Click image to open full size in new tab

Article Text

Rural Women Meet State Takes Charge 3 Who Reached Peak DEFICIT HANDICAPS For U. Of M. Course Of South Bend Bank Resting In Juneau CHILDREN'S HOME Gather For Annual Five-Day Sea. Suspension Of American Trust First To Ascend To Top Of Mount

Happy Hills Institution Maintaining 50 Beds On Budget For 20

Still facing deficit of about $3,000 on their operations for the current year, the Happy Hills Convalescent Home for Children is maintaining fifty beds on a budget adjusted to twenty beds. Mrs. Louis Eliasburg. the secretary of the home, is the authority for that The home started the year with the prospect of an $8,000 deficit. Contributions by members of the board of the institution reduced it by about $3,000. A part of the Community Fund. the home is not permitted to make public campaign, says Mrs. Eliasburg. but it is permitted to receive checks which its friends send to the treasurer, W. W. Lanahan, Baltimore city. The home. which is devoted entirely to children, is located at Rogers ave nue and the Cross Country Boulevard sion On Varied Phases Of Farm Life College Park, Md., June 15 (P)Women from rural districts in all of parts of the State gathered at the University of Maryland here today for the annual rural women's short course conducted under direction of the ex tension department of the school. The five-day program of classes and lectures embraces practically every phase of rural life, from canning to how to keep the farm home. The course was arranged by groups, including the required courses and those elective. with certificates to be awarded at the close of the meeting. Last year more than 700 women at. tended the sessions, and officials of the extension department estimated that this summer's meeting, the ninth one. would be more widely attended than those in the past.

