Click image to open full size in new tab

Article Text

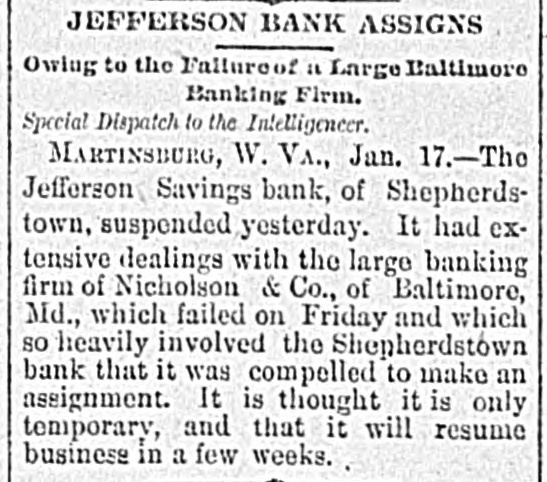

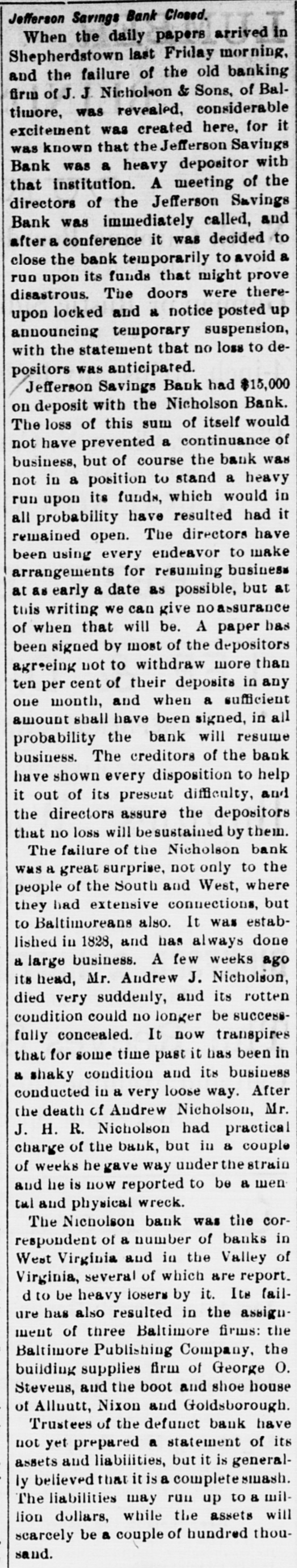

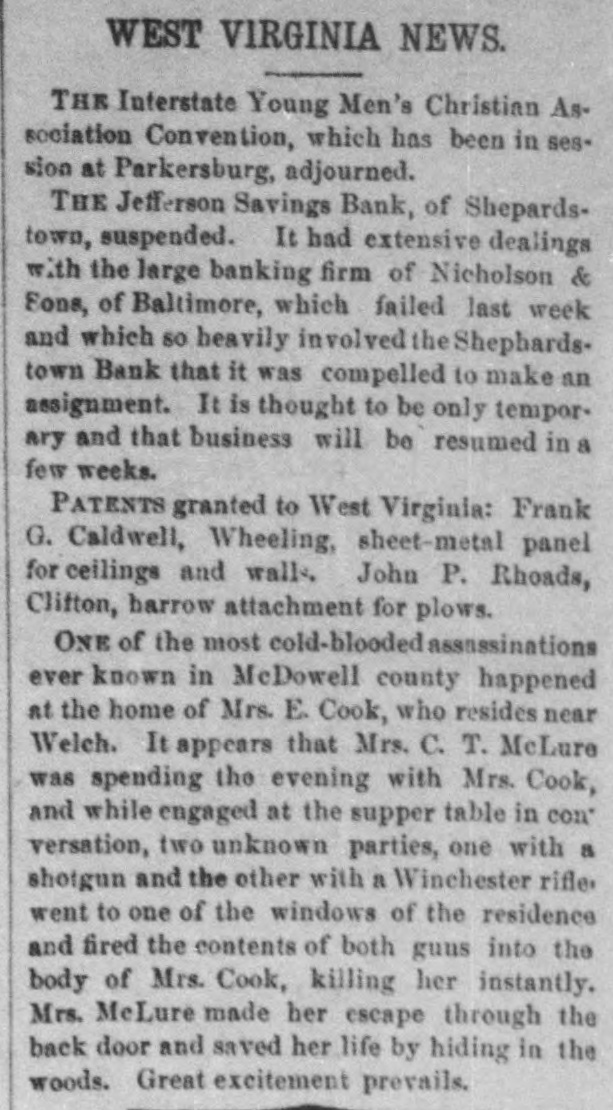

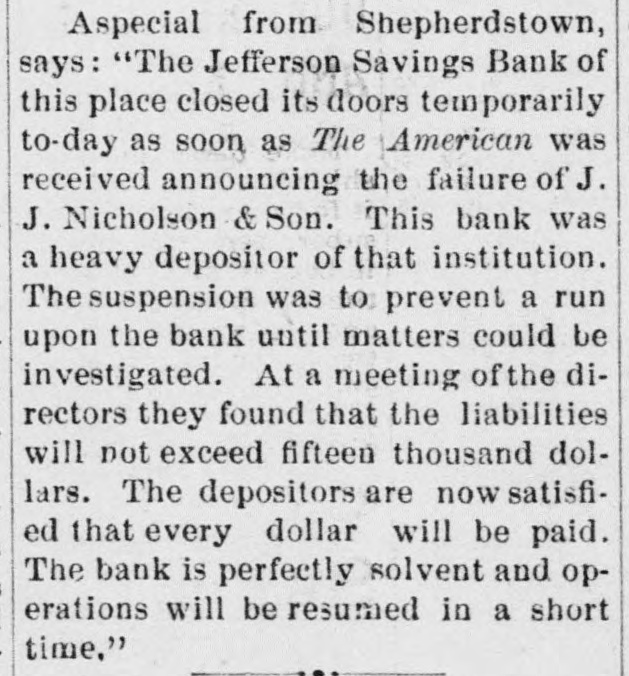

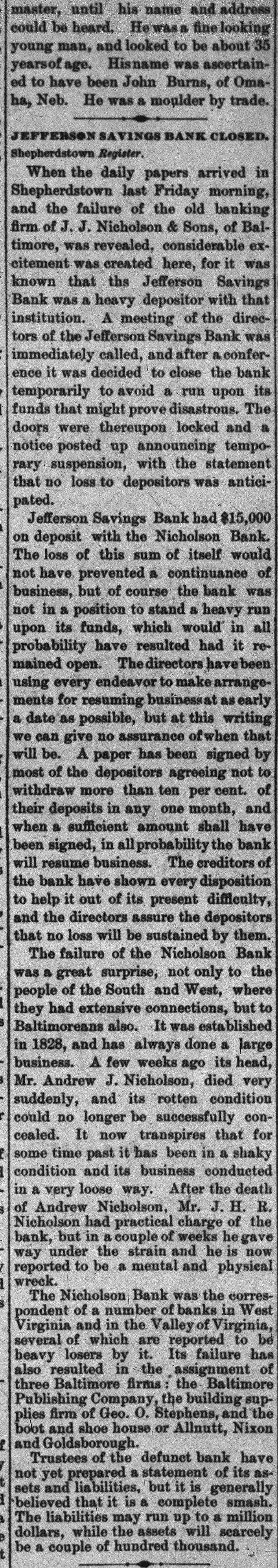

could be heard. He was a fine looking young man, and looked to be about 35 yearsof age. Hisname was ascertained to have been John Burns, of Omaha, Neb. He was a moulder by trade. JEFFERSON SAVINGS BANK CLOSED. Shepherdstown Register. When the daily papers arrived in Shepherdstown last Friday morning, and the failure of the old banking firm of J. J. Nicholson & Sons, of Baltimore, was revealed, considerable excitement was created here, for it was known that ths Jefferson Savings Bank was a heavy depositor with that institution. A meeting of the directors of the Jefferson Savings Bank was immediately called, and after a conference it was decided to close the bank temporarily to avoid a run upon its funds that might prove disastrous. The doors were thereupon locked and a notice posted up announcing temporary suspension, with the statement that no loss to depositors was anticipated. Jefferson Savings Bank had $15,000 on deposit with the Nicholson Bank. The loss of this sum of itself would not have prevented a continuance of business, but of course the bank was not in a position to stand a heavy run upon its funds, which would in all probability have resulted had it remained open. The directors have been using every endeavor to make arrangements for resuming businessat as early a date as possible, but at this writing we can give no assurance of when that will be. A paper has been signed by most of the