Click image to open full size in new tab

Article Text

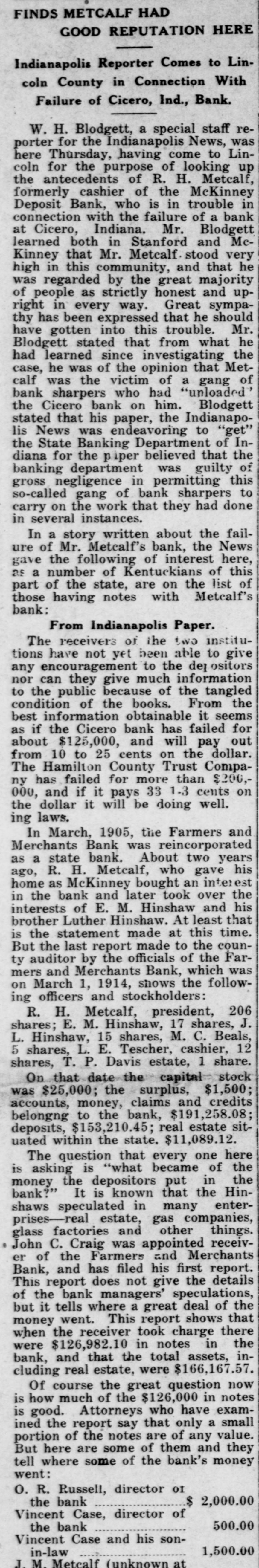

# FINDS METCALF HAD

# GOOD REPUTATION HERE

Indianapolis Reporter Comes to Lincoln County in Connection With Failure of Cicero, Ind., Bank.

