Click image to open full size in new tab

Article Text

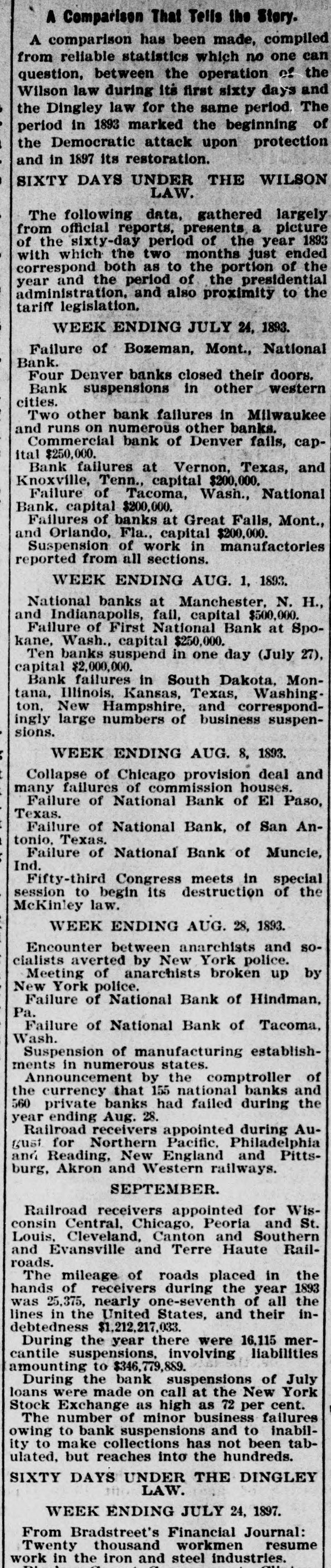

JUST FOR COMPARISON. SOMETHING IN RELATION TO THE CONDITIONS WHICH EXISTED IN 1892. And Then Look Upon the Fair Picture Presented in 1897-Then the Banks Were Failing and Everything Was Tumbling-Now Everything is on the Mend and Mills Are Opening. Washington, D. C., Oct. 11.-(Special Correspondence.)-The reports of business improvement and activity in manu. facturing and commercial lines which have come to the front since the enact. ment of the Dingley law has suggested to somebody with a good memory a comparison of present conditions with those of the corresponding dates in the first year of the Cleveland administration. It is a curious fact that the enactment of the Wilson law came at just about a corresponding period with the meeting of the free-trade congress in the first year of Cleveland's second term, and that it is therefore possible to contrast business conditions under the shadow of approaching free trade with the busid ness conditions in the sunshine of re1 turning protection. This comparison is e startling. The period covered in the comparison is the two months since the final action upon the Dingley bill compared with the corresponding two it months in the Cleveland term, or from July 24 to September 24, 1893, contrasted with July 24 to September 24, 1897. Here is the contrast; it is well worth e laying aside for reference: Week ending July 24, 1893-Failure of e Bozeman, Montana, national bank. Four Denver banks closed their doors. Bank a suspensions in other western cities. Two e banks failed in Milwaukee, and runs.on d numerous other banks. Commercial bank of Denver falls; capital $250,000. h Bank failures at Vernon, Tex., and Knoxville, Tenn., capital, $200,000. Faily ure of Takoma, Wash., National bank; capital, $200,0000; also failure of banks d at Great Falls, Mont., and Orlando, Fla.; capital, $200,000. Suspension of work in y S manufactories reported from all seca tions. Week ending August 1, 1893-National banks at Manchester, N. H., and g Indianapolis, Ind., fail; capital $500,000. e Failure of First National bank at Spo. kane, Wash.,; capital $250,000. Ten 0 banks suspended in one day (July 27); n capital $2,000,000. Bank failures in South Dakota, Montana, Illinois, Kand sas, Texas, Washington, New Hampat shire, and correspondingly large num9 bers of business suspensions. 6 Week ending August 8, 1893-Collapse r of Chicago provision deal, and many failures of commercial houses. Failure at of national bank of El Paso, Texas. FailS ure of national bank of San Antonio, 1 Texas. Failure of national bank of it Muncie, Ind. Fifty-third congress meets 1 in special session to begin its destruction d of the McKinley law. d Week ending August 28, 1893-Ener counter between the anarchists and 80y clalists averted by New York police; * meeting of New York anarchists broken d up by New York police. Failure of na. tional bank at Hindman, Pa. Failure of Ф national bank at Tacoma, Wash. SusR pension of manufacturing establishments in numerous states. Announcement by 8 6 comptroller of currency that 155 national banks and 560 private banks had falled d during the year ending August 28. Railat road receivers appointed during August for Northern Pacific, Philadelphia and s Reading, New England, and Pittsburg, Akron and Western. is September-Railroad receivers ap0 pointed for Wisconsin Central, Chicago, 0 Peoria and St. Louis, Cleveland, Canton e and Southern, and Evansville and Terre Haute railroads. The mileage of roads 19 placed in the hands of receivers during g the year 1893 was 25,375, nearly oneseventh of all the lines in the United a States, and their indebtedness, $1,212,10 217,033. During the year there were 16,115 mercantile suspenions, Involve ing liabilities amounting to $346,779,889. 8 During the bank suspensions of July loans were made on call at the New York stock exchange as high as 72 per cent.