depositors agreeing not to withdraw more than ten per cent. of their deposits in any one month, and when a sufficient amount shall have been signed, in all probability the bank will resume business. The creditors of the bank have shown every disposition to help it out of its present difficulty, and the directors assure the depositors that no loss will be sustained by them. The failure of the Nicholson Bank was a great surprise, not only to the people of the South and West, where they had extensive connections, but to Baltimoreans also. It was established in 1828, and has always done a large business. A few weeks ago its head, Mr. Andrew J. Nicholson, died very suddenly, and its rotten condition could no longer be successfully concealed. It now transpires that for some time past it has been in a shaky condition and its business conducted in a very loose way. After the death of Andrew Nicholson, Mr. J. H. R. Nicholson had practical charge of the bank, but in a couple of weeks he gave way under the strain and he is now reported to be a mental and physical wreck. The Nicholson Bank was the correspondent of a number of banks in West Virginia and in the Valley of Virginia, several of which are reported to be heavy losers by it. Its failure has also resulted in the assignment of three Baltimore firms the Baltimore Publishing Company, the building supplies firm of Geo. O. Stephens, and the boot and shoe house or Allnutt, Nixon and Goldsborough. Trustees of the defunct bank have not yet prepared a statement of its assets and liabilities, but it is generally believed that it is a complete smash. The liabilities may run up to a million dollars, while the assets will searcely