Click image to open full size in new tab

Article Text

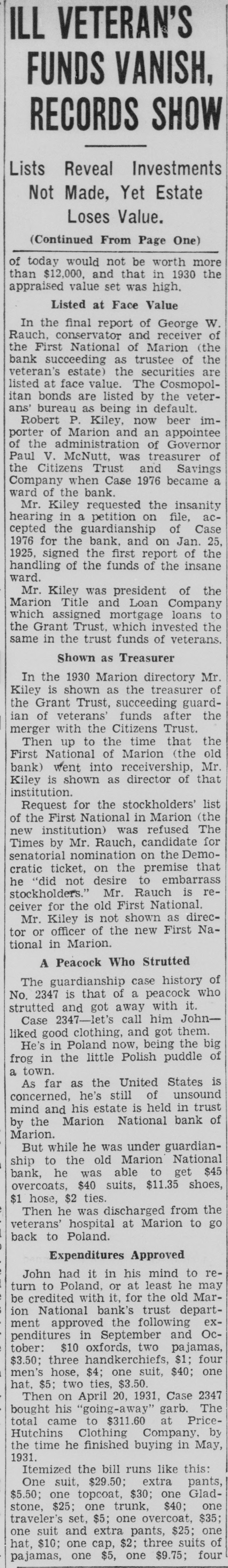

# ILL VETERAN'S

# FUNDS VANISH,

# RECORDS SHOW

Lists Reveal Investments

Not Made, Yet Estate

Loses Value.

(Continued From Page One)

of today would not be worth more than $12,000, and that in 1930 the appraised value set was high.

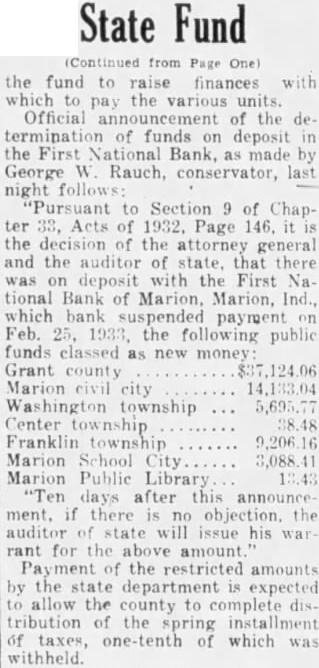

Listed at Face Value

In the final report of George W. Rauch, conservator and receiver of the First National of Marion (the bank succeeding as trustee of the veteran's estate) the securities are listed at face value. The Cosmopolitan bonds are listed by the veterans' bureau as being in default.

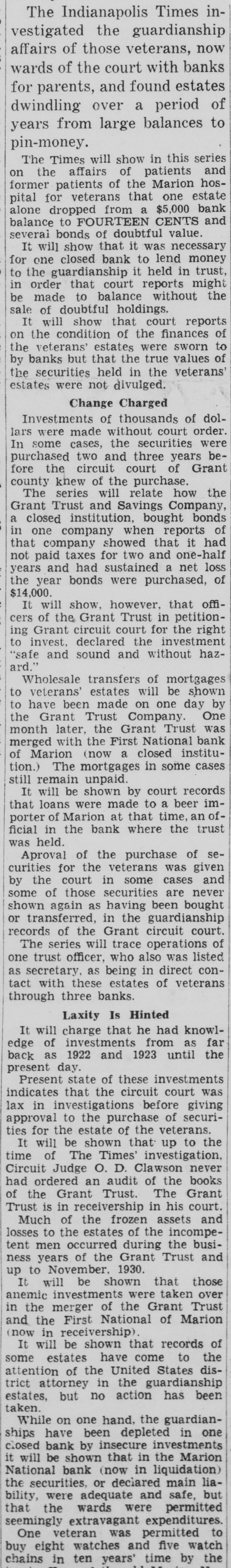

Robert P. Kiley, now beer importer of Marion and an appointee of the administration of Governor Paul V. McNutt, was treasurer of the Citizens Trust and Savings Company when Case 1976 became a ward of the bank.

