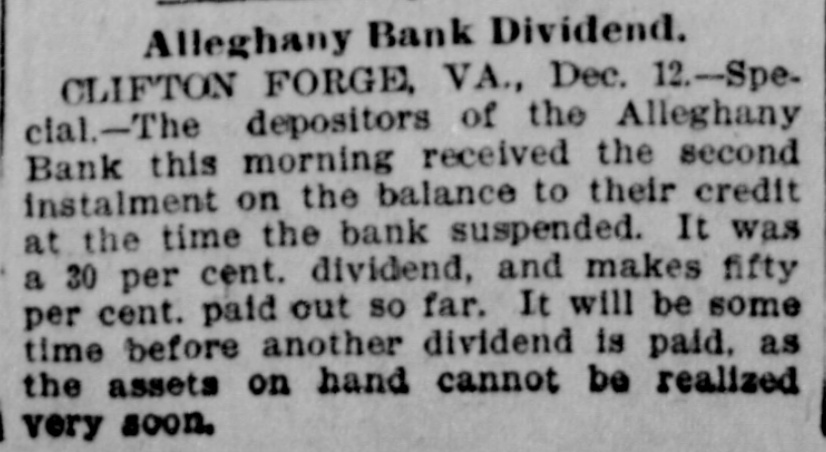

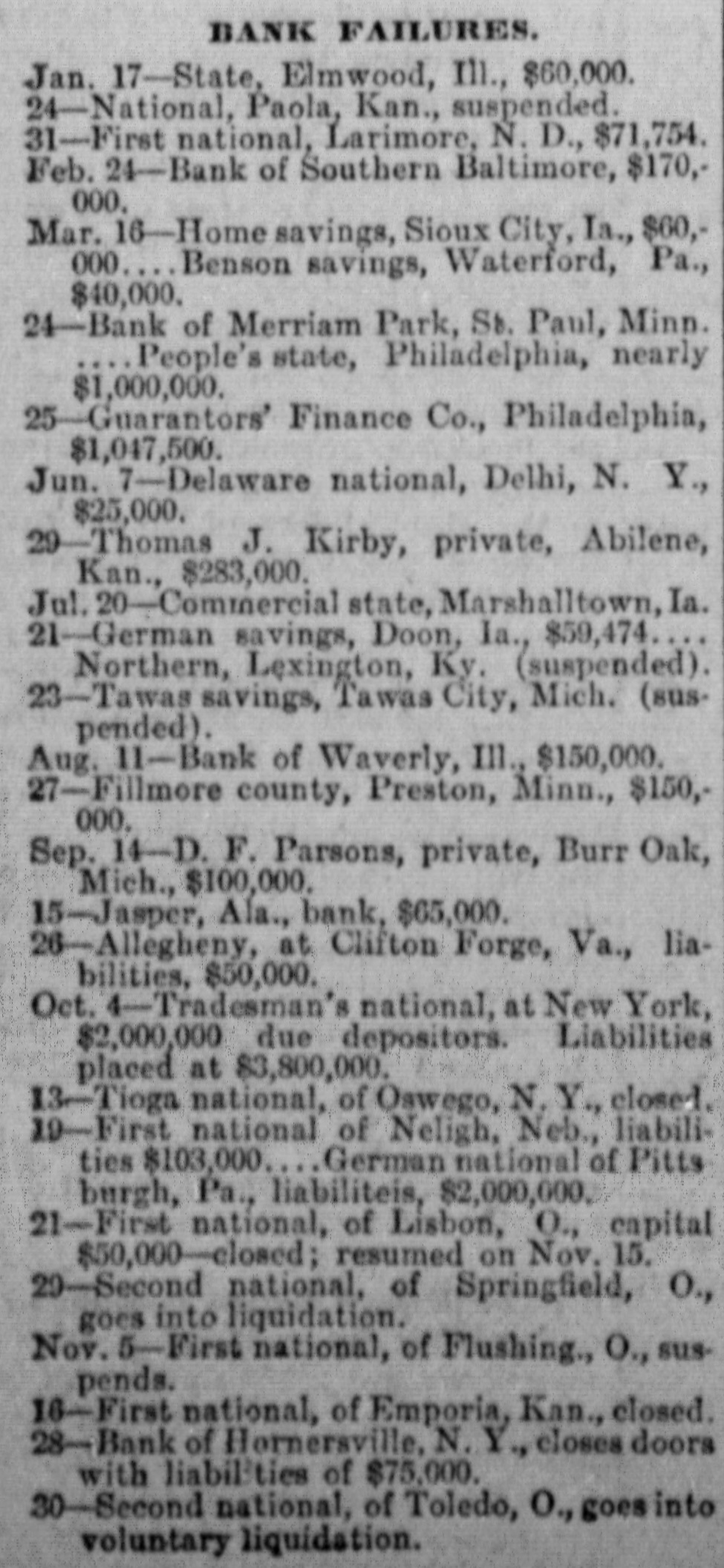

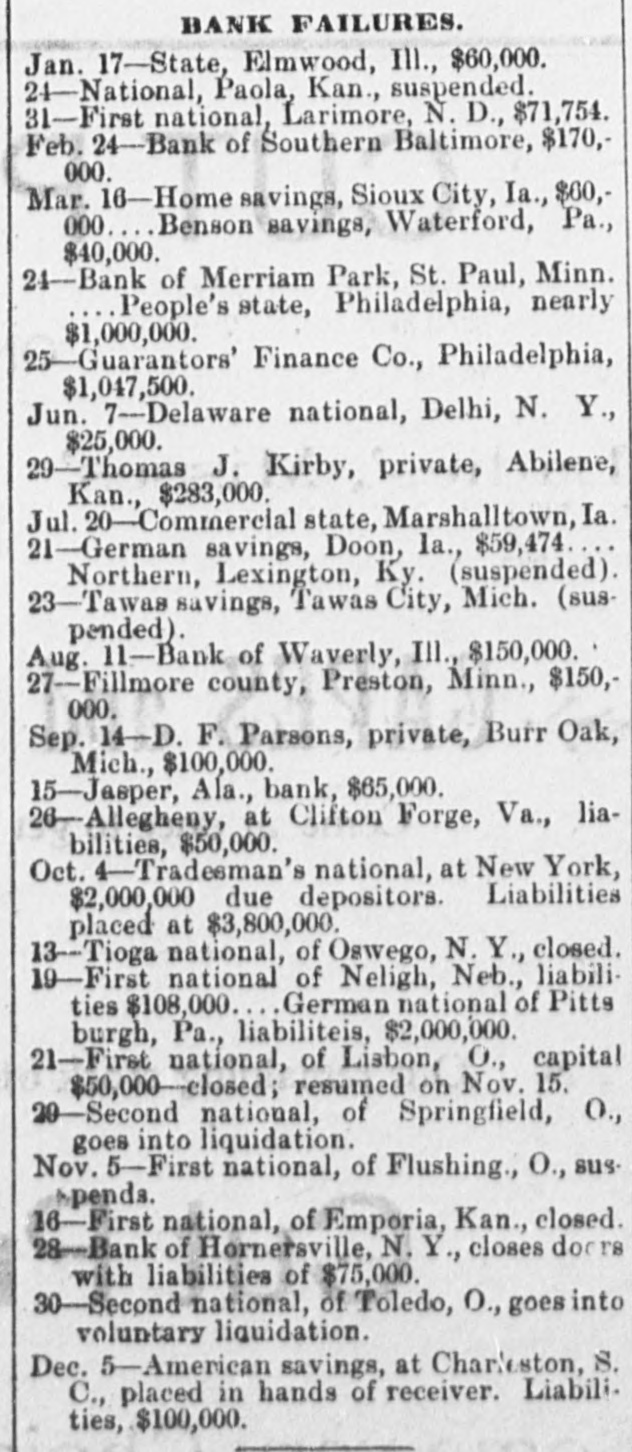

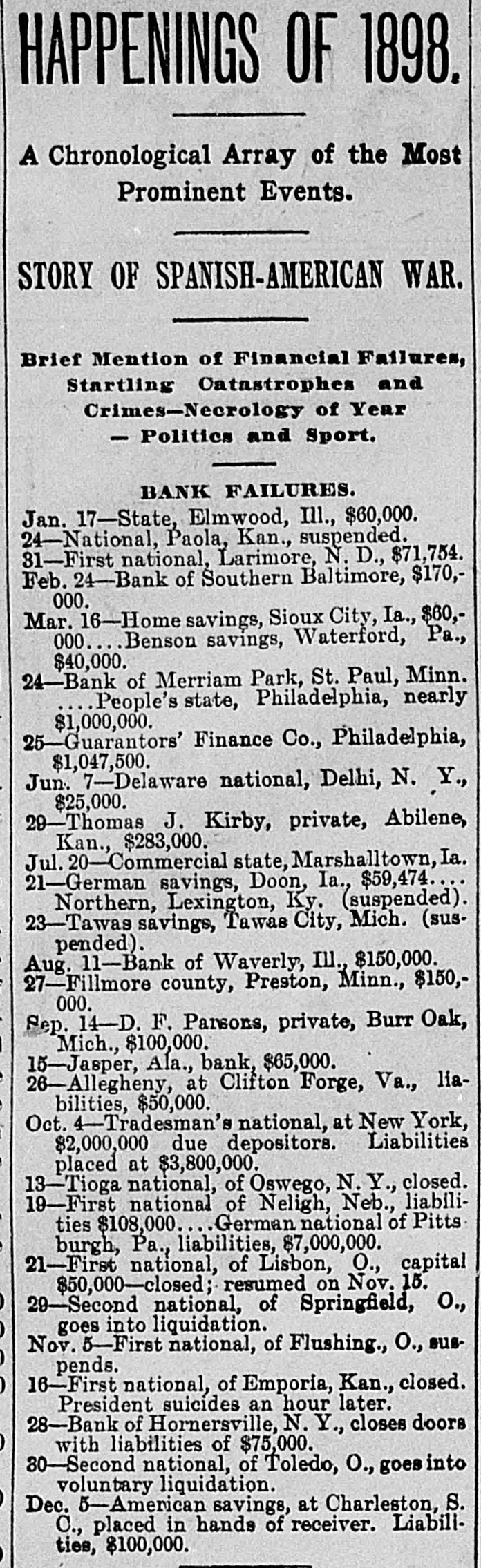

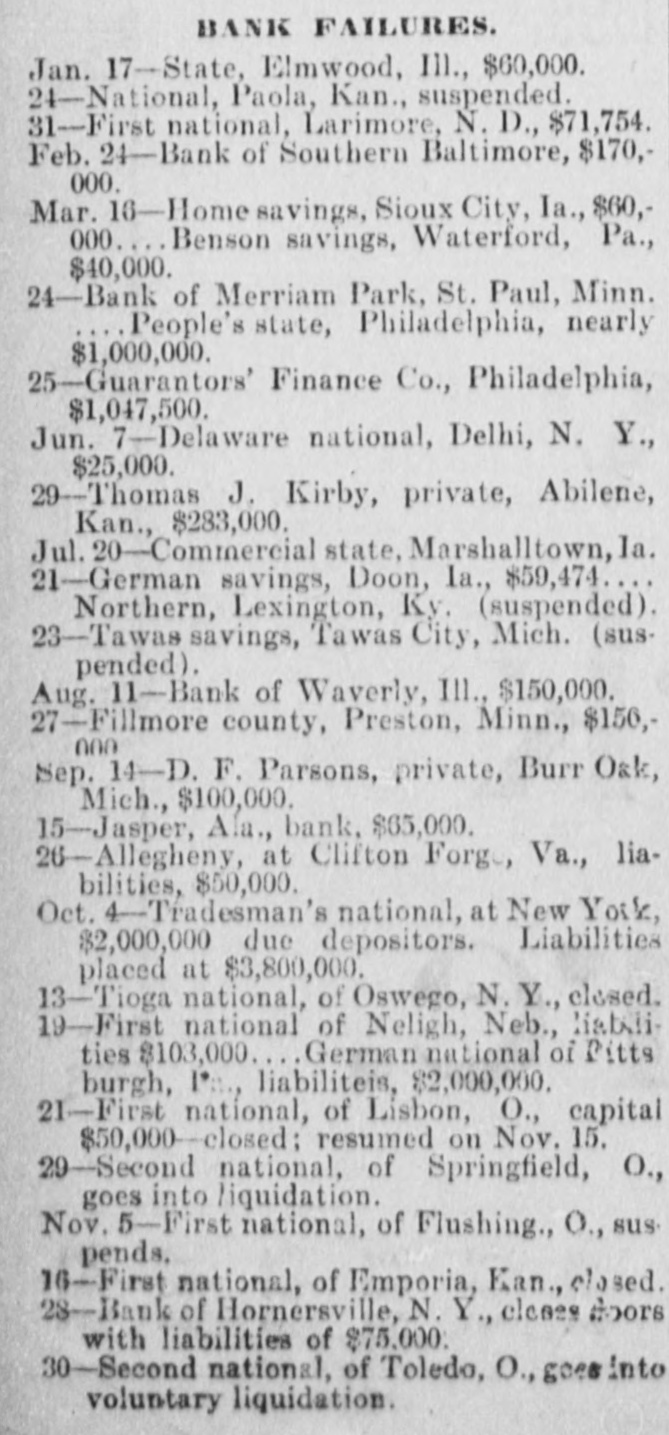

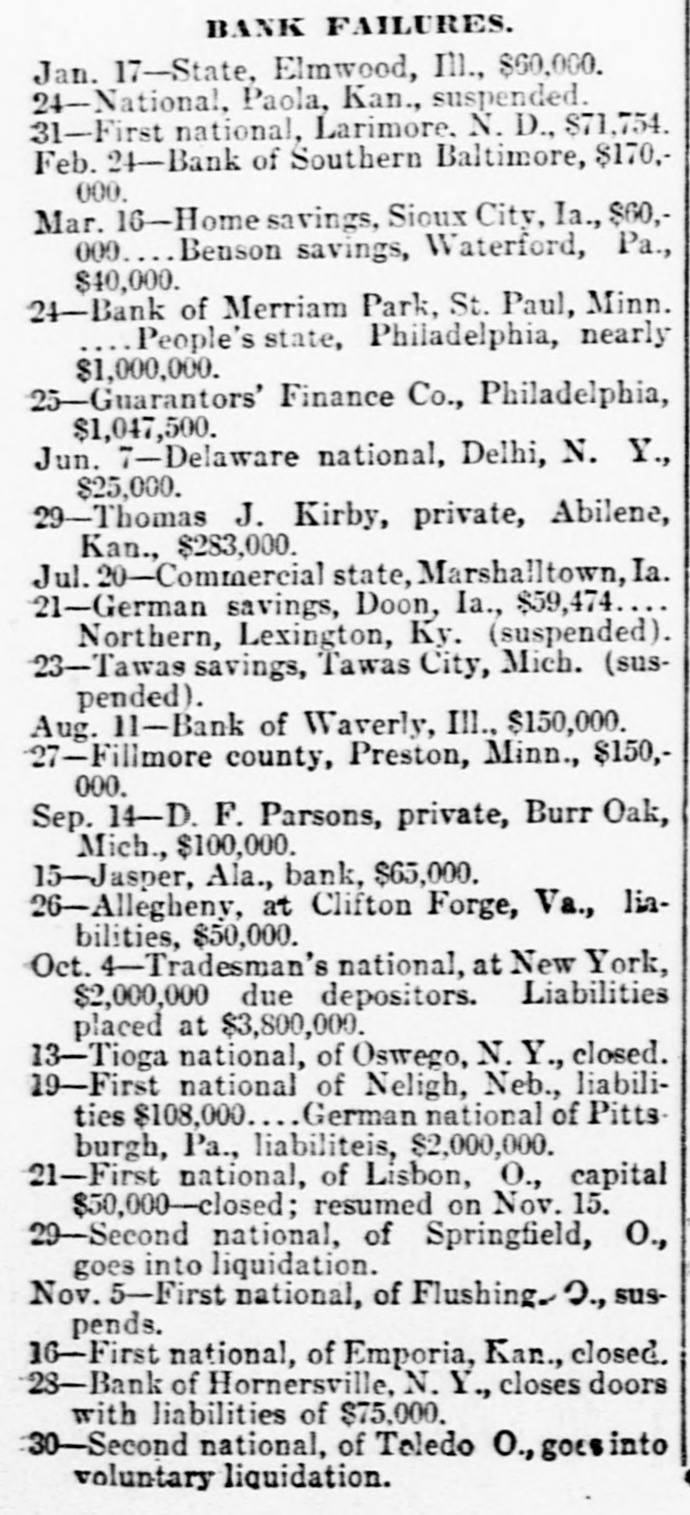

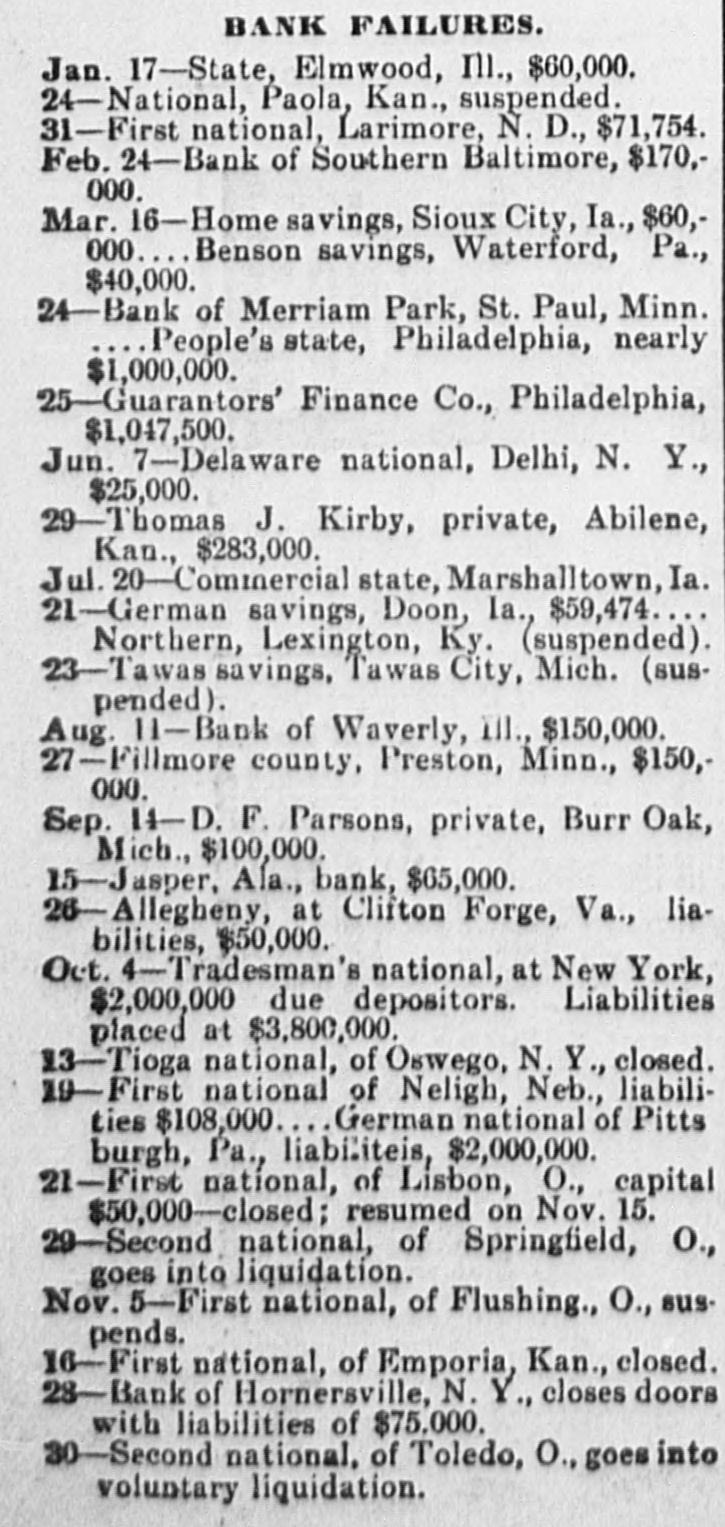

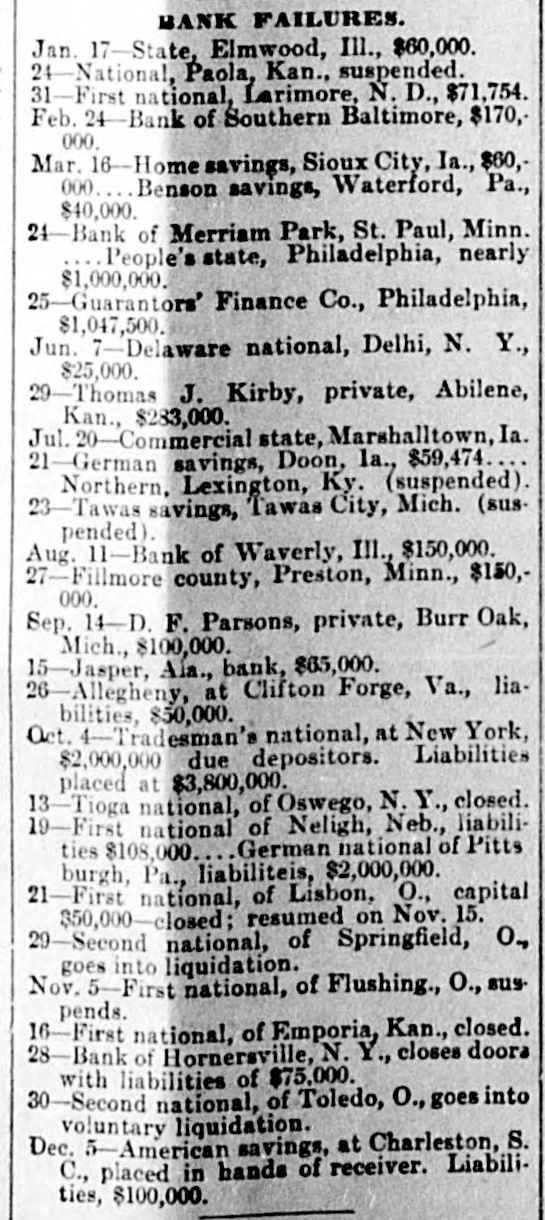

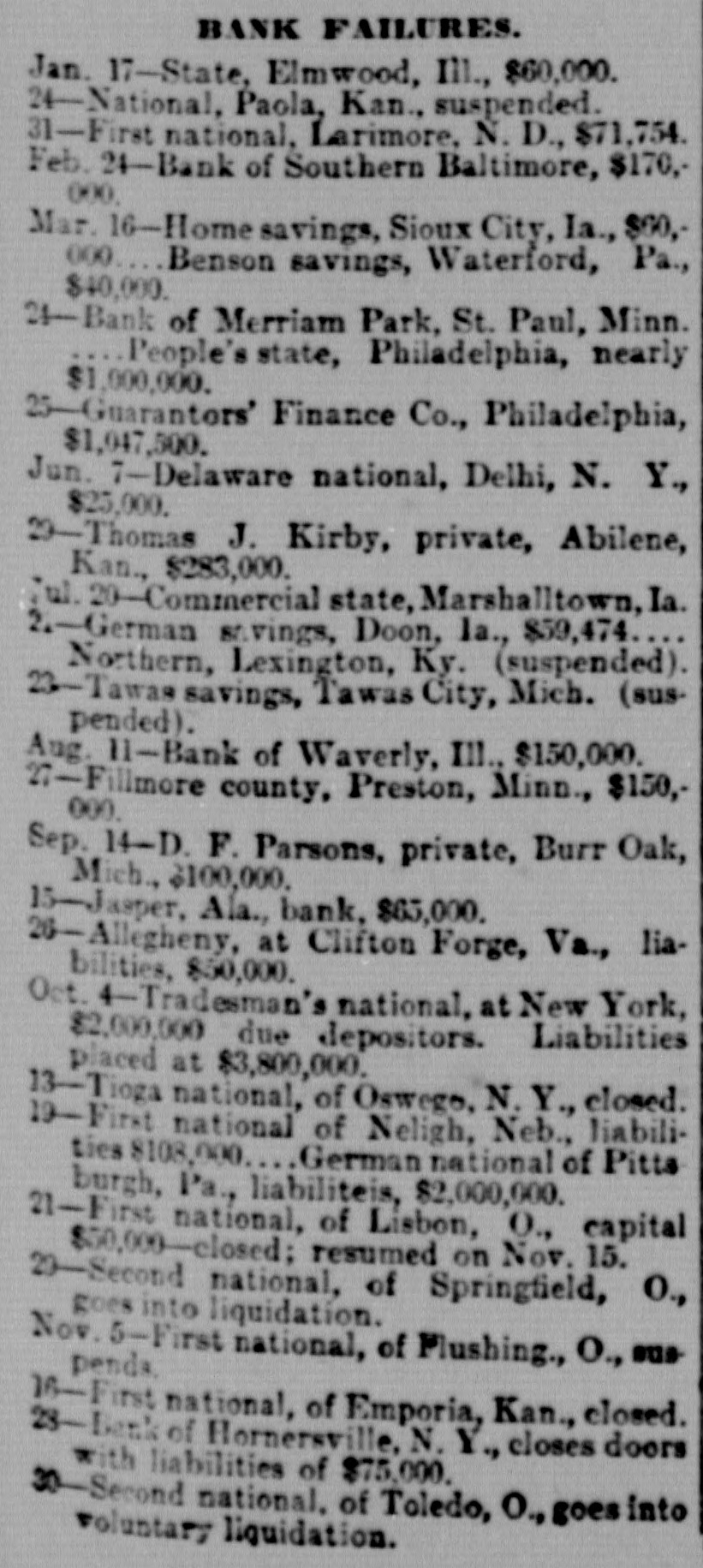

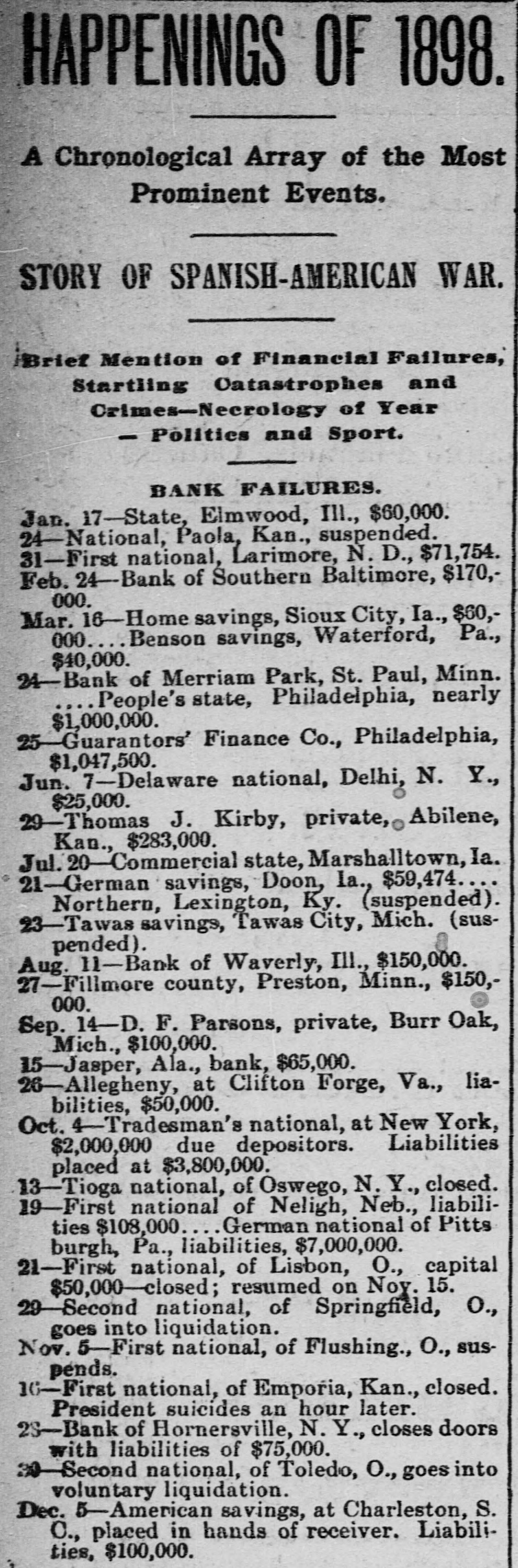

