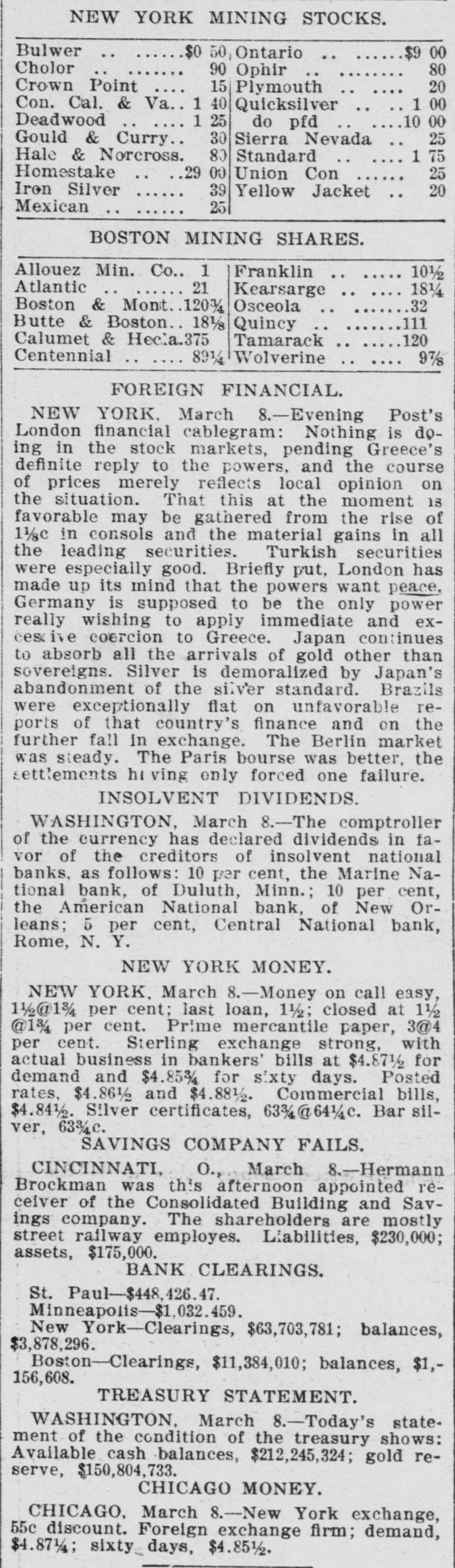

Click image to open full size in new tab

Article Text

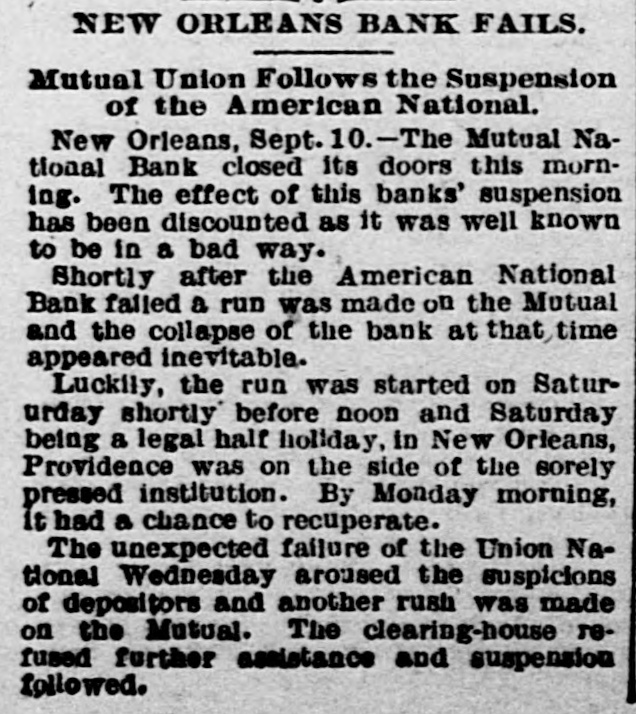

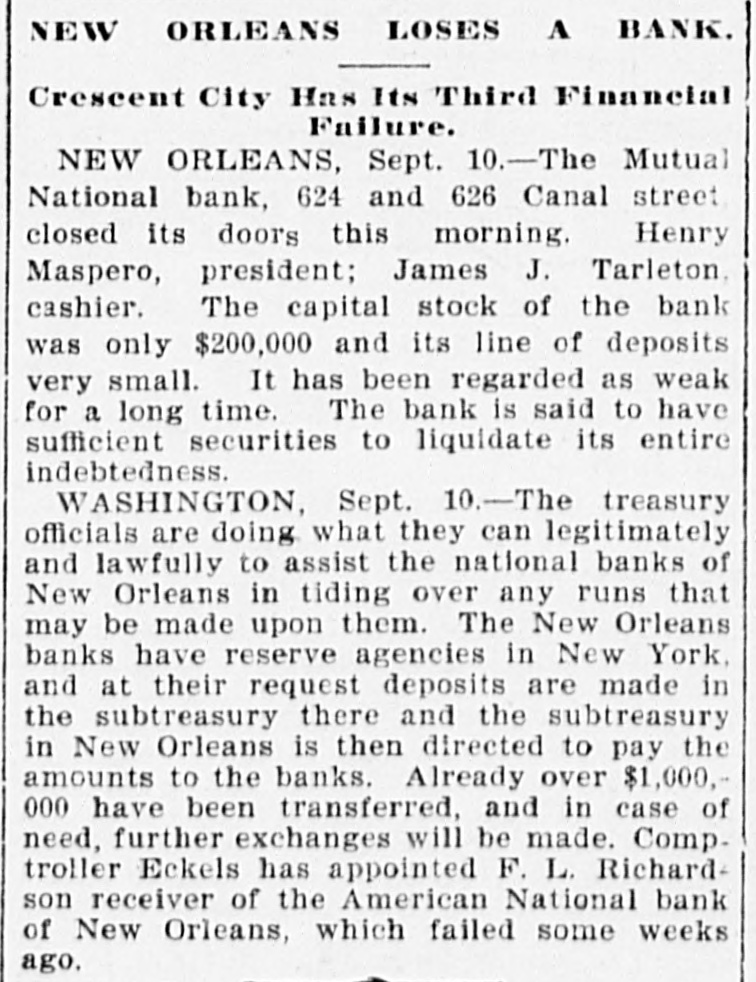

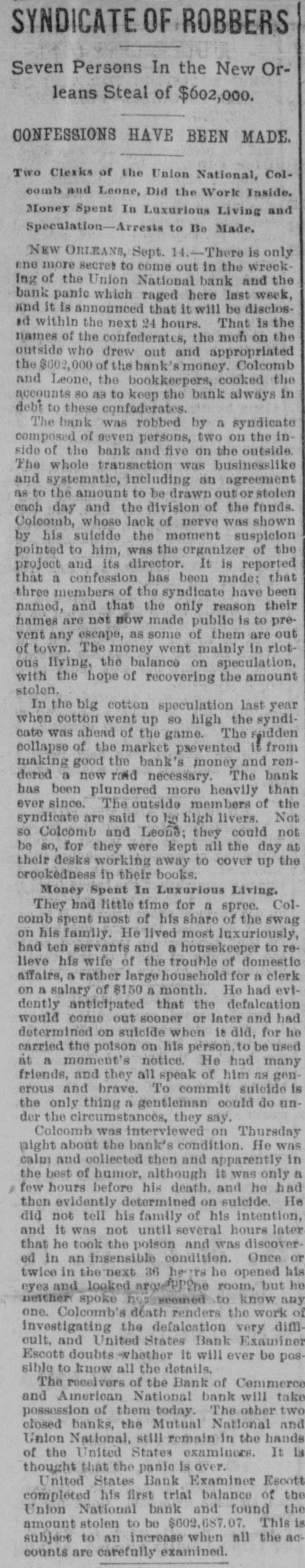

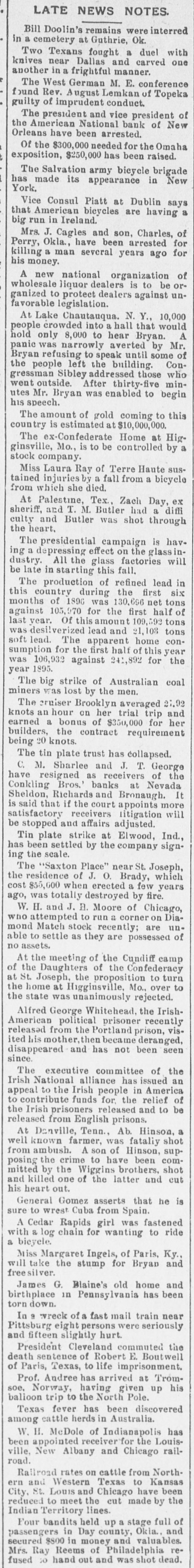

LATE NEWS NOTES. Bill Doolin's remains were interred in a cemetery at Guthrie, Ok. Two Texans fought a duel with knives near Dallas and carved one another in a frightful manner. The West German M. E. conference found Rev. August Lemkan of Topeka guilty of imprudent conduct. The president and vice president of the American National bank of New Orleans have been arrested. Of the $300,000 needed for the Omaha exposition, $250,000 has been raised. The Salvation army bicycle brigade has made its appearance in New York. Vice Consul Piatt at Dublin says that American bicycles are having a big run in Ireland. Mrs. J. Cagles and son, Charles, of Perry, Okla., have been arrested for killing a man several years ago for his money. A new national organization of wholesale liquor dealers is to be organized to protect dealers against unfavorable legislation. At Lake Chautauqua. N. Y., 10,000 people crowded into hall that would A hold only 8,000 to hear Bryan. panic was narrowly averted by Mr. Bryan refusing to speak until some of the people left the building. Congressman Sibley addressed those who went outside. After thirty-five minutes Mr. Bryan was enabled to begin his speech. The amount of gold coming to this country is estimated at $10,000,000. The ex-Confederate Home at Higginsville, Mo., is to be controlled by a stock company. Miss Laura Ray of Terre Haute sustained injuries by a fall from a bicycle from which she died. At