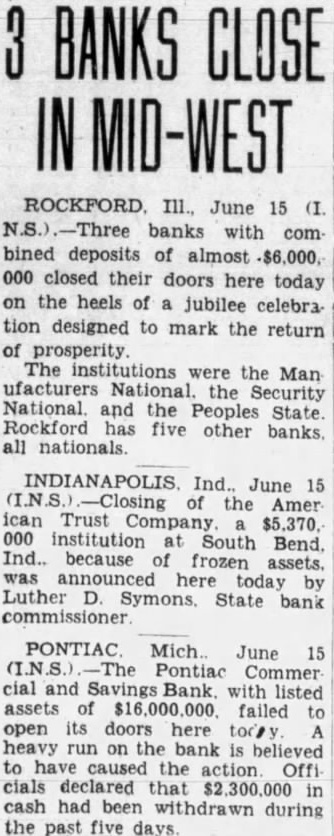

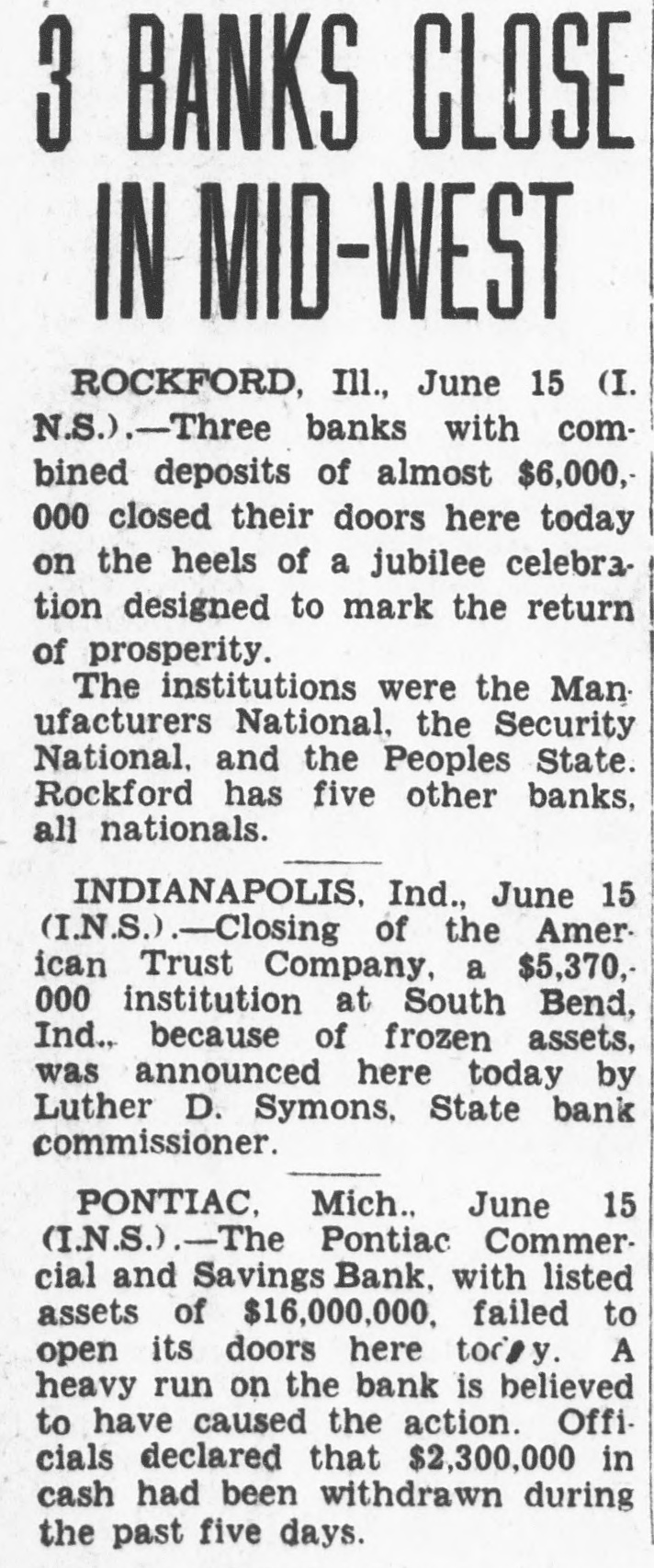

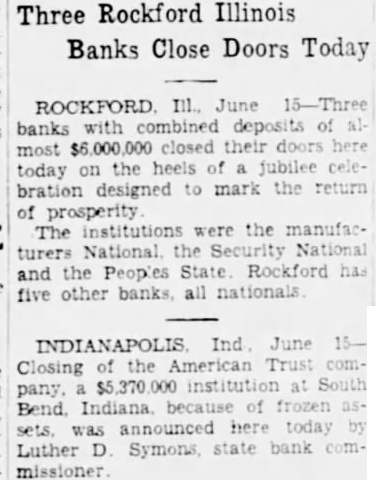

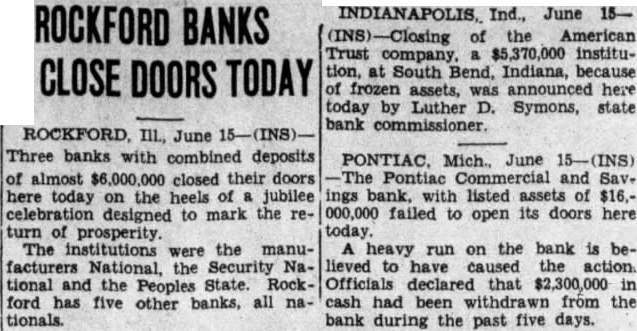

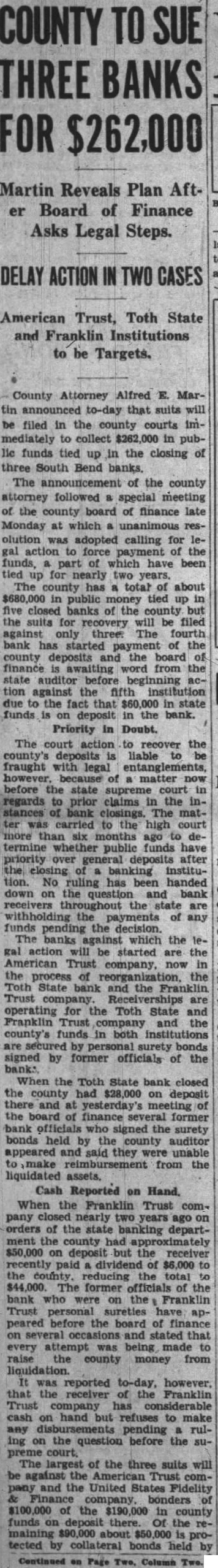

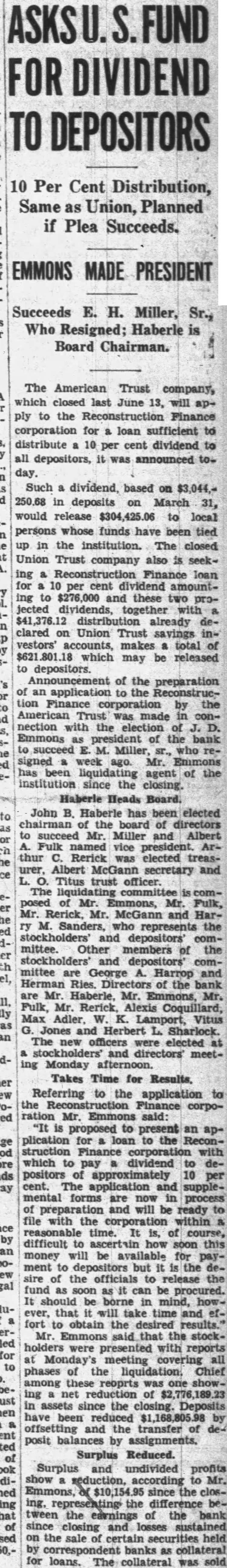

Company Attributed To Frozen Assets Indianapolis, June 15 (U.P)-Closing the American Trust Company, South Bend, one of the largest banks in the Middle West, was announced today by Thomas D. Barr, deupty State bank commissioner, who took charge of the institution. E. H. Miller, president of the bank. said frozen assets were responsible for the closing. Financial standing of the bank is listed as Deposits, $5,370,000: undivided profits, $170,000: loans, $4,670.000: capitalization, $500,000, and surplus, $160,000.

Pontiac Bank Suspends Pontiac, Mich.. June 15 (P)-The Pontiac Commercial and Savings Bank, the city's largest financial institution, was closed today by order of its directors. A notice stated the closing was ordered to conserve assets and preserve the interests of depositors.

Fairweather-Report Trip Was Difficult Juneau, Alaska, June 15 (AP)-The first ascent of Mount Fairweather, 15,292-foot peak, has been made and the three climbers, two of whom were baffied by the peak seven years ago, were here today resting from their labors. The men are Dr. W. S. Ladd and A. Carpe, both of New York, and Ter- ris Moore, Boston. Ladd and Carpe 1. tempted the ascent in 1924 too late in the season and were forced to abandon the trip. The party left here in April and the climb to the summit of Mount Fairweather was made after several days of preparation at base camp. They returned here Saturday, reporting hard trip. northtwenty miles mountain is The west of Cape Spencer.