Click image to open full size in new tab

Article Text

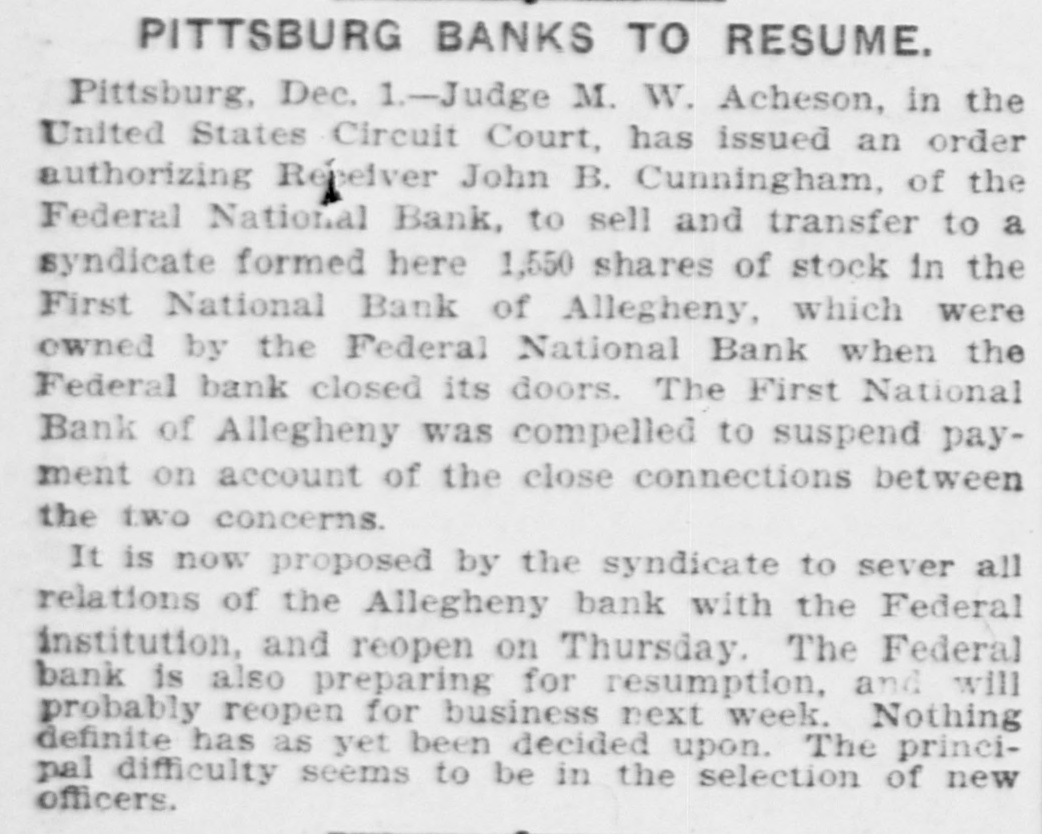

ANOTHER BANK CLOSES AN ALLEGHENY INSTITUTION FORCED TO SUSPEND. Has Ample Assets to Connection Paj All Debts, But Its Supposed With Pittsburg Federal Causes Run. ViceOct. 22-Early today of the First Pittsburg. R. J. Stoney, Jr., issued the National President Bank of Allegheny, a meeting of following statement directors after with the House clearthe house owners of and the Pittsburg Clearing from 8 o'clock ing Association. which lasted morning: last night until Allegheny, this Board Oct. of Directors 21, 1903. "At "meeting National of the Bank of 1903, Allegheny, it was of the dthis First evening, October 21, bank has amhel that, although the its depositors assets to pay all surplus full ple resolved and leave a handsome of its supposed Bank con- for in has the shareholders, Federal yet National distrust nection with the created wide to such and that we feel caused a run on it to be our of an extent Pittsburg the bank in voluntary bank this bank and liquidation directors duty the to place officers of the application to and have the decided to make Currency to take nec(Signed) Comptroller essary steps of to the accomplish this Thompson. purpose. "John "President. The First National January, Bank 1864, of Allegheny and has of organized in $350,000; a surplus $34,871. was a capital stock undivided of profits of The $100,000. officers are as Thompson; follows: and John Cashier, Vice-Presi- E.R. D. President, Jr.: John dent, Cramer; R. J. Assistant Stoney, Cashier, of the Cramer. The First National Institutions Bank in is Allegheny. one connected oldest The directors banking of the most bank important are manuMany the bank with facturing some rumors plants of the during in Allegheny. the with past few the days Fed- dehave have connected for two days after people learning of manded eral, and their deposits Pittsburg institution. a very condition of the committee has situation. so the house general this their The clearing opinion of the unfortunate at imsanguine but the two found banks to be beyond though both are mediate time were aid to be or solvent reach, and in good con- as declared dition. The correspondents of the Bank; bank are Philaof follows: New York, First Park National; National Chicago, the First First National. delphia., of the condition at the close The report Bank of 9, 1903, is of National business on September Allegheny discounts, unsecured. $1,240,- as follows: Resources-Iron and to secure overdrafts, States on United 980.01; $3,012.56; United $100,000 :premiums securities, bonds, $6,000; house estate $60,350; other banks etc., States circulation, $114,862.30 banking national stocks, real furniture State own- (not and fixtures, $5,972.30; due from $9,271.71; due from from ap ed, agents). $4,158.55 due checks banks reserve $834.82; cash items, $27,026.30; reserve proved and other and bankers, agents, $89,610.52; exchanges fractional notes of clearing banks, cents, nickles viz.: for national house, $2,311; and bank, $128.12; Speother currency reserve in $47,183: tolawful paper money legal tender reserve notes, in bank, United $113, cie, $65,935; lawful money fund with of circula113.03; tal Treasurer redemption (5 from per cent United redemp- States States $5,000; due than 5 per cent $350, Treasurer. tion), $2,850; other total, $1,735,476.19. paid in, and tion fund. Capital stock undivided pro- $53. 630.89: Liabilities surplus expenses funds, $100,000; notes taxes, utstanding, paid, less bank subject cashier's $1,735,476.19 $100,000; 000; check. fits, national $1,052,128.38: Individual $76,456.75; demand total, deposits certificates checks opening out- of to deposits, standing. Pittsburg $3,205.47 Stock quiet Exchange and trading it was light. deBy a for the will be vote of the balance of dealt in. this The morning that was stock exchange Bank, the week which The no cided bank or trust of the Allegheny of the Federal looked suspension representation esentative house, an is almost in the failure upon by sequence for no further necessary National has been bankers the believe clearing generally who as have trouble been yesterday, will follow. of the clearing outside banks through of the Allegheny Federal other to care doing All their and First National with in the crowd National have made arrangements for their paper of defuture. morning a in front of There of among banks positors This gathered Bank Allegheny. excitement small the restless First ap- the the National to be little several were to depositors, peared though to gain admission busy on and wished the bank were Robert clerks of entire of the The books the comptroller in charge of bank. their deputy was morning. currency assistant the Cramer, this the morning. were at J. D. at the bank as the assets paid cashier, was that as soon would be did the said banks of and bank. stated depositors he Alle- not off gheny think any would be realized dollar for dollar. of the affected. other