Palestine, Tex., Zach Day, ex sheriff, and T. M. Butler had a diffi culty and Butler was shot through the heart. The presidential campaign is having a depressing effect on the glass dustry. All the glass factories will be late in starting this fall. The production of refined lead in this country during the first six months of 1896 was 130,696 net tons against 105,970 for the first half of last year. Of this amount 109,592 tons was desilverized lead and 21,108 tons soft lead. The apparent home consumption for the first half of this year was 106,932 against 241,892 for the year 1895. The big strike of Australian coal miners was lost by the men. The cruiser Brooklyn averaged 21.92 knots an hour on her trial trip and earned a bonus of $350,000 for her builders, the contract requirement being 20 knots. The tin plate trust has collapsed. C. M. Sharlee and J. T. George have resigned as receivers of the Conkling Bros.' banks at Nevada Sheldon, Richards and Bronaugh. It is said that if the court appoints more satisfactory receivers litigation will be stopped and affairs adjusted. Tin plate strike at Elwood, Ind., has been settled by the company signing the scale. The "Saxton Place" near St. Joseph, the residence of J. O. Brady, which cost $55,000 when erected a few years ago, was totally destroyed by fire. W. H. and J. B. Moore of Chicago, who attempted to run a corner on Diamond Match stock recently; are unable to settle as they are possessed of no assets. At the meeting of the Cundiff camp of the Daughters of the Confederacy at St. Joseph, the proposition to turn the home at Higginsville, Mo., over to the state was unanimously rejected. Alfred George Whitehead, the IrishAmerican political