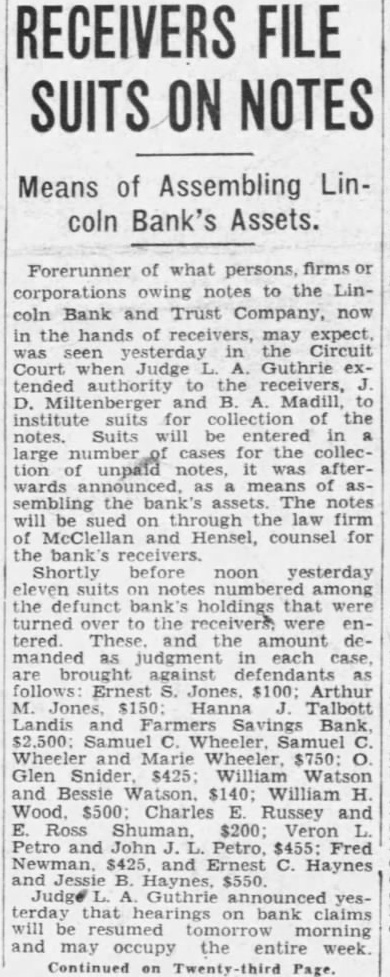

Article Text

BANK RECEIVER ASKED IN COURT Petition Filed by Deputy State Commissioner. Action on petition for appointment receiver the Lincoln Bank and Trust Company, will be taken in the Circuit morning. terday afternoon through the law firm of McClellan and Hensel by Thomas D. deputy state bank commiswho arrived here Sunday ning and took charge of the affairs the defunct banking after doors had been voluntarily closed by the bank's officers and rectors and Luther Symons, state bank had been called assume control The petition asking that receiver by the bankthe state, the failing tion and has been the best depositors, creditors, and stockholders. Formal Notice Ordered. Judge Guthrie the formal notice required by law matissued the stockholders directors the scheduling for hearing Depositors and others. many of the curiously seen yesterday throughthe about the closed Main streets. State gaged work the bank behind blinds effort to the exact financial status of the Barr said last night that the inventory would completed time today hard dict anything about said. "Some will paid that expected to be and other notes expected to be paid not be paid. occasion." depositors in closed Continued Fifth