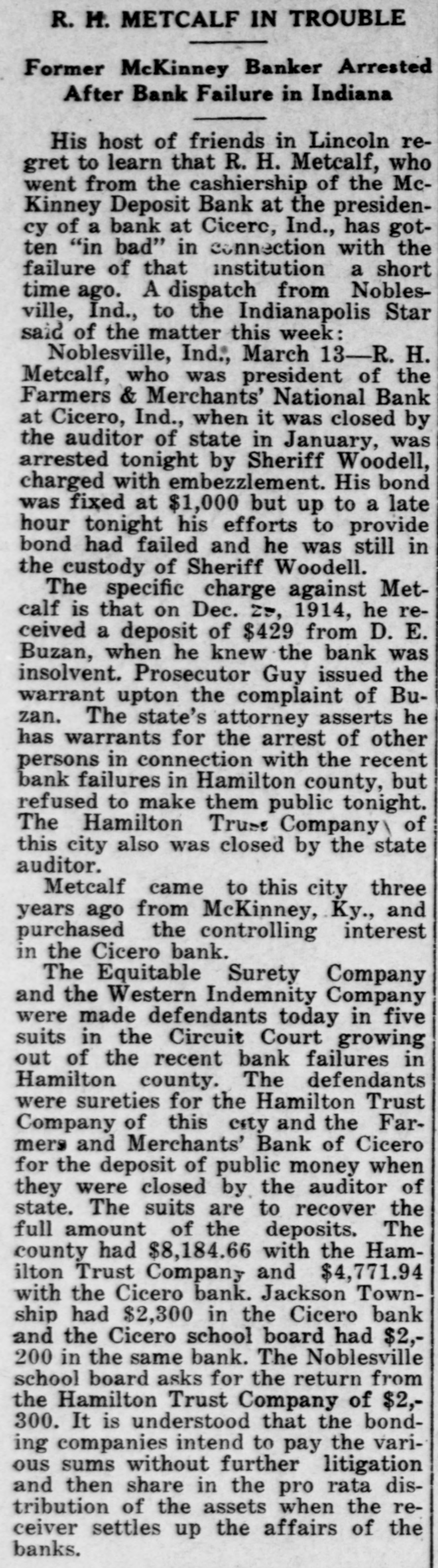

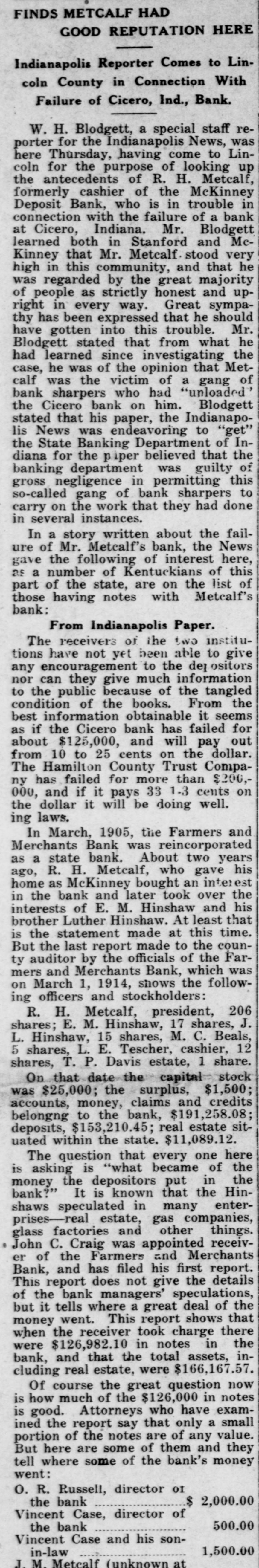

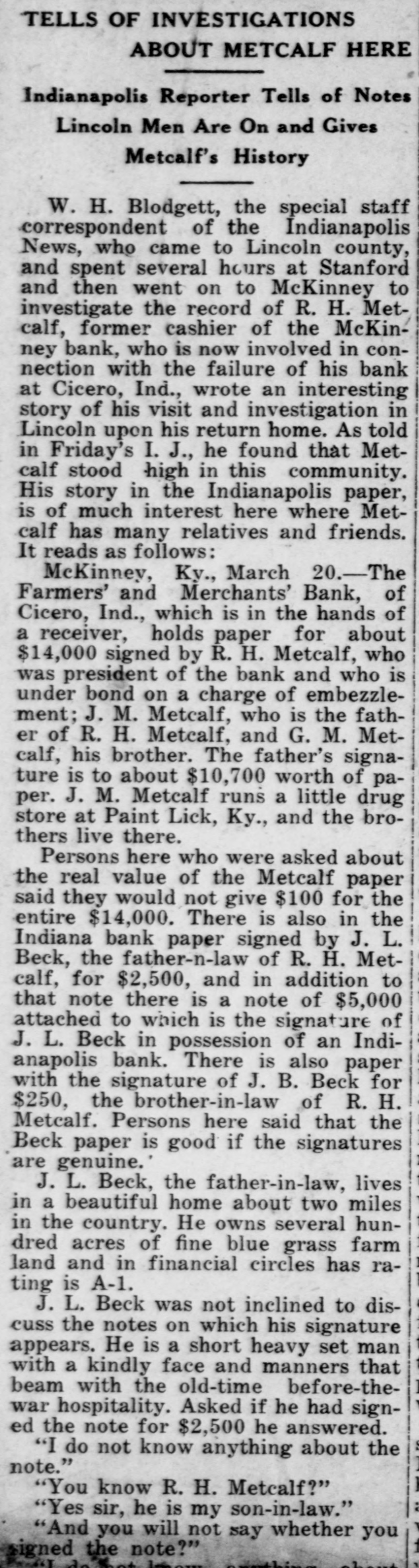

W. H. Blodgett, a special staff reporter for the Indianapolis News, was here Thursday, having come to Lincoln for the purpose of looking up the antecedents of R. H. Metcalf, formerly cashier of the McKinney Deposit Bank, who is in trouble in connection with the failure of a bank at Cicero, Indiana. Mr. Blodgett learned both in Stanford and McKinney that Mr. Metcalf stood very high in this community, and that he was regarded by the great majority of people as strictly honest and upright in every way. Great sympathy has been expressed that he should have gotten into this trouble. Mr. Blodgett stated that from what he had learned since investigating the case, he was of the opinion that Metcalf was the victim of a gang of bank sharpers who had "unloaded" the Cicero bank on him. Blodgett stated that his paper, the Indianapolis News was endeavoring to "get" the State Banking Department of Indiana for the piper believed that the banking department was guilty of gross negligence in permitting this so-called gang of bank sharpers to carry on the work that they had done in several instances.

In a story written about the failure of Mr. Metcalf's bank, the News gave the following of interest here, as a number of Kentuckians of this part of the state, are on the list of those having notes with Metcalf's bank:

From Indianapolis Paper.

