Article Text

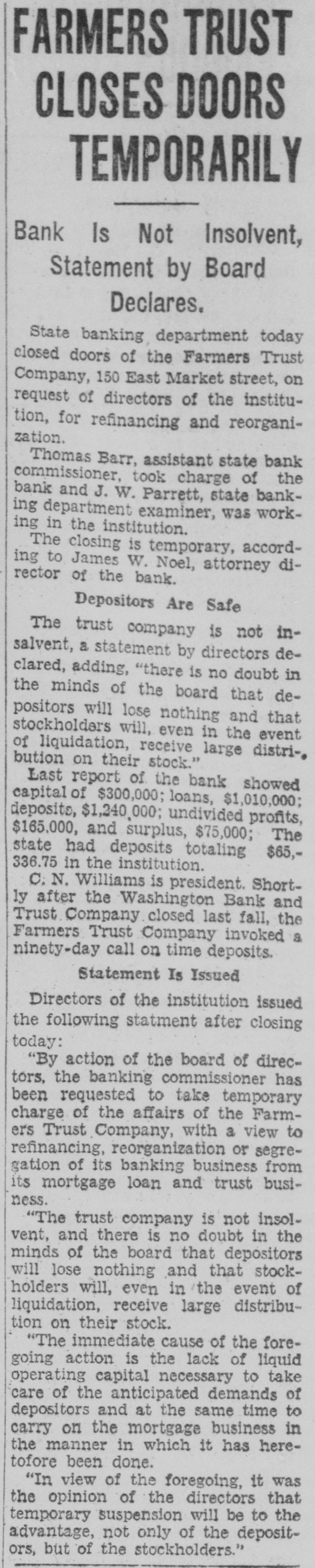

FARMERS TRUST CLOSES DOORS TEMPORARILY Bank Is Not Insolvent, Statement by Board Declares. State banking department today closed doors of the Farmers Trust Company, 150 East Market street, on request of directors of the institution, for refinancing and reorganization. Thomas Barr, assistant state bank commissioner. took charge of the bank and J. W. Parrett, state banking department examiner, was working in the institution. The closing is temporary, according to James W. Noel, attorney director of the bank. Depositors Are Safe The trust company is not insalvent, a statement by directors declared, adding, "there is no doubt in the minds of the board that depositors will lose nothing and that stockholders will, even in the event of liquidation, receive large distri-, bution on their stock." Last report of the bank showed capital of $300,000; loans, $1,010,000; deposits, $1,240,000; undivided profits, $165,000, and surplus, $75,000; The state had deposits totaling $65,336.75 in the institution. C. N. Williams is president. Shortly after the Washington Bank and Trust Company closed last fall, the Farmers Trust Company invoked a ninety-day call on time deposits. Statement Is Issued Directors of the institution issued the following statment after closing today: "By action of the board of directors, the banking commissioner has been requested to take temporary charge of the affairs of the Farmers Trust Company, with a view to refinancing, reorganization or segregation of its banking business from its mortgage loan and trust business. "The trust company is not insolvent, and there is no doubt in the minds of the board that depositors will lose nothing and that stockholders will, even in the event of liquidation, receive large distribution on their stock. "The immediate cause of the foregoing action is the lack of liquid operating capital necessary to take care of the anticipated demands of depositors and at the same time to carry on the mortgage business in the manner in which it has heretofore been done. "In view of the foregoing, it was the opinion of the directors that temporary suspension will be to the advantage, not only of the depositors, but of the stockholders."