Mr. Kiley requested the insanity hearing in a petition on file, accepted the guardianship of Case 1976 for the bank, and on Jan. 25, 1925, signed the first report of the handling of the funds of the insane ward.

Mr. Kiley was president of the Marion Title and Loan Company which assigned mortgage loans to the Grant Trust, which invested the same in the trust funds of veterans.

Shown as Treasurer

In the 1930 Marion directory Mr. Kiley is shown as the treasurer of the Grant Trust, succeeding guardian of veterans' funds after the merger with the Citizens Trust.

Then up to the time that the First National of Marion (the old bank) went into receivership, Mr. Kiley is shown as director of that institution.

Request for the stockholders' list of the First National in Marion (the new institution) was refused The Times by Mr. Rauch, candidate for senatorial nomination on the Democratic ticket, on the premise that he "did not desire to embarrass stockholders." Mr. Rauch is receiver for the old First National.

Mr. Kiley is not shown as director or officer of the new First National in Marion.

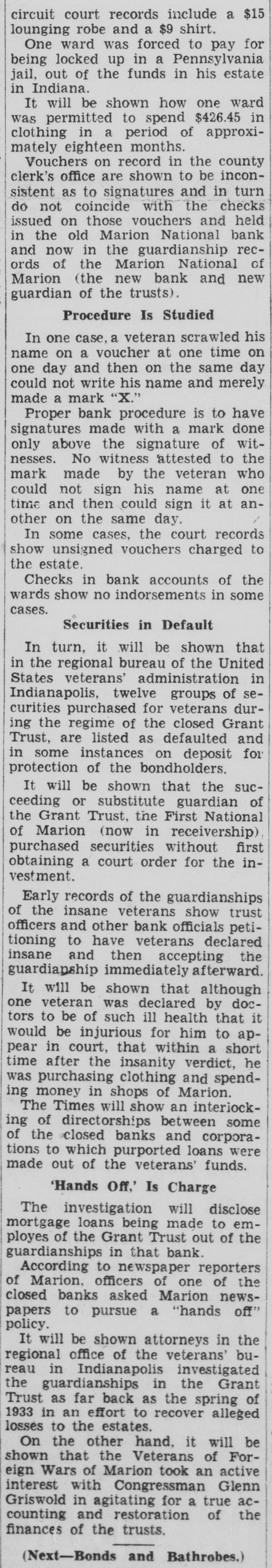

A Peacock Who Strutted

The guardianship case history of No. 2347 is that of a peacock who strutted and got away with it.

Case 2347-let's call him John-liked good clothing, and got them.

He's in Poland now, being the big frog in the little Polish puddle of a town.

As far as the United States is concerned, he's still of unsound mind and his estate is held in trust by the Marion National bank of Marion.

But while he was under guardianship to the old Marion National bank, he was able to get $45 overcoats, $40 suits, $11.35 shoes, $1 hose, $2 ties.

Then he was discharged from the veterans' hospital at Marion to go back to Poland.

Expenditures Approved

John had it in his mind to return to Poland, or at least he may be credited with it, for the old Marion National bank's trust department approved the following expenditures in September and October: $10 oxfords, two pajamas, $3.50; three handkerchiefs, $1; four men's hose, $4; one suit, $40; one hat, $5; two ties, $3.50.

Then on April 20, 1931, Case 2347 bought his "going-away" garb. The total came to $311.60 at Price-Hutchins Clothing Company, by the time he finished buying in May, 1931.

Itemized the bill runs like this:

One suit, $29.50; extra pants, $5.50; one topcoat, $30; one Gladstone, $25; one trunk, $40; one traveler's set, $5; one overcoat, $35; one suit and extra pants, $25; one hat, $10; one cap, $2; three suits of pajamas, one $5, one $9.75; four