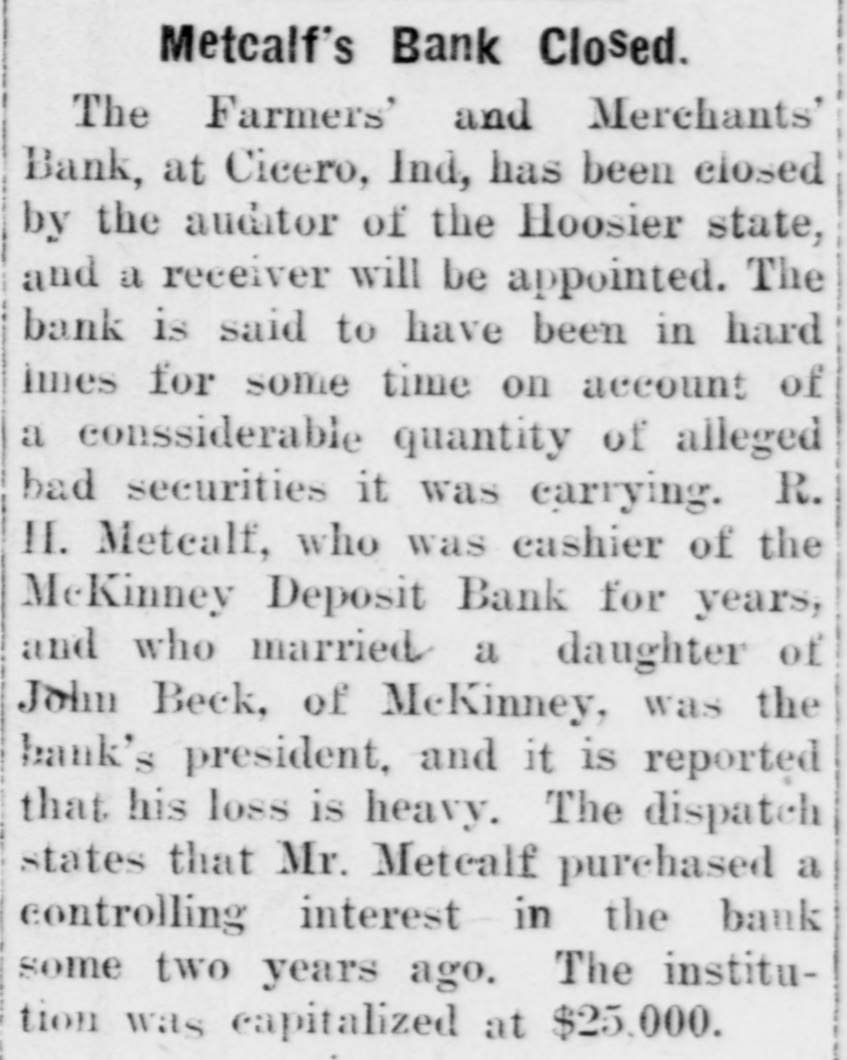

The receivers of the two institutions have not yet been able to give any encouragement to the depositors nor can they give much information to the public because of the tangled condition of the books. From the best information obtainable it seems as if the Cicero bank has failed for about $125,000, and will pay out from 10 to 25 cents on the dollar. The Hamilton County Trust Company has failed for more than $200,000, and if it pays 33 1-3 cents on the dollar it will be doing well. ing laws.

In March, 1905, the Farmers and Merchants Bank was reincorporated as a state bank. About two years ago, R. H. Metcalf, who gave his home as McKinney bought an interest in the bank and later took over the interests of E. M. Hinshaw and his brother Luther Hinshaw. At least that is the statement made at this time. But the last report made to the county auditor by the officials of the Farmers and Merchants Bank, which was on March 1, 1914, shows the following officers and stockholders:

R. H. Metcalf, president, 206 shares; E. M. Hinshaw, 17 shares, J. L. Hinshaw, 15 shares, M. C. Beals, 5 shares, L. E. Tescher, cashier, 12 shares, T. P. Davis estate, 1 share.

On that date the capital stock was $25,000; the surplus, $1,500; accounts, money, claims and credits belongng to the bank, $191,258.08; deposits, $153,210.45; real estate situated within the state. $11,089.12.

The question that every one here is asking is "what became of the money the depositors put in the bank?" It is known that the Hinshaws speculated in many enterprises—real estate, gas companies, glass factories and other things. John C. Craig was appointed receiver of the Farmers and Merchants Bank, and has filed his first report. This report does not give the details of the bank managers' speculations, but it tells where a great deal of the money went. This report shows that when the receiver took charge there were $126,982.10 in notes in the bank, and that the total assets, including real estate, were $166,167.57.

Of course the great question now is how much of the $126,000 in notes is good. Attorneys who have examined the report say that only a small portion of the notes are of any value. But here are some of them and they tell where some of the bank's money went:

O. R. Russell, director of the bank ...$ 2,000.00

Vincent Case, director of the bank ... 500.00

Vincent Case and his son-in-law ... 1,500.00

J. M. Metcalf (unknown at