HAS CLOSED DOORS. THE BANK OF ALLEGHANY, AT CLIFTON FORGE. ANXIOUS COMMUNITY. Rumors Sunday That Were Verified Monday-A History of the Institution-Started During Room TimesTalk of Reorganization. CLIFTON FORGE, VA., September 26.(Special.)-The Alleghany Bank, of Clifton Forge, closed its doors this morning, its officers finding upon investigation that its assets were not adequate to meet its liabilities. Early in the day Sunday it was rumored about the city everywhere that the bank would not open its doors this morning, and throughout the entire day the subject was discussed by groups of anxious men who had placed their hard-earned savings only a few days before within its vaults for safe-keeping, or to meet their wants and the obligations of paying for homes for themselves and their little ones. The excitement gathered as the day wore on, and when the hour Monday for the opening of the bank arrived the street in front of the building was packed with people, but instead of the doors being opened the following was posted: "Notice.-This bank has found It necessary to make an assignment. No preferences have been made and all creditors have been placed upon the same footing. The trustees will proceed as rapidly as possible to convert the assets of the bank into money and distribute them among the creditors. The stockholders will get nothing until all creditors are paid in full. "By order of the Board of Directors. (Signed) "H. T. NELSON, Trustee." What per cent. of the deposits will be paid Is conjectured at 60 to 80 per cent., possibly, and just what will be the outcome of the failure cannot be stated at this time. A meeting has been called by the depositors, who are largely merchants, railroad men, and shop-hands, to be held Tuesday, September 27th, to formulate such plans and methods as will lead to the best results. Some of the depositors are willing to allow 50 per cent. of their deposits to remain as new capital with a view to effecting a reorganization, while others of the depositors desire, and will insist at the meeting upon having the matter taken charge of by the court and a receiver appointed. The Alleghany Bank was organized as a State institution during the boom in 1890, its capital stock represented as paid up then being $20,000. Its first president was E. M. Nettleton, of Alleghany, with the late Lem Page, of Charlottesville, as cashier. Mr. Nettleton resigned the presidency, and was succeeded in office by Mr. J. C. Carpenter in 1895. He remained at the head of the bank until September 8th of the present year, when a reorganization was brought about by changes in the ownership of the stock of the bank, and Mr. Carpenter retired. He was succeeded by H. T. Nelson, Esq., as president, with a new Board of Directors. It seems that under the new organization the discovery was made that the bank was insolvent, and had been practically so for some time. The amount of deposits represented in the failure will foot between $45,000 and $50,000.