prisoner recently released from the Portland prison, visited his mother, became deranged, disappeared and has not been seen since. The executive committee of the Irish National alliance has issued an appeal to the Irish people in America to contribute funds for, the relief of the Irish prisoners released and to be released from English prisons. At Danville, Tenn., Ab. Hinson, a well known farmer, was fataliy shot from ambush. A son of Hinson, supposing the crime to have been committed by the Wiggins brothers, shot and killed one of the latter and cut his heart out. General Gomez asserts that he is sure to wrest Cuba from Spain. A Cedar Rapids girl was fastened with a log chain for wanting to ride a bicycle. Miss Margaret Ingels, of Paris, Ky., will take the stump for Bryan and freesilver. James G. Blaine's old home and birthplace in Pennsylvania has been torn down. In 9 wreck of a fast mail train near Pittsburg eight persons were seriously and fifteen slightly hurt. President Cleveland commuted the death sentence of Robert E. Boutwell of Paris, Texas, to life imprisonment. Prof. Andree has arrived at Tromsoe, Norway, having given up his balloon trip to the North Pole. Texas fever has been discovered among cattle herds in Australia. W. H. McDole of Indianapolis has been appointed receiver for the Louisville, New Albany and Chicago railroad. Railroad rates on cattle from Northern and Western Texas to Kansas City, St. Louis and Chicago have been reduced to meet the cut made by the Indian Territory lines. Four bandits held up a stage full of passengers in Day county, Okla. and secured $800 in money and valuables. Mrs. Ray Reems of Philadelphia refused so hand out and shot dead